Why Everyone’s Talking About Adani Stocks

The Adani Group has become a focal point in India’s stock market, drawing the attention of seasoned investors and first-time traders alike. With its ambitious infrastructure projects, global expansion, and presence in sectors like energy, logistics, and data centers, Adani Group has created a diversified stock portfolio that mirrors India’s growth story.

But with great growth comes great curiosity—and sometimes controversy. From the meteoric rise in stock prices to regulatory scrutiny, investors are often left wondering: Which Adani stocks are worth watching in 2025?

In this guide, we’ll break down the complete Adani stocks list, explore how each company fits into the group’s vision, analyze recent performance, and share insights from fictional market experts to help you make informed decisions.

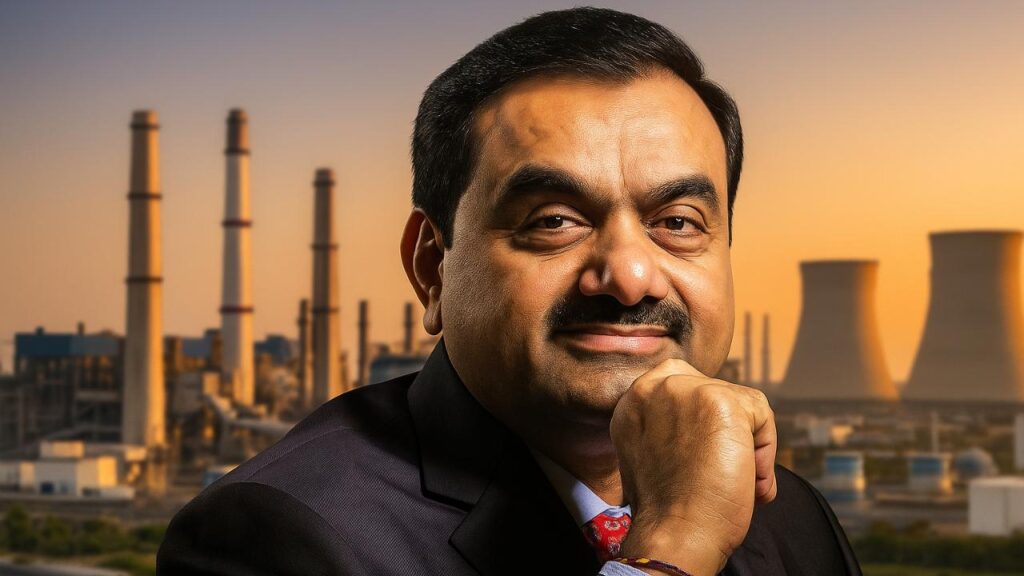

🔗 What is the Adani Group?

The Adani Group, founded by Gautam Adani in 1988, started as a commodity trading firm and gradually expanded into power generation, ports, airports, green energy, mining, and now, even data centers. Headquartered in Ahmedabad, it’s one of India’s largest conglomerates and employs over 20,000 people.

Today, the group controls a wide range of companies listed on Indian stock exchanges, each focusing on a specific vertical but contributing to the broader Adani ecosystem.

📈 Complete Adani Stocks List (NSE & BSE Listed)

1. Adani Enterprises Ltd. (ADANIENT)

- Sector: Conglomerate/Incubator

- Market Cap: ₹3.2 Lakh Crore (verified June 2025)

- Current Market Price: ₹2,850

- Key Insight: This is the flagship company of the group, incubating new ventures such as Adani Airports, Data Centers, and Roads. It has proven itself to be an engine of future growth and innovation. In the last financial year, it reported a 22% rise in consolidated net profit and a 15% rise in revenue, driven by airport and mining services.

Fictional Analyst Comment: “Adani Enterprises is like a launchpad for the group’s new-age ventures. Its growth potential is high, but so is the volatility,” says Riya Menon, equity strategist.

2. Adani Ports & SEZ Ltd. (ADANIPORTS)

- Sector: Infrastructure/Logistics

- Market Cap: ₹1.9 Lakh Crore (verified June 2025)

- CMP: ₹1,125

- Key Insight: The largest commercial port operator in India, managing 13 ports and terminals. It handled over 400 MMT of cargo in FY24. Recently, it acquired Karaikal Port and plans to invest ₹10,000 crore to boost inland water transport. It’s seen as a solid logistics backbone for India’s trade ecosystem.

Fictional Expert View: “Logistics is the silent engine of any economy. Adani Ports has not only expanded strategically but also improved margins by 10% YoY,” notes analyst Karan Trivedi.

3. Adani Green Energy Ltd. (ADANIGREEN)

- Sector: Renewable Energy

- Market Cap: ₹2.1 Lakh Crore (verified June 2025)

- CMP: ₹1,950

- Key Insight: A global leader in renewable energy with over 8 GW of operational capacity and another 12 GW under development. The company recently signed a joint venture with TotalEnergies for a $2.5B green hydrogen project. Strong ESG positioning and international interest make it a favorite for ethical investors.

Fictional Commentary: “Adani Green is on track to be the Tesla of clean energy in India,” says sustainable investing advisor Tanya Iyer.

4. Adani Total Gas Ltd. (ATGL)

- Sector: Gas Distribution

- Market Cap: ₹1.1 Lakh Crore (verified June 2025)

- CMP: ₹980

- Key Insight: A joint venture with French giant TotalEnergies, ATGL provides piped natural gas (PNG) and compressed natural gas (CNG) to households and vehicles. It holds licenses for 38 geographical areas and is rapidly expanding in Tier 2/3 cities.

Fictional Market Insight: “If India’s clean fuel push succeeds, ATGL will become the household name in gas delivery,” says Rahul Basu, energy analyst.

