In the ever-evolving landscape of stock market trading, understanding the concept of Nifty and Bank Nifty expiry days—especially for benchmark indices like Nifty and Bank Nifty—is vital for every trader and investor involved in derivatives. This blog provides a simplified yet comprehensive insight into expiry days, recent regulatory updates, and practical implications.

What is an Expiry Day?

An expiry day is the date on which a derivatives contract—such as futures or options—comes to an end. On this date, the contract is settled, and no further trading can occur in that specific contract. In India, derivatives are traded on both the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE), with well-defined expiry timelines.

Nifty and Bank Nifty: Expiry Schedules Explained

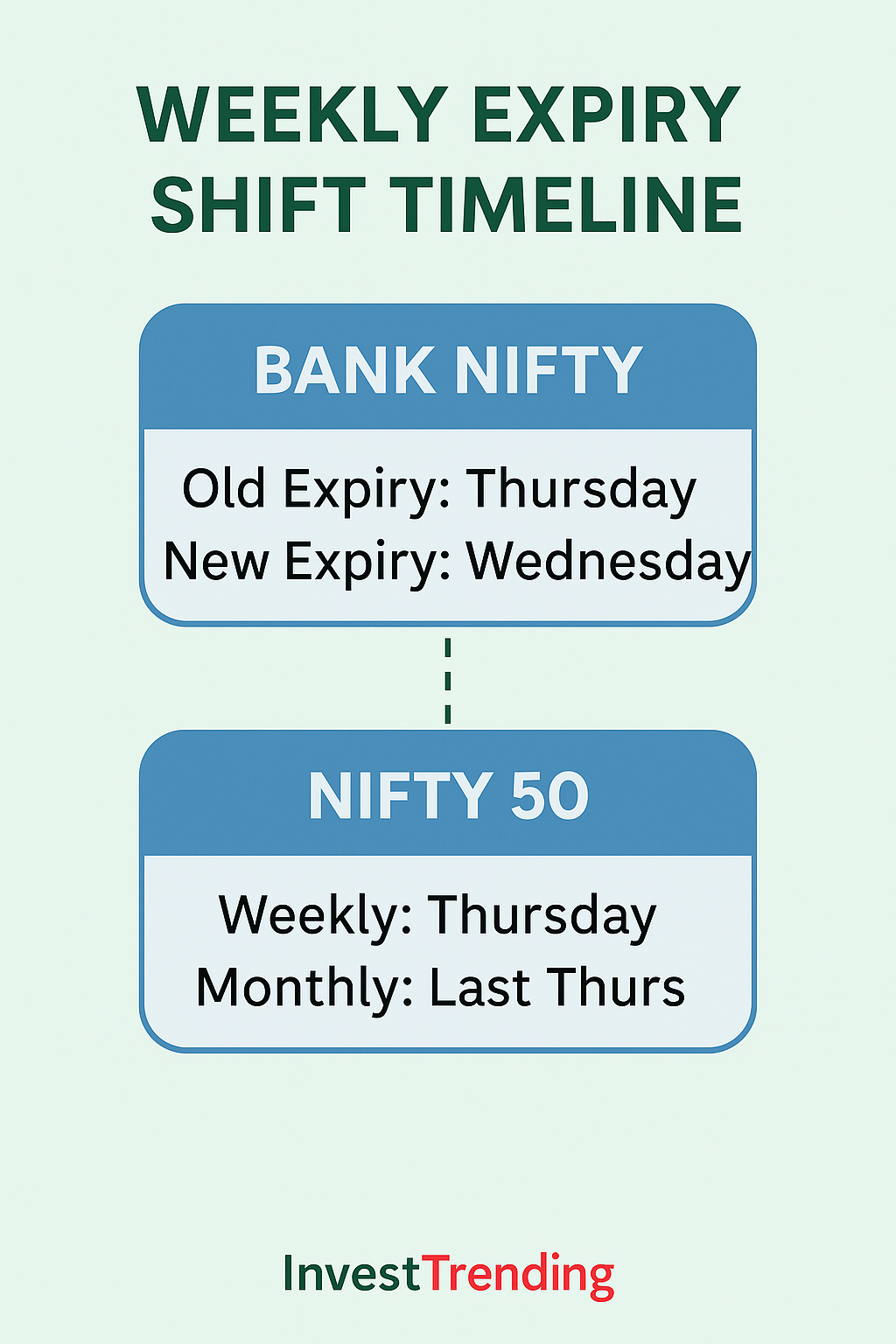

Nifty 50 Expiry

- Weekly Options: Expire every Thursday. If Thursday is a holiday, expiry shifts to the previous trading day.

