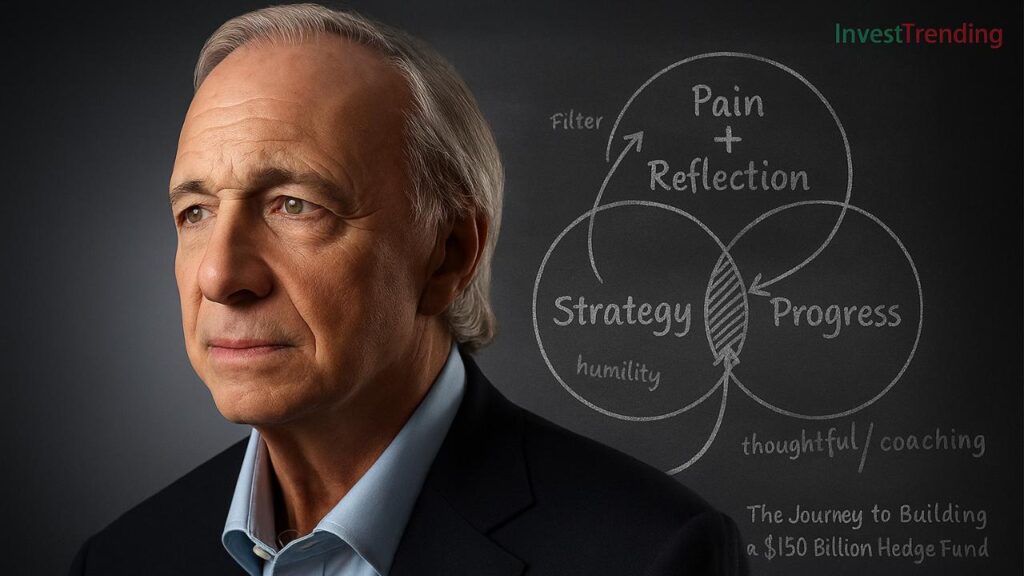

“Pain + Reflection = Progress.”

– Ray Dalio

Ray Dalio is one of the most successful investors and hedge fund managers in history. As the founder of Bridgewater Associates, a hedge fund that manages over $150 billion in assets, Dalio has built a legacy based on radical transparency, a unique investment philosophy, and a deep understanding of economic cycles. His book Principles lays out the core beliefs that shaped his success. This document explores his journey, challenges, investment strategies, and key lessons from his career.

Early Life and Entry into Investing

Childhood and Education

Raymond Thomas Dalio was born on August 8, 1949, in Jackson Heights, Queens, New York. His father, Marino Dalio, was a jazz musician, and his mother, Ann, was a homemaker. Growing up in a middle-class household, Dalio was not exposed to the world of finance early on. However, his curiosity and drive set him on a path toward investing.

Dalio attended Long Island University before transferring to Harvard Business School, where he earned an MBA in 1973. His education played a crucial role in shaping his understanding of financial markets.

“Knowing how to deal well with not knowing is more important than anything you know.”

– Ray Dalio

First Steps into Investing

Dalio began investing at a young age. At just 12 years old, he bought shares of Northeast Airlines for $300 and tripled his money when the airline merged with another company. This early success sparked his interest in the stock market and led him to explore investment opportunities throughout his teenage years.

During his time at Harvard, Dalio worked on the floor of the New York Stock Exchange, gaining firsthand experience in trading. He later joined Dominick & Dominick LLC as a commodity trader and then worked at Shearson Hayden Stone as a futures trader and broker.

“The biggest mistake most people make is to not see themselves and others objectively.”

– Ray Dalio

Founding Bridgewater Associates

In 1975, Dalio founded Bridgewater Associates from his two-bedroom apartment in New York City. Initially, the firm provided economic consulting and advisory services to institutional clients. Over time, Dalio shifted Bridgewater’s focus toward managing institutional investments and developing proprietary trading strategies.

Key Milestones in Bridgewater’s Growth

- 1975–1980: Bridgewater started as a research firm but quickly moved into asset management, advising corporate clients on managing currency risks.

- 1985: The firm developed its first institutional client, the World Bank.

- 1991: Bridgewater introduced its flagship investment strategy, Pure Alpha, which aimed to generate consistent returns regardless of market conditions.

- 2005: Bridgewater launched All Weather, a risk-parity strategy designed to perform well across different economic environments.

