Are you searching for detailed insights about the Bajaj Housing Finance share price? This guide offers everything you need — from IPO details and current performance to trading tools and long-term investment potential. Whether you’re a seasoned investor or a beginner, this resource is designed to keep you informed and ahead of the curve.

Current Share Price and Performance

As of April 6, 2025, Bajaj Housing Finance shares are trading at ₹110, reflecting a notable drop from the 52-week high of ₹188.45, which was achieved on September 18, 2024. This marks a 40%+ decline, attributed to market corrections and profit-booking.

Despite the dip, investors and analysts consider this a potential long-term opportunity based on robust fundamentals.

IPO Details and Market Debut

| Category | Details |

|---|---|

| IPO Date | September 9-11, 2024 |

| Listing Date | September 16, 2024 |

| Issue Price | ₹66 – ₹70 per share |

| Listing Price | ₹150 (114% listing gain) |

| IPO Size | ₹6,560 crore |

| Total Bids | $39 billion |

The IPO saw overwhelming investor response, making it one of the most successful IPOs in 2024.

TradingView Chart: Bajaj Housing Finance Share Price

📈 Bajaj Housing Finance Share Price – Live Chart

⚠️ If you see an error or the chart doesn’t load, please refresh the page or click here to view the live chart directly on TradingView.

Company Overview

Bajaj Housing Finance Ltd (BHFL), a wholly-owned subsidiary of Bajaj Finance Ltd, offers home loans, loan against property, and other secured mortgage products. BHFL has grown rapidly due to its efficient service delivery and customer-first approach. It has been classified by RBI as an ‘Upper Layer NBFC’, indicating its significance in the Indian financial ecosystem.

Competitive Positioning

BHFL competes with firms like HDFC Ltd, LIC Housing Finance, PNB Housing Finance, and others. It differentiates itself with:

- Strong parent backing

- Rapid digitization

- Low non-performing asset (NPA) levels

- Quick disbursement cycles

Peer Comparison

| Company | Share Price (₹) | 1Y Return | Market Cap (₹ Cr) |

| Bajaj Housing Finance | 110 | -35% | 45,000 |

| HDFC Ltd | 2,600 | +18% | 500,000 |

| LIC Housing Finance | 650 | +8% | 34,000 |

| PNB Housing Finance | 750 | +12% | 20,000 |

Analyst Recommendations

Analysts generally suggest a “Buy on Dip” strategy due to:

- Strong backing by Bajaj Finance

- Scope for growth in the housing finance segment

- Conservative lending practices

Strategic Outlook & Analysis

BHFL is expected to:

- Expand its digital lending channels

- Leverage AI for risk assessment

- Increase penetration in tier-2 and tier-3 cities

These strategies are geared toward maintaining strong growth while managing risks.

Investor Strategies

- Long-term investors: Consider SIPs or staggered entry points.

- Short-term traders: Watch technical indicators and support/resistance zones.

- Risk-averse investors: Prefer exposure through Bajaj Finance, the parent company.

Investment Considerations

Pros:

- Strong brand credibility

- High-growth sector

- Healthy financials

Risks:

- Market volatility

- Rising interest rates

- Regulatory changes

Major Recent Developments

- Sep 2024: Successful IPO launch and record subscription

- Nov 2024: Q2 results beat analyst expectations

- Jan 2025: Share hits 52-week low amid profit booking and market corrections

Share Price Journey Post IPO

- Listing Price: ₹150

- 52-Week High: ₹188.45 (Sep 18, 2024)

- 52-Week Low: ₹110 (Jan 22, 2025)

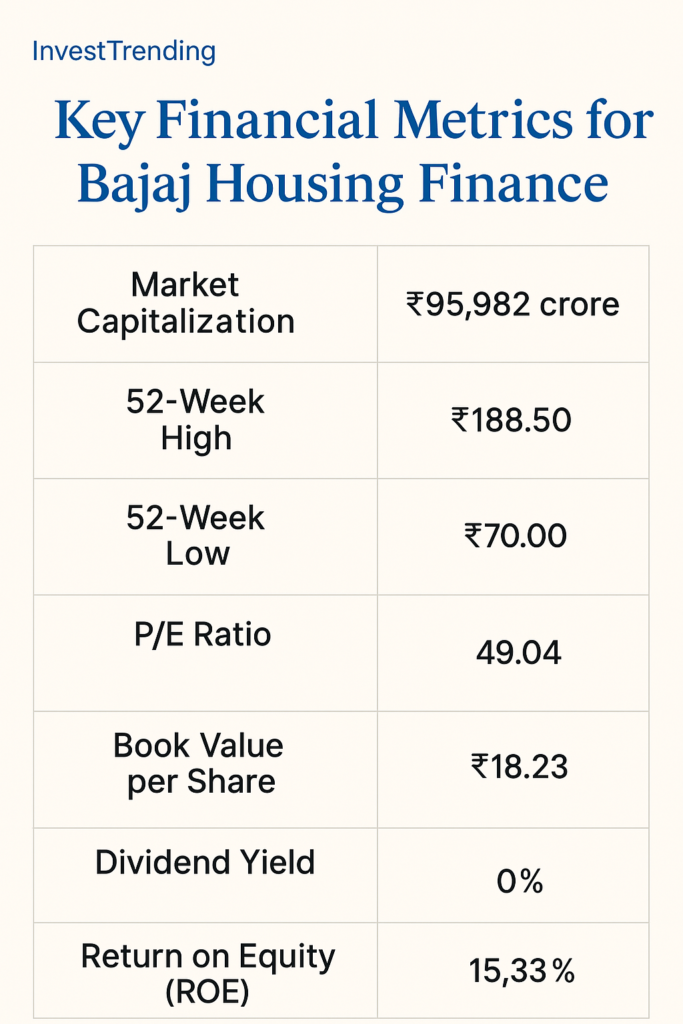

Key Financial Metrics for Bajaj Housing Finance

How to Track Bajaj Housing Finance Share Price

FAQs on Bajaj Housing Finance Share Price

Q. What is the current Bajaj Housing Finance share price?

₹110 as of April 6, 2025.

Q. Is Bajaj Housing Finance a good investment?

Yes, if you are seeking long-term growth and can withstand short-term fluctuations.

Q. How can I invest?

Use trading platforms like Zerodha, Groww, Upstox, or consult with your broker.

Resources

Final Thoughts

Though the Bajaj Housing Finance share price has dipped from its peak, the company’s strong fundamentals, digital-first approach, and backing by Bajaj Finance make it a stock to watch for the future. With proper entry points and a long-term horizon, it holds promise in India’s growing housing finance ecosystem.

Disclaimer: This content is for informational purposes only and should not be considered financial advice. Please consult with a certified financial advisor before investing.