Introduction to NSE Option Chain

If you’re an investor or trader in the Indian stock market, you’ve probably come across the term “NSE Option Chain.” It’s an essential tool used by options traders to analyze market sentiment, predict price movements, and make informed decisions. However, many beginners find it confusing.

In this blog, we will break down everything you need to know about the NSE Option Chain in a simple, easy-to-understand manner. Whether you’re a newbie or looking to refine your options trading strategy, this guide is for you.

What is NSE Option Chain?

An Option Chain (also known as Option Matrix) is a listing of all available option contracts (calls and puts) for a particular stock or index on the National Stock Exchange (NSE).

The NSE Option Chain provides valuable data for every strike price including:

- Open Interest (OI)

- Volume

- Implied Volatility (IV)

- Last Traded Price (LTP)

- Bid Price and Ask Price

- Change in OI and Price

Understanding how to use this data is crucial for identifying potential trends and market behavior.

Basic Terms to Understand

Before we dive deeper, let’s understand a few essential terms used in option chains:

| Term | Meaning |

|---|---|

| Call Option (CE) | Gives the buyer the right to buy the asset at a fixed price before expiry. |

| Put Option (PE) | Gives the buyer the right to sell the asset at a fixed price before expiry. |

| Strike Price | The price at which the asset can be bought or sold. |

| Premium | The price of the option contract. |

| Open Interest (OI) | The number of active contracts that are not yet settled. |

| Volume | Number of contracts traded during the day. |

| LTP (Last Traded Price) | The last price at which the option was traded. |

| Implied Volatility (IV) | Market’s expectation of future volatility. |

Structure of the NSE Option Chain

Here’s how a typical NSE Option Chain looks:

| CALLS | Strike Price | PUTS |

|--------------------------|--------------|---------------------------|

| OI | Vol | LTP | IV | ... | 17000 | ... | IV | LTP | Vol | OI |- The left side shows Call Options (CE).

- The middle column shows the Strike Prices.

- The right side shows Put Options (PE).

This allows traders to compare call and put data for the same strike price at once.

How to Read NSE Option Chain Data

Understanding the NSE Option Chain is all about interpreting data:

1. Identify Support and Resistance

- High Open Interest in Put Options → Possible support.

- High Open Interest in Call Options → Possible resistance.

2. Observe OI Changes

- Increasing OI + Rising Price → Strong trend.

- Increasing OI + Falling Price → Weak trend or fresh shorts.

3. Look at Volume Trends

- High volume indicates increased trader interest.

- Sudden spikes can mean potential price action.

4. Compare Implied Volatility (IV)

- High IV means more uncertainty (higher premiums).

- Low IV suggests a stable market (lower premiums).

Example of NSE Option Chain Analysis

Let’s assume Nifty is currently trading at 17000.

| Strike Price | Call OI | Call LTP | Put OI | Put LTP |

| 16800 | 1,50,000 | 320 | 50,000 | 120 |

| 17000 | 2,00,000 | 150 | 1,80,000 | 180 |

| 17200 | 2,50,000 | 80 | 2,00,000 | 300 |

Insights:

- High call OI at 17200 → Resistance.

- High put OI at 17000 → Support.

- Nifty is likely to stay between 17000-17200 in the short term.

Benefits of Using NSE Option Chain

- Predict Market Sentiment: Helps in understanding whether traders are bullish or bearish.

- Plan Entry and Exit: Identifies key levels of support and resistance.

- Risk Management: Assists in managing risk through better positioning.

- Strategy Building: Useful in forming options strategies like straddle, strangle, iron condor, etc.

- Helps in Hedging: Especially useful for investors looking to protect their existing positions.

How to Use Option Chain for Strategy Building

Based on the data in the NSE Option Chain, here are some common strategies:

| Market Outlook | Strategy | How Option Chain Helps |

| Bullish | Bull Call Spread | Look for high OI on lower strike PEs |

| Bearish | Bear Put Spread | Identify resistance using Call OI |

| Neutral | Iron Condor | Use OI levels to select upper/lower strikes |

| Volatile | Straddle or Strangle | Use high IV readings to gauge volatility bets |

NSE Option Chain Strategies for Higher Accuracy

When using the NSE Option Chain, employing effective strategies is key to making informed trading decisions. Below are some powerful strategies that traders use to improve accuracy:

1. Identifying Support and Resistance Levels:

- High Open Interest (OI) in Puts: Indicates a potential support level. When OI in put options increases at a specific strike price, traders interpret this as a price level where the market may struggle to fall below.

