The Motilal Oswal Defence Index Fund (Motilal Oswal Nifty India Defence Index Fund ) is India’s first-ever mutual fund dedicated to the country’s growing defence sector. With India significantly ramping up domestic defence production and cutting reliance on imports, this thematic fund provides a timely opportunity for investors to participate in the defence manufacturing boom. In this guide, we’ll explore everything you need to know: from its structure and holdings to its performance, advantages, risks, and investment suitability.

India has taken major strides toward becoming self-reliant in defence. Government initiatives like Make in India, Aatmanirbhar Bharat, and increased Foreign Direct Investment (FDI) limits in the defence sector are driving massive capital inflows and infrastructure development. This fund allows retail investors to directly benefit from these tailwinds without picking individual stocks.

Introduction to the Motilal Oswal Nifty India Defence Index Fund

The Motilal Oswal Nifty India Defence Index Fund was launched on July 3, 2024, making it a pioneer in India’s thematic index funds space. It tracks the Nifty India Defence Total Return Index, which comprises 15 top-listed Indian companies involved in defence manufacturing and services.

India is now among the top military spenders globally. This push is accompanied by several government policies supporting Make-in-India, particularly in defence. This fund aims to capitalize on that opportunity.

Motilal Oswal AMC has a solid reputation for launching unique thematic and sectoral index funds with a strong focus on investor education and transparency.

The fund’s launch coincided with a time when the Indian government significantly ramped up its capital expenditure on defence infrastructure. This includes domestic procurement of sophisticated technologies like drones, missile systems, and aircraft, which are now being manufactured by Indian public and private sector players. With strategic geopolitical partnerships and increased defence exports, India is positioning itself as a major global player.

Key Highlights

| Attribute | Details |

|---|---|

| Fund Type | Open-ended, equity index fund |

| Benchmark | Nifty India Defence TRI |

| Minimum Investment | INR 500 |

| Fund Manager | Abhiroop Mukherjee |

| Expense Ratio | 0.29% (Direct), 1.06% (Regular) |

| Exit Load | 1% if exited before 15 days |

| Launch Date | July 3, 2024 |

| NAV (as on March 20, 2025) | INR 7.42 (Direct Plan) |

| AUM (as on March 20, 2025) | INR 184 Crores (approx.) |

Fund Structure and Investment Objective

The scheme replicates the performance of the Nifty India Defence TRI. It passively invests in companies engaged in the manufacture of defence equipment, shipbuilding, aerospace, and related technology.

Objective:

“To provide returns that closely correspond to the total returns of the securities represented by the Nifty India Defence Total Return Index, subject to tracking error.”

Key Benefits:

- Diversification within the defence sector

- Cost-efficient exposure to a rising theme

- Long-term capital appreciation potential

This passive fund format ensures minimal fund manager bias and mirrors the performance of the underlying index. Since it is an index fund, the risk of underperformance due to stock selection is reduced. Additionally, it offers transparency, as the holdings are aligned with the index constituents.

Portfolio Holdings and Sector Allocation

Top Holdings (as of March 2025):

