“I’m only rich because I know when I’m wrong, and I’ve learned to admit my mistakes quickly and move on.”

– George Soros

Early Life and Education

George Soros was born György Schwartz on August 12, 1930, in Budapest, Hungary. He was raised in a Jewish family and experienced the horrors of World War II firsthand. His father, Tivadar Soros, was a lawyer and a strong advocate for assimilation. To protect the family from Nazi persecution, Tivadar changed their surname to Soros, which means “to soar” in Esperanto.

During the war, Soros survived by assuming a false identity and working for a Hungarian official who confiscated Jewish properties. These early experiences shaped his understanding of survival, deception, and financial maneuvering. He learned the importance of risk-taking and strategic decision-making from a young age, skills that would later define his career.

After the war, Soros moved to England in 1947 and attended the London School of Economics (LSE). He studied philosophy under Karl Popper, whose theory of “open society” greatly influenced Soros’ worldview. Though he initially aspired to be a philosopher, he later turned to finance to make a living. While studying, Soros worked various part-time jobs, including as a railway porter and a waiter, to support himself financially.

“The prevailing wisdom is often wrong. Being contrarian and willing to act on that insight is where the profits lie.”

– George Soros

Early Career in Finance

Soros’ journey in the investing world began modestly. After struggling to find employment, he secured a job at a London merchant bank, Singer & Friedlander, as a clerk. His break came when he moved to the United States in 1956, joining F.M. Mayer as an arbitrage trader. Over the next decade, he gained experience at several Wall Street firms, refining his investment philosophy.

In 1969, Soros founded the Double Eagle Fund, a hedge fund that managed $4 million in assets. His success with Double Eagle led to the creation of the Quantum Fund in 1973, with $12 million in initial capital. The fund grew rapidly due to Soros’ aggressive trading strategies, and by the 1980s, it had generated massive profits, making him one of the wealthiest hedge fund managers in the world.

“Markets are always in a state of uncertainty and flux. Understanding that and adapting your strategy accordingly is the key to success.”

– George Soros

Investment Strategies and Key Trades

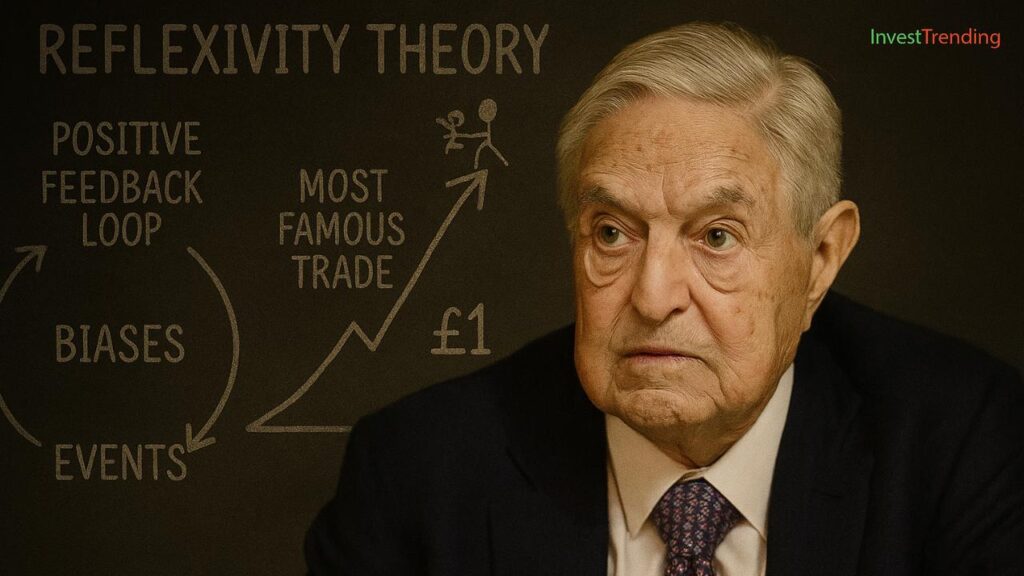

The Reflexivity Theory

Soros developed the theory of reflexivity, which suggests that markets are influenced by the biases and actions of participants, leading to self-reinforcing cycles. Unlike traditional economic models that assume rational actors, Soros believed markets were inherently unstable and prone to booms and busts. This theory guided his investment decisions and allowed him to anticipate major market movements.

Breaking the Bank of England (1992)

Soros’ most famous trade occurred in 1992 when he shorted the British pound, earning over $1 billion in a single day. The UK was part of the European Exchange Rate Mechanism (ERM), which pegged the pound to the Deutsche Mark. However, economic conditions made this peg unsustainable. Soros borrowed billions to bet against the pound, and when the UK government failed to defend its currency, it crashed, forcing the UK to exit the ERM. This event, known as Black Wednesday, cemented Soros’ reputation as a legendary investor.

Other Notable Trades

- Asian Financial Crisis (1997): Soros was accused of exacerbating the crisis by speculating against Asian currencies. He saw weaknesses in the financial structures of Thailand, Malaysia, and Indonesia and took short positions accordingly. His actions were controversial, as some governments blamed him for worsening their economic situations.

- Dot-Com Boom and Bust (2000-2001): Soros invested in technology stocks during the late 1990s but strategically adjusted his positions before the market crashed, allowing him to minimize losses.

- 2008 Financial Crisis: Soros profited by betting against overvalued financial institutions. He foresaw the collapse of mortgage-backed securities and took positions that allowed him to make significant gains while many others suffered losses.

Philanthropy and Influence

Despite his controversial trading practices, Soros has donated billions through the Open Society Foundations, funding democracy, education, and human rights initiatives worldwide. His philanthropic efforts have made him a polarizing figure. He has supported causes such as free press, human rights, and education in underdeveloped countries. His donations have also focused on anti-corruption measures and political transparency.

Soros has been particularly active in supporting democratic movements in Eastern Europe, helping former Soviet states transition to open societies. His support for liberal policies has made him a target of conspiracy theories and criticism from authoritarian governments and conservative groups.

“It’s not about predicting the future but about responding to the present.”

– George Soros

Legacy and Current Status

Soros retired from active investing but remains influential. His hedge fund has transitioned to a family office, focusing on philanthropy and political activism. His net worth exceeds $8 billion after donating over $30 billion to various causes.

In recent years, Soros has continued to influence financial markets through commentary and economic analysis. He remains an outspoken critic of authoritarianism and economic inequality, advocating for policies that promote transparency and democratic governance.

“My approach is to accept that I don’t know everything and to keep my mind open to new information.”

– George Soros

Conclusion

George Soros’ life exemplifies financial acumen, risk-taking, and a commitment to societal change. His legacy as an investor and philanthropist continues to shape global markets and political landscapes. From his humble beginnings in Hungary to his rise as one of the most influential financiers in history, Soros’ story is one of resilience, intelligence, and strategic brilliance.

“Financial markets tend to operate more on bias than reality — this is the essence of reflexivity.”

– George Soros