- Monthly Options: Expire on the last Thursday of the month.

Bank Nifty Expiry

- Weekly Options: As of September 6, 2023, Bank Nifty weekly contracts expire every Wednesday instead of Thursday. If Wednesday is a holiday, expiry is moved to the prior trading session.

- Monthly Options: Still expire on the last Thursday of the month.

This change was implemented to reduce congestion and volatility due to multiple contracts expiring on the same day.

Regulatory Reforms and Changes by SEBI

SEBI (Securities and Exchange Board of India) has introduced several structural reforms to bring more discipline and reduce unnecessary speculation in the derivatives market.

Key Reforms:

- Limiting Weekly Options Contracts:

- Effective from November 20, 2024, each exchange can now offer weekly options contracts for only one index.

- NSE: Retained Nifty 50 for weekly expiries; discontinued weekly contracts for Bank Nifty, Nifty Financial Services, and others.

- BSE: Retained Sensex for weekly options.

- Minimum Trading Lot Size Hike:

- Minimum notional value per lot increased from ₹5 lakh to ₹15–20 lakh to discourage retail participation in high-risk trades.

- Expiry Days Standardization Proposal:

- SEBI proposed standardizing all derivatives expiry days to either Tuesday or Thursday, improving risk distribution and trader convenience.

Impact on Market Participants

These reforms aim to make trading safer, more transparent, and investor-friendly. Here’s how it affects different types of participants:

For Retail Traders:

- May feel limited due to reduced weekly expiry options.

- Required to trade with higher capital, reducing the chances of over-leveraging.

For Institutional Investors:

- Better liquidity distribution across different days.

- Encourages long-term strategy building instead of intraday speculation.

For the Market as a Whole:

- Reduced volatility on expiry days.

- Improved market depth and stability.

Before and After: Summary Table

| Feature | Before Nov 2024 | After Nov 2024 |

|---|---|---|

| Weekly Options per Exchange | Multiple indices allowed | Only one index per exchange |

| Bank Nifty Weekly Options | Available | Discontinued |

| Minimum Trading Amount | ₹5 lakh | ₹15–20 lakh |

| Expiry Days | Wednesday (Bank Nifty), Thursday (Nifty) | Nifty only on Thursday |

Tips for Traders to Adapt

- Stay Updated: Regulatory changes are frequent; subscribe to NSE and SEBI updates.

- Focus on Monthly Options: With fewer weekly options, monthly strategies become key.

- Practice Proper Risk Management: Don’t over-leverage. Follow stop-loss rules and portfolio diversification.

- Use Analytical Tools: Tools like Open Interest (OI) analysis and implied volatility charts help you anticipate market moves.

- Plan Entry/Exit Before Expiry: Avoid last-minute decisions around expiry to reduce risk.

Infographic: Weekly Expiry Shift Timeline

Example Scenario: How Expiry Affects You

Suppose today is Wednesday, and you’re holding a Bank Nifty weekly call option. If you don’t square it off by market close, it will automatically expire and settle. But what if Wednesday is a public holiday? The expiry will then shift to Tuesday. Not knowing this can lead to losses or missed opportunities. Always verify the expiry calendar on NSE’s website.

Frequently Asked Questions (FAQs)

Q1: Why did NSE move Bank Nifty expiry to Wednesday?

A: To reduce market congestion from multiple contracts expiring on the same day (Thursday) and improve liquidity.

Q2: Is Bank Nifty weekly expiry still available?

A: No. As per SEBI’s November 2024 rule, NSE offers weekly expiries only for Nifty 50. Bank Nifty weekly options were discontinued.

Q3: What happens if expiry day is a holiday?

A: The expiry is moved to the previous trading session (e.g., Wednesday becomes Tuesday).

Q4: Can I still trade Bank Nifty options?

A: Yes, but only monthly Bank Nifty options are now available on NSE.

Q5: What is the difference between weekly and monthly options?

A: Weekly options expire every week, offering more short-term opportunities. Monthly options expire on the last Thursday of each month and are suited for slightly longer-term strategies.

verability and align with search engine algorithms.

Conclusion

Understanding expiry days for Nifty and Bank Nifty is essential for anyone involved in the Indian derivatives market. With SEBI’s recent reforms and structural changes, traders need to adapt their strategies accordingly. While the number of weekly options has been limited, the goal is to build a more sustainable and stable market that protects both retail and institutional participants.

Stay informed, adapt your trading strategies, and use these changes to your advantage in the long run.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Always consult a professional financial advisor before making investment decisions.