Dan Zanger

Dan Zanger is a remarkable figure in the world of trading. Hailing from Los Angeles, California, Dan went from being a pool contractor to achieving one of the most legendary feats in the stock market—transforming a small personal account into a multimillion-dollar portfolio. His record-breaking financial journey, driven by sharp technical analysis and bold market insights, has made him an icon among both retail and professional traders.

Background and Family

Dan grew up in the San Fernando Valley, California. He wasn’t born into wealth or a financial background. His mother, a psychologist, would often tune into business channels in the 1970s. This early exposure sparked Dan’s interest in the stock market. After high school, he took a traditional route, entering the workforce as a pool contractor in upscale Beverly Hills. For over a decade, he worked hands-on, digging pools, managing construction crews, and supporting himself through physically demanding work.

Though not trained formally in finance, Dan had a deep fascination with price charts. He’d come home from work and pore over stock charts, often taping them to his walls. That passion would eventually lay the foundation for his future trading success.

The Beginning of His Journey

Dan’s trading journey began with a spark of curiosity. One day, he saw a ticker symbol scrolling on TV, bought the stock for around $1, and later sold it for about $3. That small trade lit a fire in him. He began buying trading books, watching financial TV, and exploring the works of technical traders like William O’Neil.

However, the early years were challenging. Dan faced steep losses, including a memorable instance where his portfolio dropped significantly in a single day. These setbacks forced him to become more cautious, focused, and strategic. He started maintaining journals, reviewing each trade, and slowly transformed his process from emotional decisions to a rule-based, data-driven approach.

The Turning Point

In the late 1990s, Dan made a pivotal decision: he sold his Porsche for around $11,000 and used the funds to fully dedicate himself to trading. This act of commitment marked a new chapter in his life. Over the next couple of years, he grew that account to millions.

Dan credits this success to mastering chart patterns, timing breakouts, and having the discipline to follow a strict trading plan. His trades were not guesses—they were calculated entries based on clear signals. Importantly, he stayed away from the crowd during market euphoria and exited when the charts signaled overextension, protecting his profits.

Investment Strategies and Tools

Dan’s primary strategy is momentum trading—buying stocks that are breaking out of well-defined chart patterns on high volume. He does not rely on common indicators like the RSI, MACD, or moving averages. Instead, he studies the price and volume relationship intensively.

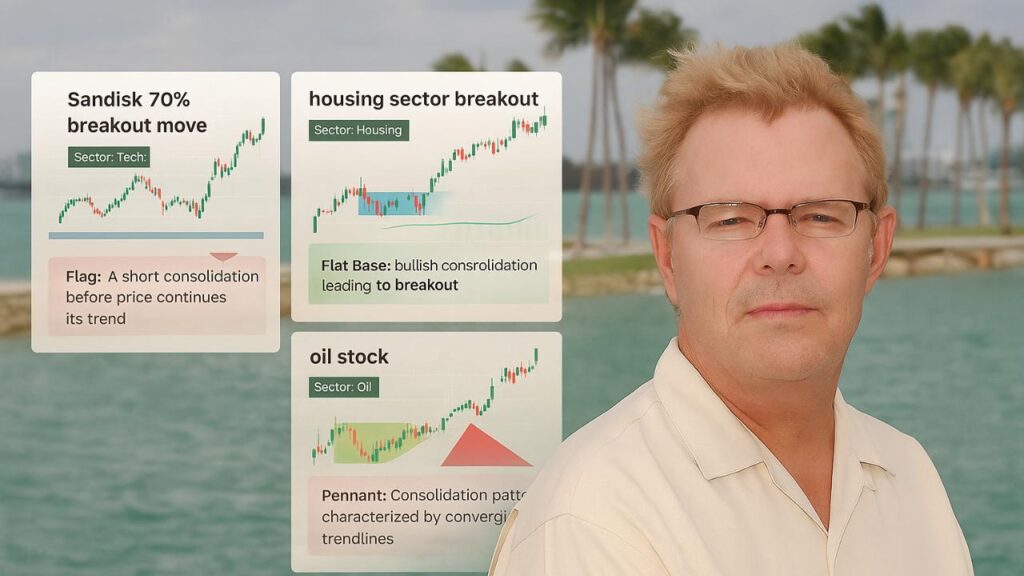

Each night, Dan reviews hundreds of charts, looking for patterns such as:

- Cup and Handle

- Flat Base Breakouts

- Flags and Pennants

- Ascending Triangles

He uses breakout points confirmed by volume surges to identify entries and places tight stop-losses to protect his capital. He emphasizes risk management as the cornerstone of successful trading.