| Company | Sector | Allocation % |

| Bharat Electronics Ltd. (BEL) | Aerospace & Defence | 21.39% |

| Hindustan Aeronautics Ltd. (HAL) | Aerospace & Defence | 18.73% |

| Solar Industries India | Explosives | 15.63% |

| Mazagon Dock | Shipbuilding | 9.63% |

| Cochin Shipyard | Shipbuilding | 7.91% |

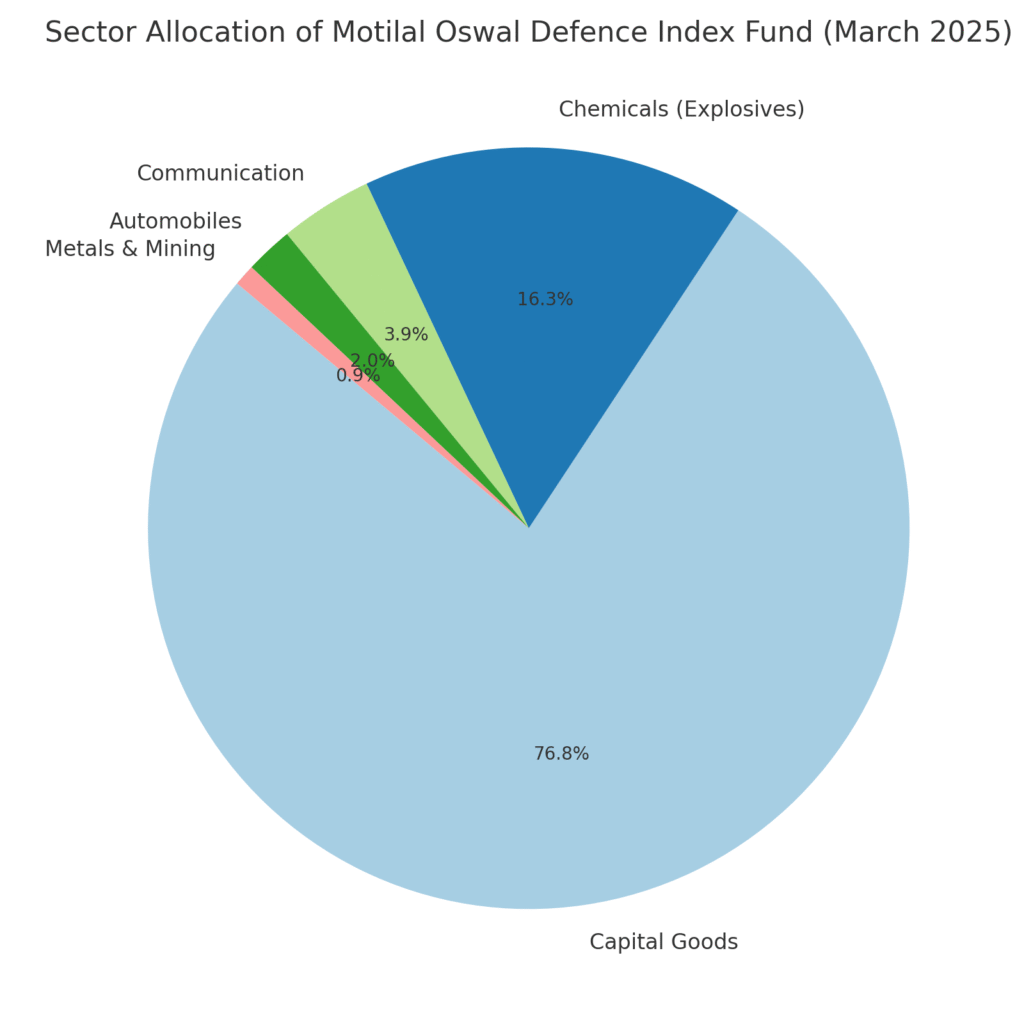

Sector Allocation:

| Sector | Allocation % |

| Capital Goods | 73.77% |

| Chemicals (Explosives) | 15.63% |

| Communication | 3.79% |

| Automobiles | 1.95% |

| Metals & Mining | 0.87% |

Note: The “Capital Goods” sector here broadly includes public sector undertakings and companies involved in defence electronics, aerospace manufacturing, and shipbuilding.

These holdings represent critical components of India’s defence supply chain. BEL and HAL are strategic suppliers for advanced radar systems, avionics, and aircraft. Solar Industries supports ammunition and missile systems. Shipbuilders like Mazagon Dock contribute to naval modernization.

Visual Insights

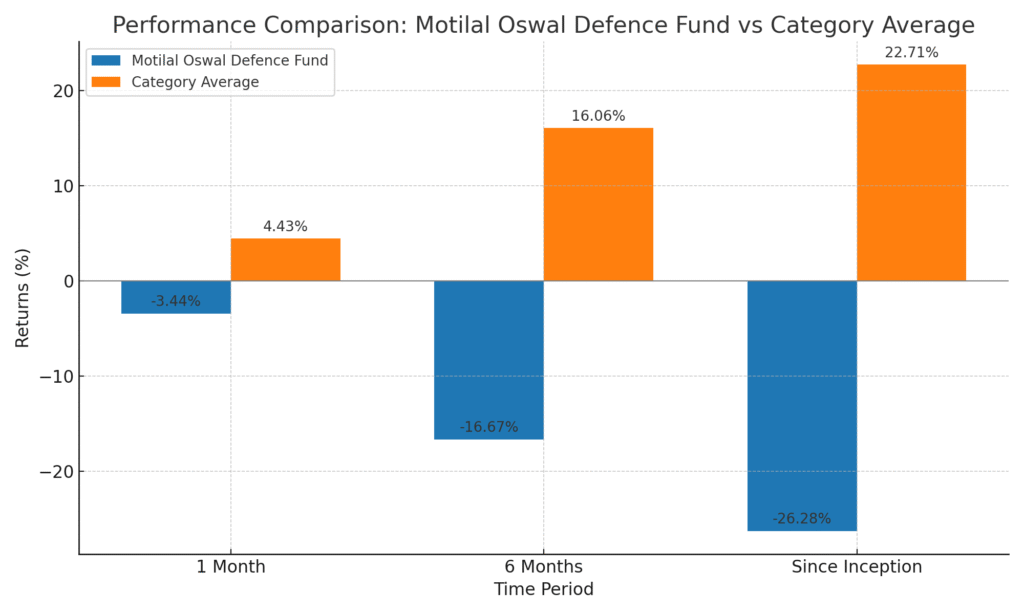

Performance Analysis

Since its inception in July 2024, the fund has shown short-term volatility typical of thematic investments. However, its performance aligns closely with the underlying Nifty India Defence TRI, delivering returns driven by policy momentum, budget allocations, and order wins in the defence sector.

