Basant Maheshwari: How He Created Wealth by Betting on Growth Stocks

Basant Maheshwari is one of India’s most respected investors, known for his sharp stock-picking skills and ability to spot growth stories long before they become popular. His journey from a failed business to becoming a full-time successful investor is filled with insights, lessons, and inspiration for anyone interested in wealth creation through the stock market.

Early Life and Background

Basant Maheshwari started his professional career by managing his family business. Unfortunately, the business failed after six years. Faced with adversity, he didn’t give up. Instead, he took up teaching to support himself and began investing his remaining savings in the stock market. What started as a side activity soon became his passion and full-time profession.

Key Milestones Timeline

| Year | Milestone |

|---|---|

| 1990s | Started investing after business failure |

| Early 2000s | Identified retail boom – invested in Pantaloon |

| 2008 | Big bets on Page Industries, Hawkins Cookers |

| 2011 | Founded Basant Maheshwari Wealth Advisers LLP |

| 2014 | Authored “The Thoughtful Investor” |

| 2020s | Regular speaker at financial seminars & media |

Investment Philosophy

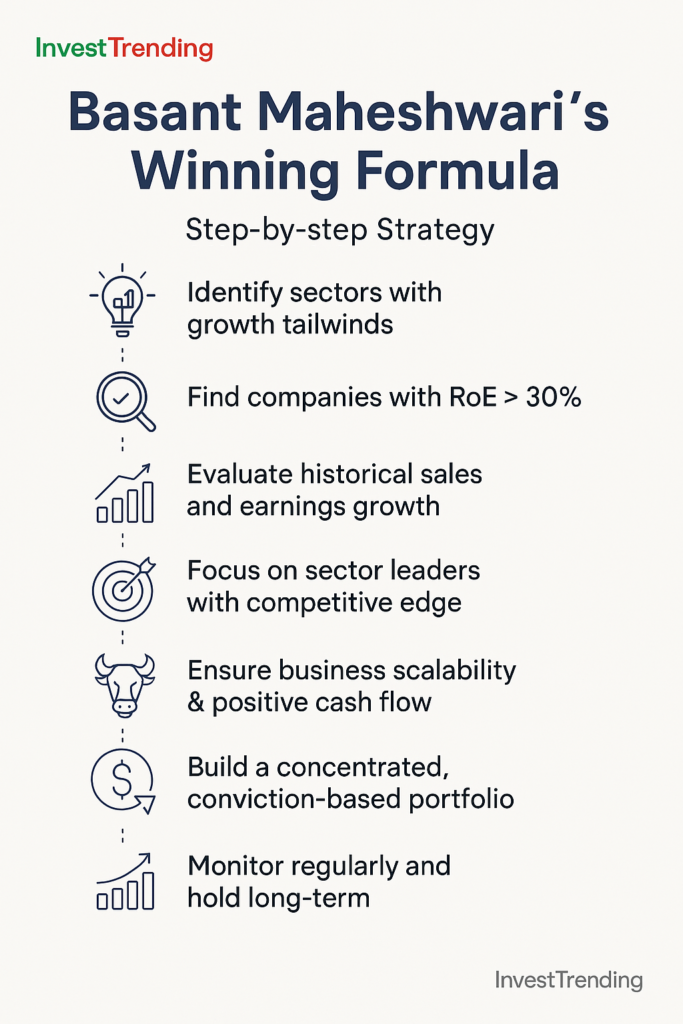

Basant Maheshwari’s approach to investing is straightforward, yet powerful. He looks for growth stocks with strong fundamentals. His philosophy is based on these principles:

| Principle | Description |

| High RoE | Look for companies with Return on Equity > 30% |

| Sales Growth | Sales growth of 25-30% over 5-6 years |

| Market Leadership | Invest in sector leaders with strong brand and dominance |

| Scalability | Business should have the potential to grow at scale |

| Free Cash Flow | Companies that generate and use cash efficiently |

| Concentration | Fewer stocks, better quality – not over-diversified |

Key Investment Strategies

- Buy High-Quality Growth Stocks

- Focus on companies with consistent earnings growth

- Long-Term Holding

- Hold winning stocks for multiple years to benefit from compounding

- Exit When Fundamentals Change

- Always keep an eye on business environment and company performance

- Don’t Fear High P/E Stocks

- Good quality businesses always trade at premium valuations

Multi-Bagger Success Stories

| Stock | Period | Buy Price | Growth | Reasons for Investment |

| Pantaloon Retail | 2003-08 | Low | 40x | Belief in retail boom in India |

| Page Industries | 2008-14 | ₹350 | 20x | Strong brand, 40% annual growth |

| Hawkins Cookers | 2008-14 | ₹350 | 8x | Good dividend, growth potential |

| Titan | 2008-13 | Low | 6x | Premium brand, high RoE |

| Gruh Finance | 2011-14 | Low | 4x | Rural lending focus |

Hypothetical Case Study: Compounding in Action

If you had invested ₹1 lakh in Page Industries in 2008 at ₹350/share and held till 2014…

- Stock multiplied ~20 times

- Investment value in 2014: ₹20 lakhs

- CAGR: ~68% over 6 years

Sectors He Loves to Invest In

Financial Services

- NBFCs and private banks

- India’s growing credit demand

Consumer and Retail

- FMCG, apparel, and lifestyle

- Rising middle-class spending

Digital and Technology

- Tech platforms with scalable models

- Digital India movement

Specialty Chemicals & Manufacturing

- India’s shift to export-led growth

- Beneficiary of China+1 strategy

Inspirational Quotes by Basant Maheshwari

“Buy right, sit tight.”

“Identify the sector before the stock.”

“Markets reward growth – even at a premium.”

“Concentration creates wealth, diversification preserves it.”

Common Mistakes by Investors (and Basant’s Fixes)

| Mistake | Correction |

| Chasing low P/E stocks | Focus on consistent earnings growth |

| Over-diversifying | Stick to 5-6 well-researched stocks |

| Frequent trading | Practice patience and long holding |

| Ignoring fundamentals | Study balance sheets, ratios, and management vision |

Public Influence and Media Presence

- Regular guest on CNBC TV18, ET Now, Zee Business

- Known for market commentary and investment insights

- Author of the book: “The Thoughtful Investor” – highly recommended

Basant Maheshwari Wealth Advisers LLP

- SEBI-registered PMS (Portfolio Management Services)

- Focus on high-growth and high-conviction bets

- Caters to HNIs and serious long-term investors

- Transparent approach with regular communication and reports

Investor Toolkit Inspired by Basant Maheshwari

| Tool | Purpose |

| Screener.in | Filter high RoE, high-growth stocks |

| TickerTape | Compare fundamentals, valuations |

| Value Research | Analyze mutual funds and company insights |

| Annual Reports | Deep-dive into company operations and performance |

Basant Maheshwari’s Winning Formula

Final Thoughts

Basant Maheshwari’s story is one of persistence, smart decision-making, and deep understanding of business fundamentals. From failure in business to building wealth in the stock market, his journey teaches us that with knowledge, patience, and the right mindset, anyone can become successful in investing.

Whether you’re a beginner or an experienced investor, following Basant’s principles can set you on the path to financial independence and stock market success.

“Don’t diversify too much. You don’t need to own 20 stocks to get rich. Own 5-6 great ones and understand them deeply.” — Basant Maheshwari