For tools, Dan has used charting platforms such as eSignal, AIQ Systems, and traditional candlestick software. He believes that the human eye, trained to spot subtle shifts in chart structure, remains more powerful than automation alone.

Dan also avoids trading during earnings announcements and volatile news unless the pattern is exceptionally strong—another key insight for traders who often get caught in unpredictability.

Real Investment Wins

Dan’s most memorable trades came during the tech boom, where his strategies truly shined. He focused on leading stocks in strong sectors, such as technology and housing, during periods of growth. By identifying the strongest stocks early, he was able to ride massive price moves while managing downside risk.

Some of his biggest trades included:

- Tech companies like Apple and Google in their early breakout phases

- Sandisk, a leader in storage technology

- Housing and oil stocks during strong macroeconomic tailwinds

One of his standout trades was in CMGI, a company that surged during the dot-com bubble. He captured over 200% gain in just a few days, showcasing the power of proper entry and exit timing. Another example includes identifying a cup-and-handle in Broadcom, entering at breakout and exiting with a 3x return.

Recognition, Innovation, or Influence

Dan’s trading results eventually gained national attention. His portfolio’s explosive growth was audited and covered in financial media, including Fortune magazine. He holds the verified record for one of the highest percentage gains ever achieved in a single year.

To share his methods, Dan launched Chartpattern.com, where he provides market commentary, trade setups, and real-time analysis. His newsletter, The Zanger Report, became widely popular among both novice and professional traders.

He also co-authored the book “Momentum Masters”, which breaks down high-level trading techniques and includes contributions from other elite traders. Through webinars, interviews, and articles, Dan has helped educate thousands of aspiring traders worldwide.

Dan’s influence also extends to social trading forums and YouTube communities, where his approach to chart analysis has been referenced in dozens of case studies and discussions.

Key Lessons for Readers

Dan Zanger’s journey offers valuable insights that every trader can apply:

- Discipline matters more than intelligence. You don’t need a finance degree to win—just focus and commitment.

- Study chart patterns daily. The more you recognize structure, the better your timing.

- Use volume as a signal. Price action is important, but volume confirms intention.

- Cut losers quickly. Holding onto hope is not a strategy.

- Let winners run. Exit partially at targets, but ride momentum when a stock proves strength.

- Avoid overtrading and emotional decision-making. Set clear rules and follow them.

- Protect your capital first. Never trade without a stop-loss.

- Focus on leaders in strong sectors. Market trends provide tailwinds—ride them.

- Journal your trades. Learn from every loss and every win—treat trading as a business, not a gamble.

- Never chase a stock. If you miss the move, wait for the next setup.

“I use absolutely no indicators whatsoever. I simply rely on chart patterns, price, and volume.”

“Volume is extremely important. In fact, it’s everything.”

“Every breakout tells a story. You just need to read the chart.”

🔗 Related Posts

📘 Michael Burry: The Real-Life Big Short and His Remarkable Investment Success Story

Discover how Burry foresaw the housing collapse and turned his conviction into a billion-dollar profit.

👉 Read More »

📘 Nassim Nicholas Taleb: The Trader Who Profited from Chaos

Learn how Taleb’s unique philosophy and risk management helped him thrive during unpredictable markets.

👉 Read More »

📘 From Queens to Wall Street: The Real Story of John Paulson’s Investment Triumphs

Explore how Paulson’s bold bet against the U.S. housing market made financial history.

👉 Read More »