Introduction

Dr. Alexander Elder, born in Leningrad (now St. Petersburg), Russia, is a globally respected name in stock trading and market psychology. Once a practicing psychiatrist, Elder’s remarkable journey took him from treating patients in hospitals to diagnosing market behaviors on Wall Street. By blending his medical expertise with deep financial insight, he developed a holistic approach to trading that emphasizes psychological control, technical methods, and disciplined money management.

Background and Family

Raised in the Soviet Union, Elder was nurtured in a culture of intellectual rigor. He trained as a doctor and began working as a ship’s physician in his early 20s. In a bold move for freedom, Elder jumped ship in Africa and sought asylum in the United States. There, he restarted his life, practicing psychiatry in New York. His experience with human behavior would later become the cornerstone of his financial philosophy.

The Beginning of the Journey

Dr. Elder’s curiosity about the stock market began while he was still working as a psychiatrist. He viewed the market as a living system influenced by crowd psychology. This led him to experiment with trading, making his first investments with modest capital. Like many beginners, he experienced losses but treated each one as a learning opportunity. These early challenges sparked his lifelong mission to understand the emotional drivers behind market decisions.

The Turning Point

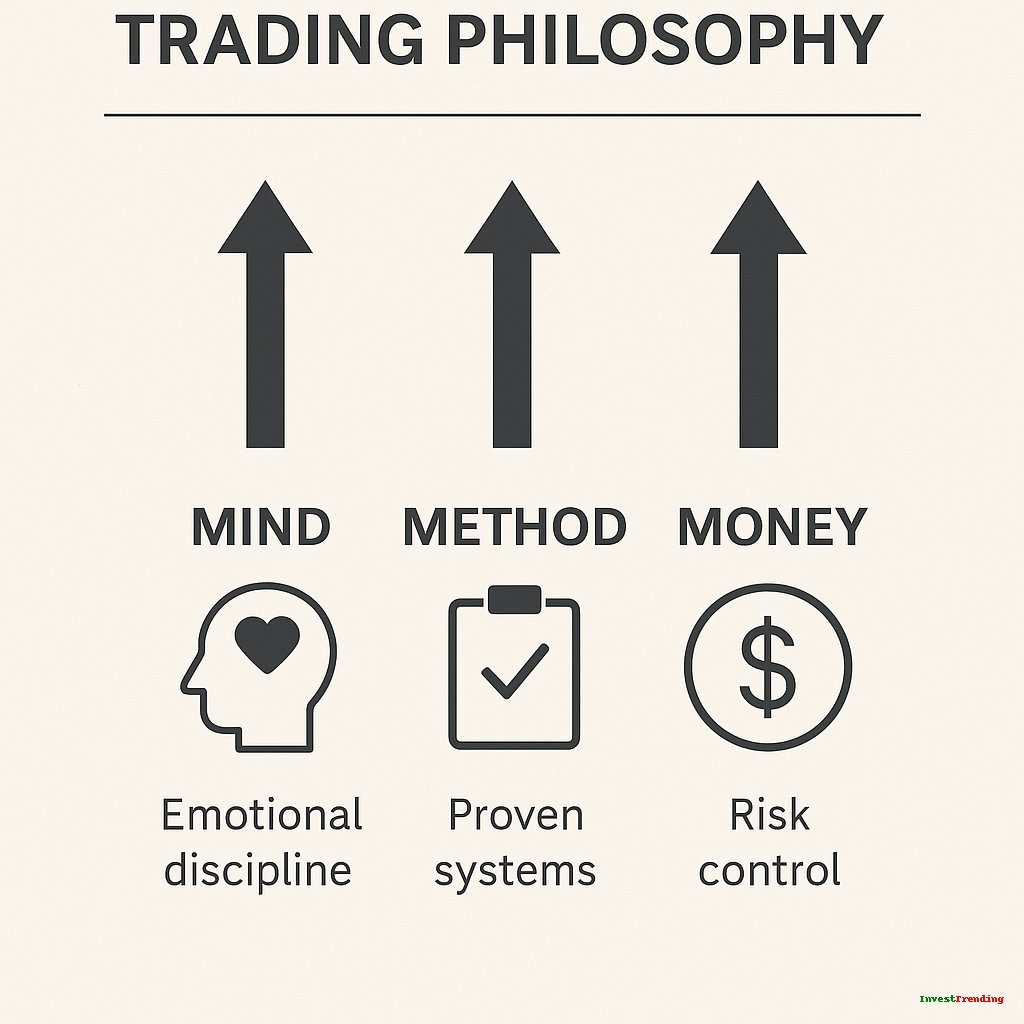

Elder’s defining moment came when he realized that emotional control was the missing ingredient in most trading strategies. Combining this insight with his medical training, he created the “Three M” strategy:

- Mind: Control your emotions.