Trailing Returns (as of March 2025):

| Duration | Returns (Direct Plan) |

| 1 Month | -2.8% |

| 3 Months | 4.6% |

| Since Inception | 7.42% NAV from ₹10 |

While short-term numbers may seem modest or even negative, investors should view this fund from a long-term perspective (5+ years), especially as defence capex and order books expand in coming quarters.

Investment Rationale

Why Consider This Fund?

- Strategic Sector Exposure: India’s defence spending is among the highest globally, driven by geopolitical pressures and modernization needs.

- Policy Support: Budget 2024 increased allocations to defence procurement, while the government continues banning defence imports in favor of local production.

- Technological Innovation: Companies in the index are involved in cutting-edge technologies like missiles, radar systems, drones, and submarines.

- Export Opportunities: India’s defence exports have grown significantly, opening up international revenue streams for domestic companies.

This fund provides a focused way to participate in this multi-decade growth story with minimal active risk.

Key Risks and Limitations

Like all thematic investments, this fund is not without risks:

- Concentration Risk: Exposure to a single theme (defence) makes it vulnerable to policy or budget reversals.

- Cyclicality: Defence orders can be lumpy, and delays in government spending may affect earnings.

- Liquidity and Valuation Risks: Some underlying stocks may be less liquid or experience sharp price movements.

- Geopolitical Shocks: Conflicts or sanctions affecting partners or suppliers may impact performance.

Investors should diversify adequately and avoid overexposure to this theme.

Who Should Invest?

The Motilal Oswal Nifty India Defence Index Fund is well-suited for investors who:

- Are looking to capitalize on India’s growing defence sector and government-led policy tailwinds.

- Seek long-term capital appreciation from a high-growth, strategic industry.

- Prefer a passive investment style, with lower costs and minimal active management risk.

- Want to diversify beyond traditional index funds (like Nifty 50 or Sensex) and gain exposure to a focused, thematic opportunity.

- Have a high risk appetite, given the sector-specific nature of the fund and its potential volatility.

Ideal for:

- Young investors or professionals with a long investment horizon (5+ years).

- Investors aiming to allocate a small portion (5-10%) of their portfolio to thematic funds for enhanced growth.

- Those interested in defence, technology, or self-reliance themes.

However, this fund may not be suitable for conservative investors or those seeking short-term gains.

Expert Opinion

Market analysts and fund managers see strong potential in defence-themed investments:

- According to Motilal Oswal AMC, “The Nifty India Defence Index has delivered a CAGR of over 40% in the past three years, showing its strong momentum and investor interest.”

- Independent experts recommend using it as a satellite holding, making up 5-10% of a portfolio.

- They also suggest monitoring government defence contracts, budget allocations, and export data to understand index dynamics.

In summary, most experts agree that this fund is a strong long-term bet if aligned with your risk profile and financial goals.

Final Verdict

The Motilal Oswal Nifty India Defence Index Fund is a unique thematic offering that taps into India’s growing push for defence self-reliance. While recent underperformance highlights short-term volatility, the long-term structural opportunity remains compelling.

This fund is best suited as a satellite allocation within a diversified equity portfolio. If you’re a long-term investor with high risk tolerance and a conviction in India’s defence modernization story, this fund offers a timely and strategic entry point into a niche, high-potential sector.

It’s important to track index changes and defence policies periodically, as shifts in global geopolitics or domestic strategy could influence performance. For SIP investors with a 5+ year horizon, this fund may serve as a valuable thematic bet.

Taxation Aspects

Since this is an equity-oriented index fund, taxation follows equity mutual fund norms:

- Short-Term Capital Gains (STCG): If units are sold within 12 months, gains are taxed at 15%.

- Long-Term Capital Gains (LTCG): If units are sold after 12 months, gains up to ₹1 lakh per year are tax-free. Gains beyond ₹1 lakh are taxed at 10% without indexation.

- Dividend Distribution Tax: Not applicable; dividends are added to the investor’s income and taxed as per applicable slab.

Investors should consult a tax advisor based on their individual financial circumstances.

Frequently Asked Questions (FAQs)

1. Is the Motilal Oswal Defence Fund risky? Yes, it is a high-risk fund due to its sector-specific concentration.

2. Can I do SIP in this fund? Yes, SIPs start at INR 500.

3. How long should I stay invested? At least 5+ years to benefit from the long-term defence sector growth.

4. Is it suitable for beginners? Only if you understand thematic funds and are willing to tolerate volatility.

5. What is the fund’s benchmark? Nifty India Defence Total Return Index (TRI).

Disclaimer: Mutual Fund investments are subject to market risks. Please read all scheme-related documents before investing.