Advance tax is a key part of India’s taxation system that requires taxpayers to pay taxes in advance during the financial year, rather than waiting until the year-end. It ensures a steady inflow of funds to the government and helps individuals and businesses manage cash flow more effectively. Whether you’re a freelancer, salaried employee, or business owner, understanding how advance tax works is essential for staying compliant and avoiding penalties.

What Is Advance Tax?

Advance tax—often referred to as the “pay-as-you-earn” tax—is income tax that must be paid in installments instead of a single lump sum at the end of the financial year. This rule applies if your total tax liability exceeds ₹10,000 after considering any Tax Deducted at Source (TDS).

Advance tax is governed by Sections 208 to 219 of the Income Tax Act, 1961, and applies to individuals, freelancers, professionals, NRIs, and corporations alike. It ensures a steady flow of revenue for the government while encouraging timely compliance from taxpayers. By distributing payments across the year, advance tax also helps individuals and businesses manage cash flow more effectively. Failing to pay on time can lead to interest penalties, making it crucial to understand the rules and deadlines in advance.

Who Needs to Pay Advance Tax?

You’re required to pay advance tax if:

- You are a salaried individual earning income from other sources such as capital gains, rent, or a side business, and your tax due (after TDS) exceeds ₹10,000.

- You are a freelancer, consultant, or self-employed professional with a net tax liability over ₹10,000.

- You are running a business or a company, including startups and MSMEs.

- You are an NRI earning taxable income in India exceeding ₹10,000.

📌 Tip: Even if your employer deducts TDS, you may still have to pay advance tax on income from sources like stocks, fixed deposits, or property rental.

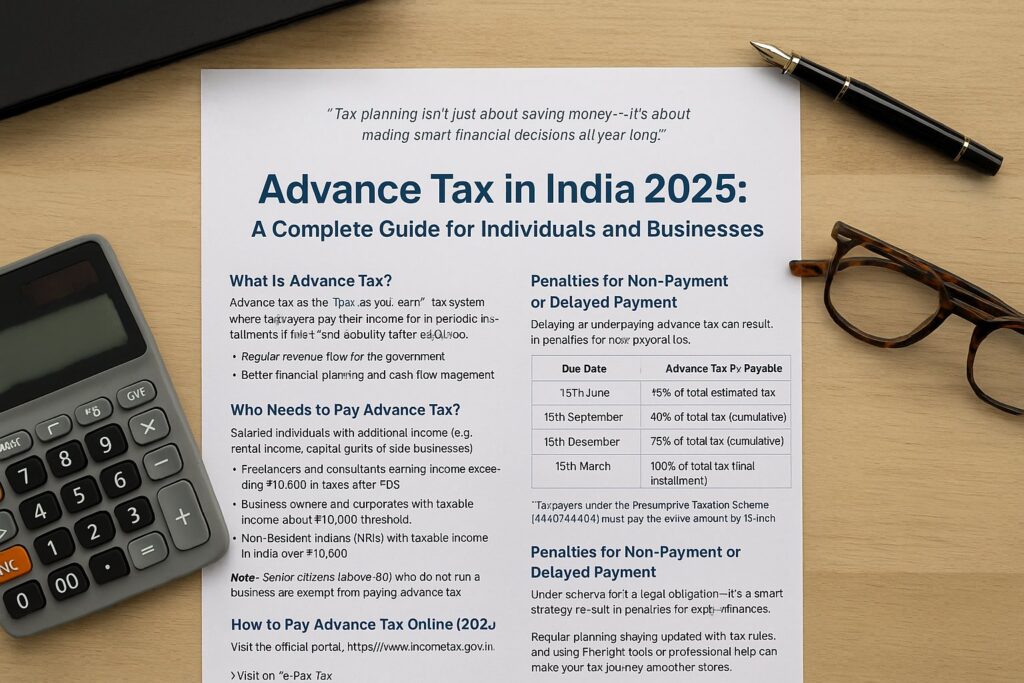

Advance Tax Payment Schedule

You don’t have to wait till March to pay your taxes. The Income Tax Department mandates four payment dates:

| Due Date | Advance Tax Payable |

|---|---|

| 15th June | 15% of total tax liability |

| 15th September | 45% of total tax liability |

| 15th December | 75% of total tax liability |

| 15th March | 100% of total tax liability |

For taxpayers under the Presumptive Taxation Scheme (Section 44AD or 44ADA), the entire advance tax must be paid by 15th March in a single installment.

