Introduction

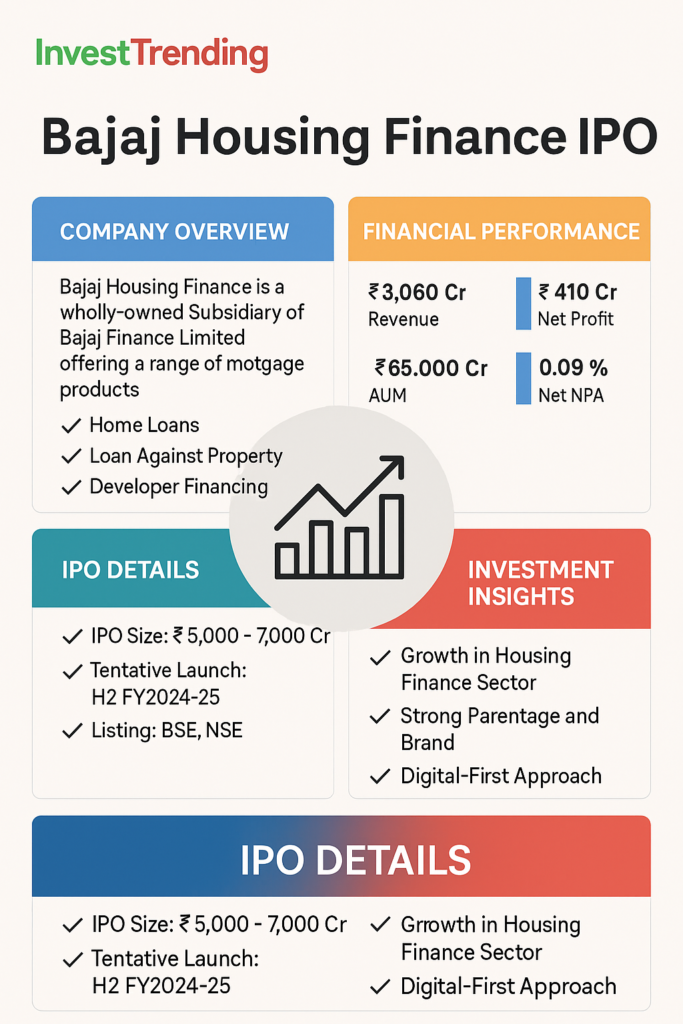

Bajaj Housing Finance Limited (BHFL), a wholly-owned subsidiary of Bajaj Finance Limited, is all set to make headlines with its upcoming Initial Public Offering (IPO). This much-anticipated event has caught the attention of investors and financial analysts alike. The IPO is not just a fundraising event; it’s a strategic move in the growth journey of one of India’s most trusted financial institutions.

In this blog, we’ll cover everything you need to know about the Bajaj Housing Finance IPO — from company background and financials to IPO details, reasons behind the listing, and expert insights.

About Bajaj Housing Finance Limited

Bajaj Housing Finance Limited is a 100% subsidiary of Bajaj Finance, one of India’s largest and most trusted NBFCs (Non-Banking Financial Companies). BHFL offers a wide range of mortgage products to both salaried and self-employed individuals, including:

- Home Loans

- Loan Against Property

- Lease Rental Discounting

- Developer Financing

Key Highlights:

| Feature | Details |

|---|---|

| Founded | 2015 |

| Parent Company | Bajaj Finance Limited |

| Headquarters | Pune, Maharashtra |

| Core Business | Mortgage Lending |

| Customers Served | Over 1 million |

| Employee Strength | 3,000+ |

| Technology Integration | AI-based underwriting, e-KYC, digital documentation |

| Credit Ratings | AAA (CRISIL, ICRA) |

Why Bajaj Housing Finance is Going Public

Bajaj Housing Finance is aiming to unlock value through its IPO by achieving the following:

- Capital Augmentation: To strengthen its capital base for future growth and expansion.

- Regulatory Compliance: As per RBI guidelines, housing finance subsidiaries of NBFCs crossing a certain asset threshold must get listed within a specific timeframe.

- Enhanced Visibility: Being a listed entity increases transparency and brand visibility.

- Shareholder Liquidity: Provides liquidity to existing shareholders through the Offer for Sale (OFS).

