Company Overview

Elcid Investments Ltd. is a Mumbai-based Non-Banking Financial Company (NBFC) engaged in investment activities. The company primarily earns through dividends and capital appreciation by investing in high-quality blue-chip stocks, including its significant stake in Asian Paints Ltd. Despite being a relatively lesser-known entity, Elcid Investments has garnered attention due to its unusually high stock price and premium valuation.

- Name: Elcid Investments Ltd.

- Industry: Non-Banking Financial Company (NBFC)

- Primary Business: Investment in shares, debentures, and mutual funds

- Revenue Sources: Interest, dividends, and capital gains from investments

- Stock Exchange Listing: BSE (Bombay Stock Exchange)

- Ticker Symbol: 503681

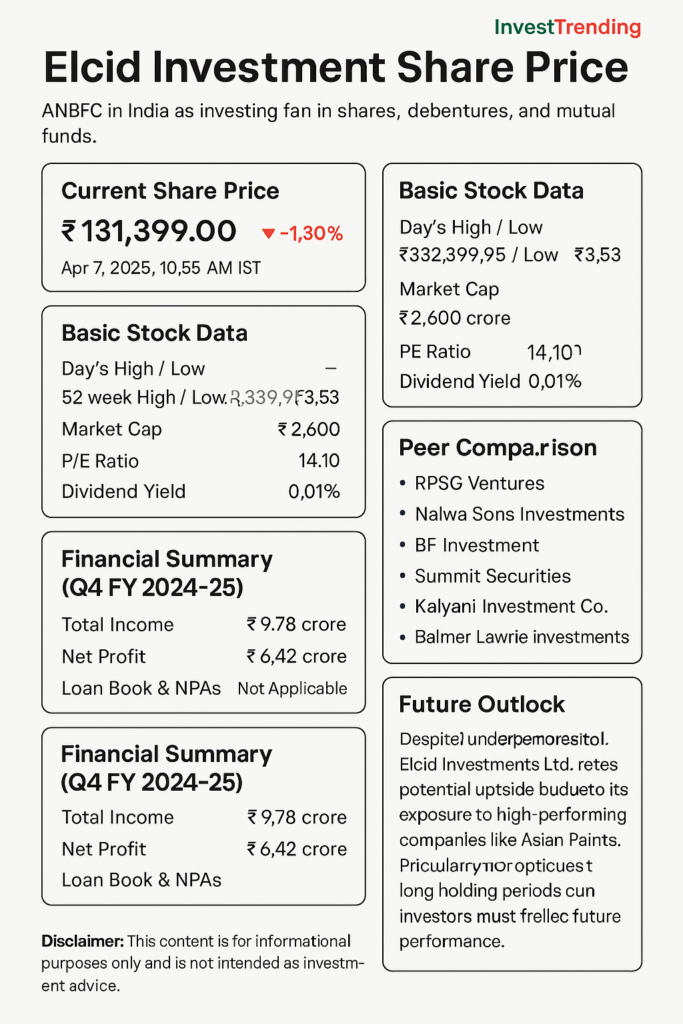

Current Market Performance

Elcid Investments Ltd. is known for its extremely high share price, which reflects its holdings in lucrative companies. However, the stock remains illiquid and rarely trades on the BSE.

| Metric | Value |

|---|---|

| Current Share Price | ₹131,399.00 |

| Price Change (Today) | -1.30% |

| Previous Close | ₹133,819.35 |

| Day’s High / Low | ₹134,000.00 / ₹129,500.00 |

| 52-week High | ₹332,399.95 |

| 52-week Low | ₹3.53 |

| Market Capitalization | ₹2,600.02 crore |

| P/E Ratio | 14.10 |

| Dividend Yield | 0.01% |

| Volume Traded | Extremely Low / Illiquid |

Note: The dramatic 52-week range is due to very few trades at extremely low volumes.

Historical Performance

Due to very low trading volumes, price changes can be volatile. Still, the share has shown a long-term upward trajectory driven by its investment portfolio.

| Period | % Change in Share Price |

| 1 Week | -0.92% |

| 1 Month | -6.62% |

| 6 Months | +4.10% |

| YTD | +1.05% |

| 1 Year | +7.65% |

Compared to the Nifty 50 and BSE Financial Services Index, Elcid’s stock appears to move independently due to its low float and specific investor base.