- High Open Interest (OI) in Calls: Suggests a potential resistance level. A high OI in call options at a certain strike price indicates that the market might face upward pressure at that price point.

Pro Tip: Combine this analysis with Implied Volatility (IV) trends to better gauge market sentiment.

2. Volume and Open Interest (OI) Analysis:

- Rising OI with Increasing Price: Indicates a strong trend, either bullish or bearish. A strong trend is suggested when OI increases alongside a rising price.

- Rising OI with Decreasing Price: Could suggest a reversal or fresh short positions are being established, indicating possible weakness in the trend.

Pro Tip: Always look for consistency across time frames for stronger conviction.

3. Implied Volatility (IV) & Time Decay (Theta):

- High IV: Signals higher market uncertainty and risk, often leading to higher premiums in options. This typically occurs when major events like earnings or economic reports are expected.

- Low IV: Suggests that the market is calm, and options premiums will be lower, making it more ideal for long positions if you expect volatility to rise.

- Theta (Time Decay): As options approach expiration, the value of options decreases. This is important for short options strategies or if you are trading close to expiry.

Pro Tip: For traders in the options market, balancing risk with IV and Theta helps ensure successful outcomes.

4. Max Pain Theory:

- Max Pain: The strike price at which the largest number of options (calls and puts) will expire worthless, creating maximum pain for option buyers and benefiting option sellers.

- Application: Traders use the Max Pain theory to predict where the market might head towards expiration, focusing on the strike price with the highest open interest.

What is Max Pain in Option Chain?

Max Pain is the strike price where the most number of options (calls and puts) will expire worthless, causing maximum loss to option buyers and minimum to sellers.

- Calculated based on total open interest.

- Helps identify expiry targets.

- Many traders use it for expiry day positions.

📌 You can find Max Pain levels using tools like Opstra or Sensibull.

Key Metrics to Monitor for Greater Accuracy:

- Put-Call Ratio (PCR): Measures the ratio of open interest between put and call options. A higher PCR suggests a bearish market, while a lower ratio indicates a bullish sentiment.

- Change in OI: Helps to determine the market’s momentum. Significant increases in OI typically suggest that the trend is strengthening.

- Liquidity: Trading options with higher liquidity minimizes slippage and enhances the accuracy of your trades.

Key Tips for Beginners:

- Start by observing index options like Nifty or Bank Nifty to understand the dynamics.

- Focus on At-the-Money (ATM) strike prices for smoother market entry.

- Combine the Option Chain with technical analysis to validate your trades.

By understanding these strategies and interpreting the data from the NSE Option Chain effectively, you can improve your accuracy and decision-making while trading options.

Common Mistakes to Avoid

- ❌ Relying only on OI without checking news/announcements.

- ❌ Ignoring IV changes before results or macro events.

- ❌ Misinterpreting support/resistance without technical confirmation.

- ❌ Holding options close to expiry expecting big moves (due to time decay).

Beginner, Intermediate, and Advanced Tips

For Beginners:

- Start with observing only Nifty or Bank Nifty.

- Focus on strike prices nearest to the current index level (ATM).

- Use Option Chain to understand sentiment rather than trade initially.

For Intermediate Traders:

- Combine Option Chain data with basic technical indicators.

- Learn about concepts like Max Pain and PCR (Put-Call Ratio).

- Track how IV changes with news or earnings events.

For Advanced Users:

- Deploy strategies like butterfly spread, calendar spread, or iron condor using Option Chain cues.

- Use real-time data analytics platforms like Sensibull or Opstra.

- Monitor market depth and changes in OI live during trading sessions.