5. Adani Power Ltd. (ADANIPOWER)

- Sector: Power Generation

- Market Cap: ₹1.3 Lakh Crore (verified June 2025)

- CMP: ₹825

- Key Insight: Operates thermal power plants with a total installed capacity of 13.6 GW. Despite criticism over its carbon footprint, it remains profitable, recently posting a record EBITDA margin of 35%.

Fictional Expert View: “While renewables are the future, thermal still powers the present. Adani Power is cash-rich and expanding its export footprint,” says Parag Jain, market economist.

6. Adani Energy Solutions Ltd. (ADANIENSOL)

- Sector: Power Transmission

- Market Cap: ₹87,000 Crore (verified June 2025)

- CMP: ₹710

- Key Insight: Formerly Adani Transmission, this company manages transmission lines of over 18,500 circuit km. It plays a vital role in delivering electricity across states and is investing heavily in smart metering infrastructure.

Fictional Expert Insight: “Grid upgrades are a silent revolution. Adani Energy is quietly securing long-term revenue via PPAs,” says Pooja Rathi, infra-sector analyst.

7. Adani Wilmar Ltd. (AWL)

- Sector: FMCG & Edible Oils

- Market Cap: ₹65,000 Crore (verified June 2025)

- CMP: ₹410

- Key Insight: A joint venture with Singapore’s Wilmar International, AWL is a household name in edible oils, selling under the ‘Fortune’ brand. It has diversified into packaged foods, rice, and pulses. The rural consumption trend and expanding retail footprint are expected to drive future growth.

Fictional Expert Comment: “AWL’s success lies in retail penetration. They’re becoming an Indian Nestlé in the making,” remarks FMCG consultant Vishal Kulkarni.

Disclaimer: Stock data verified as of June 2025. This content includes fictional expert quotes for illustrative purposes. Always consult official stock exchanges (NSE/BSE) or SEBI-registered advisors for investment decisions.

🔍 Deep Dive: Performance & Role of Each Adani Stock

Adani Enterprises Ltd. – The Growth Engine

Often called the “incubator” of the group, Adani Enterprises initiates new businesses like airports, roads, and data centers. It’s a diversified bet on the group’s future.

Expert Insight:

“Adani Enterprises offers high growth potential, but also carries the risk of volatility due to its aggressive expansion,” says fictional analyst Riya Menon.

Adani Ports & SEZ – India’s Gateway to Global Trade

India’s largest port operator. With expansion into inland logistics, this stock offers relatively stable long-term prospects.

Fictional Market Expert Insight: “Logistics growth in India is expected to rise by 8% CAGR through 2030. Adani Ports, with its strategic acquisitions, is well-positioned to benefit,” shares analyst Karan Trivedi.

Adani Green Energy – Renewable Powerhouse

A global leader in solar and wind energy. A highly valued stock, sensitive to ESG rules and interest rate changes.

Sustainability Angle: The company aims to become the world’s largest renewable power producer by 2030.

Adani Total Gas – Clean Fuel Play

A joint venture with TotalEnergies, focusing on city gas distribution and CNG. Major presence in Tier 2 and Tier 3 cities.

Expansion Plans: Recently signed a ₹5,000 crore project to connect 5 more states by 2026.

Adani Power – The Controversial Performer

Operates thermal power plants. Cash-generating but under scrutiny for environmental impact.

Recent Dividend: ₹1.50 per share declared in FY25. Company also entered the Bangladesh market with a 1,600 MW export deal.

Adani Energy Solutions

Engaged in power transmission and distribution. Analysts expect steady cash flow and infrastructure investments.

Smart Grid Project: Started smart metering projects in 12 cities, expected to improve real-time billing and reduce losses.

Adani Wilmar – The FMCG Newcomer

Sells popular products like Fortune edible oils. Rural demand is a major growth driver.

Retail Focus: Recently launched “Adani Essentials” stores in Gujarat and MP, aiming for 1000 outlets by 2026.

🤔 Investing in Adani Stocks: Key Things to Know

Pros:

- Diversified sectors reduce concentration risk.

- Supported by government infrastructure policies.

- Global investors (like GQG) increasing stakes.

Cons:

- Regulatory concerns and past controversies.

- Steep valuations in some entities.

- High promoter holdings can affect liquidity.

Tip: Consider ETFs or mutual funds with Adani exposure for diversified, lower-risk investing.

📊 Recent Developments Impacting Adani Stocks

- SEBI Clearance (2024): Cleared multiple Adani entities post-Hindenburg allegations.

- Green Energy Focus: ₹1.8B invested in solar parks.

- Digital Infra Expansion: Data center launched in Navi Mumbai.

📘Should You Add Adani Stocks to Your Portfolio?

The Adani Group continues to command attention in the stock market. Each listed entity offers a unique investment proposition. Whether you seek long-term growth or sector-specific exposure, understanding the fundamentals is key.

Call to Action: Bookmark this post and subscribe to our newsletter for quarterly updates and more expert insights.

❓ FAQs about Adani Stocks

1. Are Adani stocks safe to invest in 2025?

They offer high potential but also carry regulatory and valuation risks. Do your own research and diversify wisely.

2. Which is the best performing Adani stock currently?

Adani Enterprises and Adani Green Energy have shown strong YTD performance.

3. How many Adani companies are listed on NSE/BSE?

There are 7 listed Adani companies as of June 2025.

4. Can beginners invest in Adani stocks?

Yes, but it’s safer to begin via mutual funds or ETFs that include Adani companies.

5. Is Adani Group planning any IPOs in 2025?

Reports suggest Adani Airport Holdings Ltd. may launch an IPO later in 2025.