Financial Performance Snapshot

Bajaj Housing Finance has shown a consistent growth trajectory in recent years. Below is a snapshot of its recent financials:

| Financial Year | Revenue (INR Crores) | Net Profit (INR Crores) | AUM (Assets Under Management) |

| 2021-22 | 2,120 | 260 | 52,500 Cr |

| 2022-23 | 3,060 | 410 | 65,000 Cr |

| 2023-24 (Est.) | 4,250 | 600 | 78,000 Cr |

Note: FY2023-24 figures are based on provisional estimates from market sources and may change after final audits.

IPO Details (Tentative)

While the exact details of the IPO are yet to be officially announced, here’s what we can expect:

- IPO Size: Estimated at INR 5,000 – 7,000 crores

- Fresh Issue: To raise capital for growth

- Offer for Sale (OFS): Some shares may be offered by the parent company

- Expected Launch: Likely in the second half of FY2024-25, subject to regulatory approvals

- Lead Managers: Axis Capital, ICICI Securities, and others likely to be involved

- Listing Exchange: BSE and NSE

- Valuation Range: Estimated valuation of INR 45,000 – 50,000 crores

Market Opportunity

India’s housing finance sector is booming, thanks to:

- Government’s focus on affordable housing

- Increasing urbanization

- Growing middle-class aspirations

Bajaj Housing Finance is well-positioned to leverage these trends with its:

- Robust distribution network (including physical and digital channels)

- Digital-first approach (end-to-end digital loan processing)

- Trusted brand image (part of the Bajaj Group)

Competitive Landscape

BHFL operates in a competitive space that includes:

| Competitor | Strengths |

| HDFC Ltd | Legacy, strong portfolio |

| LIC Housing Finance | Government backing |

| PNB Housing Finance | Wide reach |

| Tata Capital Housing | Tata brand trust |

What sets BHFL apart is its tech-driven approach, operational efficiency, use of advanced analytics for credit scoring, and aggressive digital strategy.

Risks to Consider

Every investment comes with its risks. Here are a few for BHFL:

- Interest rate volatility impacting cost of funds

- Regulatory changes by RBI or SEBI

- Rising competition from fintech and large HFCs

- Economic downturns affecting home loan demand

- Cybersecurity concerns in digital operations

However, the company’s solid parentage, diversified loan book, and conservative lending approach help mitigate these risks to some extent.

Expert Opinions and Analyst Views

Many market experts view the IPO as a good opportunity for long-term investors:

- ICICI Direct (March 2024 Report): “BHFL’s growth and strong promoter backing make this IPO attractive.”

- Motilal Oswal: “A well-diversified mortgage portfolio and prudent risk management are key strengths.”

- Angel One: “The IPO is coming at a time when housing demand is on the rise.”

- HDFC Securities: “Strong balance sheet and scalable digital infrastructure make BHFL a future-ready enterprise.”

Should You Invest?

If you are a long-term investor looking for exposure in the growing housing finance segment, BHFL’s IPO could be a promising bet. Here’s a quick pros and cons list:

Pros:

- Strong parent backing (Bajaj Finance)

- Consistent financial performance

- Positive industry outlook

- Digital infrastructure

- AAA-rated debt instruments

Cons:

- Regulatory challenges

- Macroeconomic uncertainties

- Sector-specific risks

Bajaj Housing Finance IPO

Conclusion

The Bajaj Housing Finance IPO is more than just a financial event — it marks a strategic milestone for the Bajaj Group. For investors, it offers a gateway into India’s promising housing finance sector, backed by a trustworthy brand. While the final verdict should depend on the IPO pricing and personal investment goals, the fundamentals and future outlook certainly look encouraging.

Stay tuned for official announcements and detailed IPO prospectus for making an informed decision.

FAQs

Q1: Is Bajaj Housing Finance listed currently?

No, it’s a subsidiary of Bajaj Finance and is planning its IPO.

Q2: Can I apply through Zerodha or Groww?

Yes, once the IPO is open, you can apply through any major brokerage platform.

Q3: How do I stay updated?

Follow BSE/NSE announcements and financial news portals like Moneycontrol and Economic Times.

Q4: Will retail investors get a quota in the IPO?

Yes, as per SEBI norms, a portion is reserved for retail investors in public issues.

Q5: What are the expected listing gains?

Analysts are optimistic, but actual listing gains depend on final pricing and market conditions.