- 2010s: Bridgewater became the largest hedge fund in the world, managing assets for pension funds, governments, and sovereign wealth funds.

Investment Strategies and Philosophy

Dalio’s investment strategies are based on deep macroeconomic research and systematic decision-making. He believes that understanding economic cycles and human behavior is key to making informed investment decisions.

“Don’t confuse what you wish were true with what is really true.”

– Ray Dalio

Principles of Investing

1. The Economic Machine

Dalio explains that the economy operates like a machine, driven by productivity growth, the short-term debt cycle, and the long-term debt cycle. By understanding these forces, investors can anticipate market movements and position themselves accordingly.

2. Diversification and Risk Parity

Dalio introduced the concept of risk parity, which involves balancing risk across asset classes rather than allocating investments based on capital weightings. His All Weather portfolio is designed to perform well in various economic conditions by diversifying across stocks, bonds, commodities, and currencies.

3. Systematic Decision-Making

Dalio emphasizes data-driven, systematic investment decisions. Bridgewater’s algorithms analyze vast amounts of economic data to identify trends and predict market movements.

4. Radical Transparency

One of Dalio’s most famous principles is radical transparency. At Bridgewater, employees are encouraged to provide honest feedback and engage in open discussions. This culture helps eliminate bias and improve decision-making.

5. Understanding Debt Cycles

Dalio’s study of historical debt cycles has helped him predict financial crises, including the 2008 global financial crisis. He believes that debt accumulation leads to booms and busts, and understanding these cycles is crucial for investors.

“Radical transparency and radical honesty are critical to meaningful work and meaningful relationships.”

– Ray Dalio

Challenges and Setbacks

Despite his success, Dalio faced numerous challenges throughout his career.

1982: Near Bankruptcy

Dalio nearly lost everything in 1982 after making a wrong bet on the economy. He had to lay off all his employees and borrow money to pay his bills. This experience taught him the importance of humility and diversification.

2008 Financial Crisis

While most investors suffered during the 2008 financial crisis, Dalio’s Pure Alpha fund generated strong returns. He had anticipated the crisis by analyzing excessive debt levels and market imbalances.

Internal Challenges at Bridgewater

Bridgewater’s radical transparency culture has led to conflicts among employees. Some critics argue that the firm’s management style can be intense and stressful.

“If you’re not failing, you’re not pushing your limits, and if you’re not pushing your limits, you’re not maximizing your potential.”

– Ray Dalio

How Ray Dalio Became One of the Best Investors

Dalio’s success is a result of his deep understanding of economic principles, disciplined investment strategies, and ability to adapt to changing market conditions.

Key Factors Behind His Success:

- Deep Economic Research: He continuously studies economic history to understand market behavior.

- Risk Management: Diversification and risk parity strategies have helped Bridgewater maintain stability.

- Technology and Data-Driven Investing: Algorithms and AI play a crucial role in Bridgewater’s decision-making.

- Resilience: Dalio’s ability to learn from failures has strengthened his investment approach.

- Long-Term Thinking: He focuses on sustainable, long-term investment strategies rather than short-term gains.

Ray Dalio Today

Dalio stepped down as the co-CIO of Bridgewater in 2022 but remains involved as an advisor. He focuses on philanthropy, economic research, and sharing his principles with the world. His books, including Principles and The Changing World Order, provide insights into his investment philosophy and economic theories.

Conclusion

Ray Dalio’s journey from a middle-class upbringing to running the world’s largest hedge fund is a testament to his intelligence, discipline, and ability to learn from mistakes. His principles of radical transparency, systematic decision-making, and deep economic analysis have made him one of the most respected figures in finance. Investors and business leaders can learn valuable lessons from his experiences and apply his principles to achieve long-term success.

Key Takeaways

- Dalio’s early curiosity about investing shaped his career.

- Bridgewater Associates became the largest hedge fund through disciplined investment strategies.

- His investment principles focus on risk management, data-driven decision-making, and economic cycles.

- Overcoming failures and continuously learning were crucial to his success.

- Even after stepping down from Bridgewater, Dalio continues to influence the financial world through research and philanthropy.

Dalio’s story proves that with the right principles, resilience, and a long-term vision, anyone can achieve extraordinary success in the world of investing.

“An idea meritocracy is the best decision-making system. In it, the best ideas win — no matter who they come from.”

– Ray Dalio