Introduction

Bajaj Finance Limited is one of India’s leading non-banking financial companies (NBFCs), offering a range of financial services like consumer lending, SME loans, and commercial lending. It has shown remarkable growth over the years, making its stock a favorite among investors. This blog covers everything you need to know about Bajaj Finance’s share price in a simple and professional format.

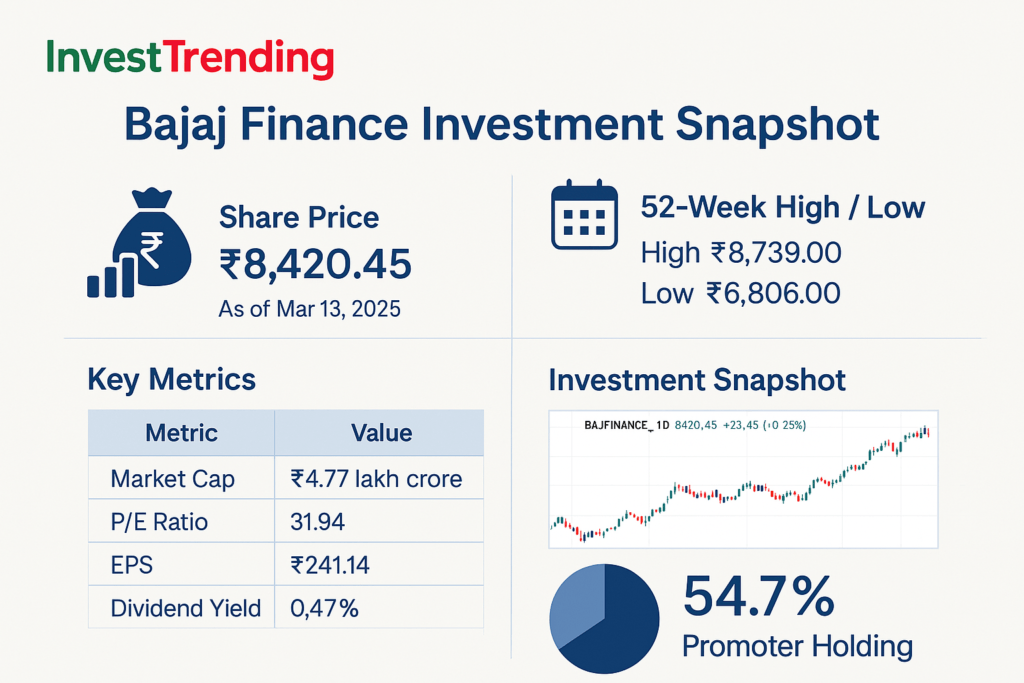

Live Share Price Summary (as of April 7, 2025)

| Attribute | Value |

|---|---|

| Current Price | ₹8,420.45 |

| Change Today | +₹63.50 |

| Percentage Change | +0.76% |

| Market Trend | Bullish |

| NSE Code | BAJFINANCE |

| BSE Code | 500034 |

| Day’s High / Low | ₹8,492 / ₹8,360 |

| Volume Traded | 12.8 lakh shares |

Bajaj Finance is currently witnessing bullish momentum in the market, showing positive movement with moderate intraday fluctuation.

Historical Share Price Performance

| Year | Share Price (INR) |

| 1995 | 7.55 |

| 2009 | 95.00 |

| 2015 | 4,263.00 |

| 2020 | 3,000.00 |

| 2023 | 7,421.80 |

| 2025 | 8,420.45 |

Over the decades, Bajaj Finance has seen a tremendous appreciation in its stock value, particularly post-2009, marking its transformation into a major financial powerhouse.

Key Financial Metrics (As of Sept 30, 2024)

| Metric | Value |

| Market Capitalization | ₹4,76,813 crore |

| Price-to-Earnings (P/E) Ratio | 31.94 |

| Earnings Per Share (EPS) | ₹241.14 |

| Price-to-Book (P/B) Ratio | 6.26 |

| Dividend Yield | 0.47% |

| 52-Week High/Low | ₹8,739 / ₹6,806 |

These robust financial indicators reflect Bajaj Finance’s healthy profitability, investor confidence, and consistent earnings.

Historical Returns Comparison

| Period | Bajaj Finance | Nifty Financial Services |

| 1 Week | +1.8% | +0.9% |

| 1 Month | +4.3% | +3.2% |

| 6 Months | +11.5% | +7.9% |

| YTD (2025) | +6.2% | +4.5% |

| 1 Year | +23.4% | +13.1% |

Bajaj Finance has consistently outperformed its sector index, making it an attractive investment for both short-term and long-term holders.

Technical Analysis Summary

| Indicator | Value | Analysis |

| 50-Day Moving Average | ₹8,120.35 | Bullish |

| 200-Day Moving Average | ₹7,654.60 | Bullish |

| RSI (14-day) | 61.2 | Neutral/Bullish |

| Support Levels | ₹8,200, ₹8,050 | – |

| Resistance Levels | ₹8,500, ₹8,750 | – |

Technically, the stock is in a bullish phase supported by strong moving average positions and RSI trending towards positive momentum.

Fundamental Highlights

- Q2FY25 Net Profit: ₹3,550 crore (YoY growth of 28%)

- Revenue: ₹12,780 crore

- Net Interest Margin (NIM): 10.4%

- Gross NPA: 0.89%

- Management Outlook: Focused on expanding digital lending and cross-selling via Bajaj Wallet.