Financial Summary (Q3 FY 2024-25)

Elcid reported a net loss this quarter due to lower dividend inflows and a decline in investment value. The business model remains asset-heavy with minimal operational costs.

- Total Income: ₹-4.95 crore (Loss)

- Net Loss: ₹-6.89 crore

- Earnings Per Share (EPS): Negative

- Loan Book & NPAs: Not Applicable (Investment Company)

Technical Indicators

Traditional technical analysis may not be applicable to Elcid Investments due to its illiquidity and infrequent trading. However, long-term investors may track the value of its investment holdings, particularly its stake in Asian Paints.

- Support & Resistance Levels: Difficult to determine

- 50/200-Day Moving Averages: Not meaningful due to irregular trades

- Relative Strength Index (RSI): Not Available

Peer Comparison

Compared to other investment holding companies, Elcid stands out for its unique valuation and concentrated portfolio. However, most peers have more transparent disclosures and active trading patterns.

| Company Name | Industry Type |

| RPSG Ventures Ltd. | Investment Company |

| Nalwa Sons Investments Ltd. | Investment Company |

| BF Investment Ltd. | Investment Company |

| Kalyani Investment Company Ltd. | Investment Company |

| Vardhman Holdings Ltd. | Investment Company |

Shareholding Pattern (Dec 2023)

Elcid remains tightly held, with minimal floating stock, contributing to its low liquidity.

- Promoters: 75%

- Retail & Other Investors: 25%

Analyst Ratings & Social Sentiment

- Analyst Ratings: Not Available due to limited institutional coverage

- Target Price Estimates: Not provided

- Social Media Sentiment: Limited discussion due to low public awareness

Recent News & Events

- No recent dividend announcements or board updates

- Company remains low-profile with minimal public communications

- No AGM or earnings call details released recently

ESG & Risk Metrics

Environmental, Social, and Governance data is not currently disclosed for Elcid Investments Ltd.

- Beta Value: Not Available

- Debt-to-Equity Ratio: Negligible debt

- ESG Rating: Not Available

Investment Considerations

Why some investors consider Elcid Investments?

- Extremely high share price and limited float make it a unique speculative asset

- Exposure to high-growth companies like Asian Paints indirectly

- Almost no debt, and strong promoter backing

Why to be cautious?

- Very low liquidity and trading volumes

- Lack of detailed financial disclosures and coverage

- No guarantee of returns as dividends or capital appreciation

Key Insights for Investors

- Why Elcid Investments Has a High Share Price

- The company holds substantial equity in Asian Paints Ltd., a market leader with consistent growth.

- Its limited number of outstanding shares contributes to high price per share, despite low liquidity.

- Elcid Investments vs Blue-Chip Stocks

- While Elcid provides indirect exposure to blue-chip returns, it does not offer the liquidity, transparency, or dividend consistency of direct investment in stocks like Asian Paints or HDFC Bank.

- Use Case: Portfolio Diversification

- This stock is often used by niche investors for diversification in passive, asset-heavy NBFCs.

Future Outlook

Despite recent underperformance, Elcid Investments Ltd. retains potential upside due to its exposure to high-performing companies like Asian Paints. If these underlying assets continue to grow, the book value of Elcid’s portfolio could rise, potentially reflecting in its share price over the long term. However, the company’s passive management approach, lack of active communication, and extremely low liquidity mean investors must be prepared for long holding periods and limited market exits. Regulatory changes in NBFC and investment sectors could also impact future performance.

Snapshot of Elcid Investments

Conclusion

Elcid Investments Ltd. is a rare and unconventional stock in the Indian financial market landscape. While its valuation draws intrigue, the lack of liquidity and transparent communication poses significant risks. Ideal for ultra-long-term or niche investors, Elcid should be approached with caution and thorough research.

Disclaimer

This analysis is for informational purposes only and should not be considered investment advice. Please consult a certified financial advisor before making any investment decisions. Stock prices and financial data are subject to change without notice.