- Method: Follow a proven system.

- Money: Manage your capital responsibly.

This shift allowed him to approach trading with the discipline of a surgeon and the insight of a psychologist. The strategy has since become a foundational concept for traders globally.

Investment Strategies and Tools

Elder is a technical trader with a heavy focus on:

- Trend-following systems

- Momentum and volume indicators

- Multi-timeframe analysis

- Risk management through stop-loss placement

He introduced tools like the Elder-ray Index, helping traders analyze bull and bear power. Elder also emphasizes the importance of journaling trades and reviewing emotional patterns, a habit he credits for much of his success.

In addition, Elder’s Triple Screen Trading System, another of his notable contributions, is widely adopted by technical traders. It uses a three-layered approach to filter out market noise, analyze long-term trends, and pinpoint short-term entry points with confirmation indicators.

Trading for a Living

Dr. Elder’s international bestseller, “Trading for a Living”, is more than just a manual—it’s a mindset shift. Written in a conversational tone, it combines psychology, trading tactics, risk management, and self-discipline. One of the most powerful messages in the book is the idea that a trader’s worst enemy is often their own emotions.

“Your goal is to be the calmest person in the room when everyone else is losing their heads.” — Trading for a Living

The book is structured around helping readers:

- Understand and master their mindset

- Develop technical trading systems

- Manage risk effectively

- Keep records and improve continuously

Many readers say the book feels like a conversation with a mentor—one who’s been through the ups and downs of the market and wants to help you avoid costly mistakes.

Real Investment Wins

Though Elder keeps many of his personal trades private, his systems have guided thousands to profitable outcomes. During the 2008 financial crisis, he advocated staying out of volatile markets until technical clarity returned, saving many from panic-driven losses.

In 2020, amid COVID-19 market chaos, Elder focused on technical confirmations. Those who followed his teachings waited for trend reversals instead of jumping prematurely, capturing the post-crash rally safely.

Recognition, Innovation, and Influence

- Authored the international bestseller “Trading for a Living”, now a classic in trading literature.

- Created the Elder-ray Indicator, widely used for trend strength analysis.

- Designed the Triple Screen Trading System, a strategic multi-timeframe filter.

- Founded Financial Trading Inc., offering global trading education.

- Built a strong following through seminars, webinars, and publications.

- Contributed to top publications like Stocks & Commodities Magazine.

His influence extends beyond profits: he has helped shape how traders think and act.

Key Lessons for Readers

Dr. Elder’s journey holds valuable insights:

- ✅ Control emotions before capital

- ✅ Always use a trading journal

- ✅ Define your system and follow it strictly

- ✅ Never risk more than you can afford to lose

- ✅ Focus on survival, not just success

Tips from Dr. Elder:

- Limit losses with disciplined stop-loss use

- Avoid impulsive trades based on news or emotions

- Review each trade’s outcome and your mindset

- Study price behavior over predictions

- Use multi-timeframe analysis to confirm trade setups

Top 3 Elements of Elder’s Trading Philosophy

Quote Highlight

“The goal of a successful trader is to make the best trades. Money is secondary.”

— Alexander Elder

“Beginners focus on analysis, but professionals operate in a three-dimensional space: mind, method, and money.”

— Alexander Elder

“Markets are never wrong—opinions often are.”

— Alexander Elder

Reader Experience Highlight

Many traders credit Elder’s teachings for improving their discipline. One follower wrote in a seminar review:

“Reading ‘Trading for a Living’ made me rethink everything I was doing wrong. It wasn’t just the strategies—it was how I thought about trading that changed everything.”

Another testimonial from a trading community member noted:

“The Elder-ray and Triple Screen changed how I approach risk. I feel more in control—not just of my trades, but of my reactions.”

Conclusive Summary

Dr. Alexander Elder’s life is a testament to the idea that understanding oneself is just as important as understanding the market. His work has shown traders worldwide that the most powerful tools aren’t just found in software or charts, but within the trader’s own mindset. His influence continues to inspire new generations to approach trading with integrity, structure, and emotional discipline.

📚 Related Success Stories You’ll Love

Explore more inspiring journeys of legendary investors and traders:

- 🔹 Dan Zanger: From Pool Contractor to World‑Record Momentum Trader

Discover how Dan Zanger turned $11,000 into $42 million using momentum trading—and broke world records doing it. - 🔹 Michael Burry: The Real-Life Big Short and His Remarkable Investment Success Story

Learn how Michael Burry foresaw the 2008 crash, bet against the housing market, and walked away with legendary status. - 🔹 Nassim Nicholas Taleb: The Trader Who Profited from Chaos

Meet the philosopher-trader who built wealth from uncertainty and taught the world about “Black Swan” events.