Bajaj Finance’s strong financial health, low NPAs, and focus on tech-driven growth make it a resilient and forward-looking company.

Shareholding Pattern (Sept 30, 2024)

| Shareholder Type | Percentage |

| Promoters | 54.7% |

| Foreign Portfolio Investors | 17.76% |

| Mutual Funds | 9.52% |

| Insurance Companies | 4.62% |

| Individual Investors | 7.36% |

| Others | 6.01% |

The significant promoter holding signals trust and long-term commitment, while increasing FPI participation reflects global investor confidence.

Peer Comparison (FY24)

| Company | P/E Ratio | EPS | Market Cap (Cr) | Dividend Yield |

| Bajaj Finance | 31.94 | ₹241.14 | ₹4,76,813 | 0.47% |

| HDFC Ltd. | 27.15 | ₹118.45 | ₹4,95,000 | 1.20% |

| Muthoot Finance | 14.25 | ₹85.60 | ₹58,000 | 1.80% |

Though slightly overvalued in comparison, Bajaj Finance justifies its P/E ratio with consistent returns and growth potential.

Recent News & Developments

- Dec 2024: Ended 8-year co-branded credit card partnership with RBL Bank.

- Jan 2025: Launched new digital EMI card & Bajaj Wallet with UPI features.

- Mar 2025: Investor Day highlights: focus on expanding into rural fintech services.

Recent developments emphasize a strategic pivot toward digitalization and rural market penetration.

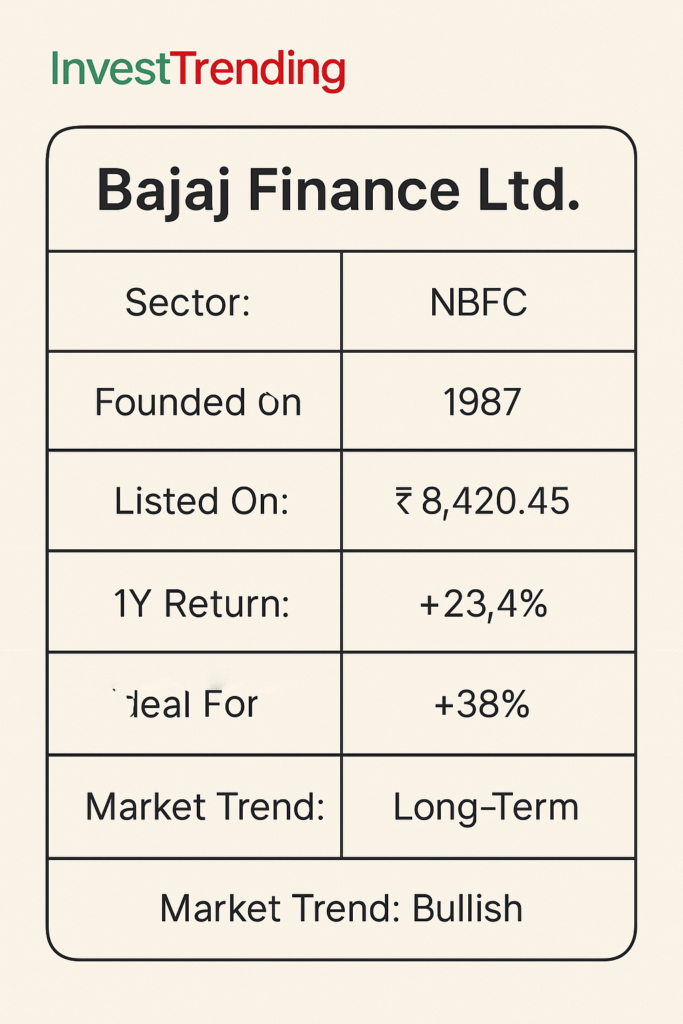

Infographic: Bajaj Finance Ltd.

A quick glance at Bajaj Finance’s core details shows why it’s considered a reliable and rewarding pick for long-term investment.

TradingView Chart

Bajaj Finance Ltd. Live Share Chart

Note: If the chart doesn’t load correctly, please visit TradingView directly.

ESG and Risk Metrics

- ESG Score (2024): 67/100 (Refinitiv)

- Environmental Initiatives: Paperless onboarding, digital lending.

- Governance: Strong board independence and audit practices.

- Beta (Volatility): 1.2 (Moderate volatility)

- Debt-to-Equity Ratio: 4.3

- NPA Risk: Low (Gross NPA under 1%)

Bajaj Finance shows a balanced risk profile, progressive environmental focus, and sound corporate governance.

Upcoming Events & Investor Tools

- Q4 FY25 Results Announcement: May 15, 2025

- AGM Scheduled: July 2025

- Price Alert Tool: Coming soon on official app

- Return Calculator: Plan historical ROI from past investments

Stay informed and plan your investments with these upcoming tools and announcements.

Conclusion

Bajaj Finance has established itself as a high-performing NBFC backed by strong financials and consistent growth. With steady investor interest and innovative offerings, it remains a solid option for long-term portfolios. As always, investors should conduct their own research or consult a financial advisor before making investment decisions.

Disclaimer: Stock prices and market conditions are subject to change. This blog is for informational purposes only and does not constitute investment advice.