Option Chain and Expiry Dates

Option contracts come with expiry dates (weekly or monthly). Close to expiry, option values decay quickly — a concept known as time decay (theta). Be mindful of:

- Expiry Dates

- Weekly vs Monthly Options

- Impact of time decay on premiums

Tools to Access NSE Option Chain

You can check the Option Chain directly on the NSE India website. Other platforms that offer advanced analytics:

- Sensibull

- Opstra

- TradingView

- Zerodha Kite (for Zerodha users)

- Upstox Pro

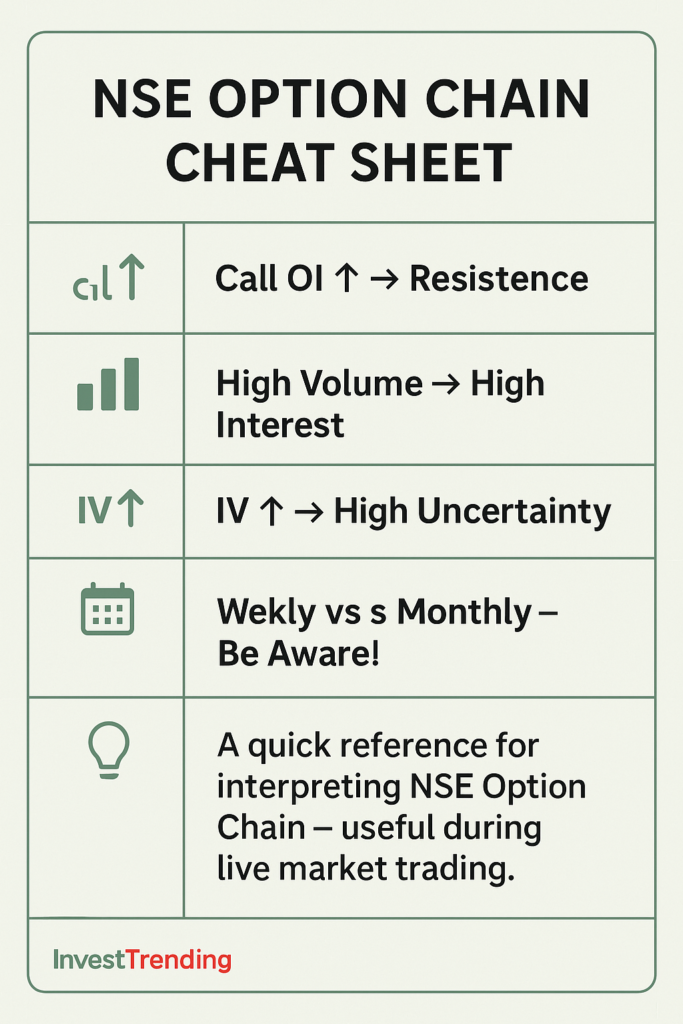

NSE Option Chain Cheat Sheet

💡 A quick reference for interpreting NSE Option Chain – useful during live market trading.

Final Thoughts

Understanding the NSE Option Chain is crucial for any serious trader in the Indian market. It gives a window into market psychology, helps form strategies, and increases your chances of profitable trades.

Always pair Option Chain analysis with technical and fundamental analysis for best results.

FAQs

Q1. Is Option Chain only available for Nifty? No, it’s available for many stocks listed on NSE like Reliance, TCS, Infosys, and others.

Q2. Can beginners use the Option Chain? Yes, but it’s important to learn the basics first and practice with virtual trading.

Q3. How often should I check the Option Chain? Daily for active traders, or weekly for positional traders.

Q4. Is Option Chain analysis accurate? It offers insights but should not be used in isolation. Always combine with other forms of analysis.

Q5. Can I use NSE Option Chain for intraday trading? Yes, intraday traders use it to identify breakout or reversal points.

Q6. What is the best time to read Option Chain? Ideally after market opens and before 2 PM when liquidity is highest.

Disclaimer

This article is for educational and informational purposes only. Trading in options involves risk and may not be suitable for all investors. Always do your own research or consult a qualified financial advisor before making any investment decisions. The examples used here are hypothetical and for illustrative purposes only.

Stay updated, stay smart, and happy trading!