How to Calculate Your Advance Tax

To calculate your advance tax, start by estimating your total income for the financial year. Then, subtract eligible deductions and exemptions under various sections like 80C and 80D. Finally, apply the applicable tax slabs and deduct any TDS already paid to determine the remaining tax payable in installments.

To accurately estimate and pay your advance tax:

- Estimate your total income for the current financial year.

- Subtract exemptions and deductions:

- Section 80C (e.g., LIC, PPF, ELSS)

- Section 80D (Health Insurance)

- Section 80E (Education Loan Interest)

- Any other applicable deductions

- Compute your taxable income based on the latest income tax slabs.

- Deduct any TDS already deducted.

- If the net tax liability exceeds ₹10,000, pay it in advance as per the schedule above.

Example:

If your estimated income for FY 2024-25 is ₹12 lakhs, after claiming ₹1.5 lakhs under 80C and ₹25,000 under 80D, and if ₹75,000 has been deducted as TDS by your employer, you will need to pay advance tax on the balance tax due.

How to Pay Advance Tax Online

Paying advance tax online is simple and convenient through the Income Tax Department’s official e-payment portal. Visit https://www.incometax.gov.in, select the ‘e-Pay Tax’ option, and choose Challan 280 for advance tax payments. Enter the required details, including the assessment year, and complete the payment using Net Banking, Debit Card, or UPI. Don’t forget to download and save the payment receipt as proof for your records.

Paying advance tax has become easier than ever. Here’s how to do it online:

- Go to the Income Tax e-Filing portal.

- Click on ‘e-Pay Tax’.

- Select Challan 280 (Self Assessment/Advance Tax).

- Enter your PAN, assessment year, and other relevant details.

- Choose the appropriate mode of payment (Net Banking, Debit Card, or UPI).

- Save and download the payment receipt for your records.

✅ Pro Tip: Always double-check the assessment year while making the payment to avoid errors.

Penalties for Non-Payment or Late Payment

Failing to pay advance tax or paying less than the required amount attracts penalties under Sections 234B and 234C of the Income Tax Act.

- Section 234B: Interest of 1% per month on the unpaid amount if 90% of the tax liability is not paid before 31st March.

- Section 234C: Interest of 1% per month for missing installment deadlines.

Avoid Penalties:

- Use a tax calculator to stay on top of your dues.

- Set calendar reminders for installment dates.

- Consult a tax advisor for accurate tax planning.

Recent Updates: Advance Tax News (March 2025)

Advance tax made headlines recently due to some high-stakes tax disputes:

- Kia Motors India: Challenged a ₹116 crore tax demand, citing trade treaty exemptions.

- Skoda Auto Volkswagen India: Slapped with a whopping ₹11,600 crore notice for allegedly misclassifying car imports.

- Wealth Tax Talks: French economist Thomas Piketty proposed a 2% wealth tax on India’s richest citizens, sparking a policy debate.

These developments underline the importance of tax compliance and proactive planning.

Government Initiatives and Expert Advice

The Indian government is streamlining the tax filing process to improve ease of doing business and ensure faster refunds.

Expert Tips:

- Maximize deductions under Section 80C, 80D, 80G, and Capital Gains exemptions.

- Keep detailed financial records and expense proofs.

- Freelancers and small business owners should use accounting software or hire a tax consultant.

“Smart tax planning isn’t about finding loopholes — it’s about understanding the law and leveraging it wisely.”

Final Thoughts: Why Advance Tax Matters

Advance tax isn’t just a legal requirement—it’s a smart financial habit. By understanding when and how much to pay, you can avoid unnecessary penalties and better manage your income throughout the year. Stay informed, consult experts when needed, and make tax planning an ongoing process—not just a year-end scramble.

Disclaimer: This blog post is for informational purposes only and does not constitute legal or financial advice. Please consult a certified tax professional or financial advisor for guidance tailored to your specific situation.