Forex trading, or foreign exchange trading, is one of the most dynamic and liquid financial markets in the world. It operates 24 hours a day, five days a week, with trillions of dollars traded daily across the globe. For newcomers, the idea of profiting from currency fluctuations may seem appealing but can also be overwhelming without proper guidance. This guide on forex trading strategies for beginners will help you get started on the right foot by introducing essential concepts, effective strategies, practical tools, and risk management techniques.

Understanding the Foundations of Forex Trading

Before diving into specific strategies, it’s important to build a solid understanding of the basic mechanics of the forex market.

What is Forex Trading?

Forex trading involves the buying and selling of currency pairs. Each transaction involves two currencies — one being bought and the other being sold. For example, when you trade the EUR/USD pair, you are simultaneously buying euros and selling US dollars.

Key Terms You Should Know

- Currency Pairs: These come in major (e.g., EUR/USD, GBP/USD), minor (e.g., EUR/GBP, AUD/JPY), and exotic (e.g., USD/TRY) categories.

- Pips: A pip (percentage in point) is the smallest price move that a given exchange rate can make. For most pairs, it’s 0.0001.

- Spread: The difference between the buying (ask) and selling (bid) price. A lower spread usually indicates lower trading costs.

- Leverage: Allows you to control a large position with a small amount of capital. For example, 50:1 leverage means you can control $50,000 with $1,000. While it can amplify gains, it also increases risk.

- Margin: The amount of money required to open a leveraged position.

Core Forex Trading Strategies for Beginners

When starting out, it’s important to avoid complicated strategies and instead focus on approaches that are easy to understand and apply. Here are four effective forex trading strategies tailored for beginners:

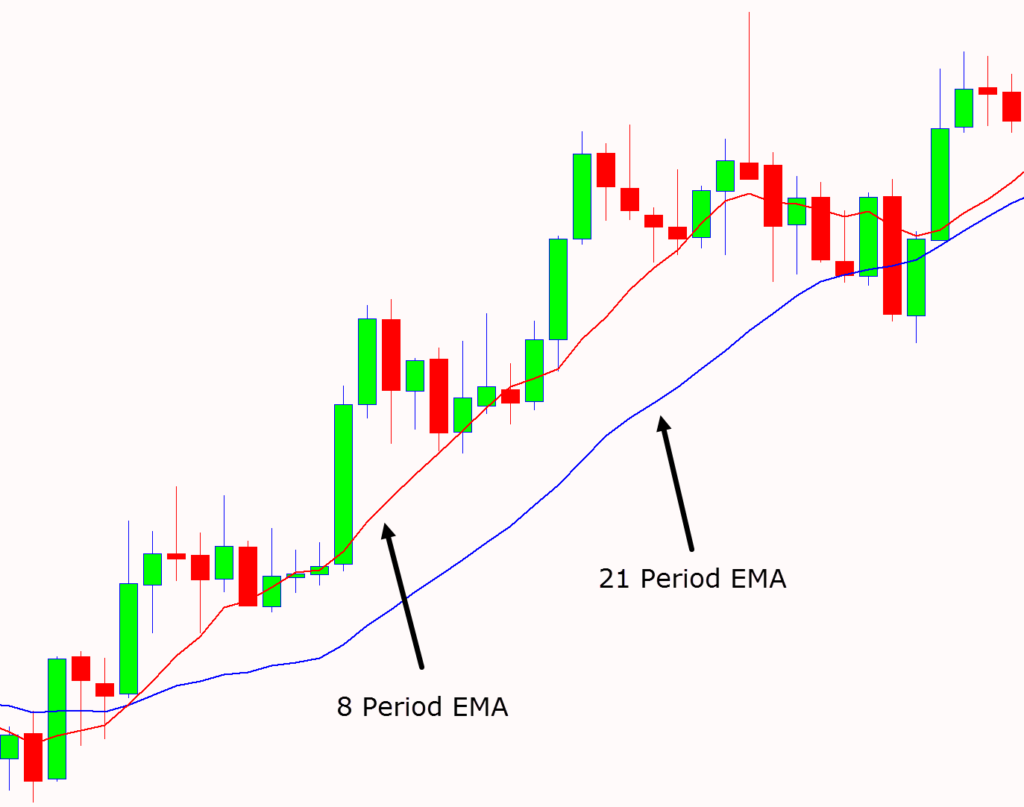

1. Trend Following Strategy

A candlestick chart showing an uptrend with trendlines.

Trend following is a time-tested strategy that involves trading in the direction of the market’s momentum. The basic premise is simple: “the trend is your friend.”

How to Implement:

- Use moving averages, such as the 50-day and 200-day MA, to identify the trend direction.

- Confirm the trend with indicators like Relative Strength Index (RSI) or MACD (Moving Average Convergence Divergence).

- Look for entry points where the price bounces off the moving average in the direction of the trend.

- Always set a stop-loss to manage risk.

Real-World Tip:

Many successful traders focus on trending markets because they provide more predictable outcomes. A strong uptrend or downtrend often signals trader sentiment driven by economic fundamentals or geopolitical events.

2. Breakout Trading Strategy

A breakout chart with clear resistance and support levels marked.

Breakout trading involves entering the market when the price breaks through a defined resistance or support level. This strategy works well during periods of high market volatility.

How to Implement:

- Identify key support and resistance levels on the chart.

- Wait for a clear breakout, confirmed by high trading volume.

- Use indicators like Bollinger Bands or ATR (Average True Range) to gauge volatility.

- Set a stop-loss slightly below the breakout level to protect against false breakouts.

Real-World Example:

If EUR/USD has been consolidating between 1.0850 and 1.0900, a breakout above 1.0900 with volume could signal a strong bullish move.

3. Scalping Strategy

Scalping is a short-term strategy aimed at making small profits from frequent trades. It’s suited for traders who can dedicate time to watching the markets during active trading sessions.

How to Implement:

- Use a low spread broker to reduce transaction costs.

- Trade highly liquid pairs like EUR/USD or GBP/USD during peak market hours.

- Employ technical indicators like Stochastic Oscillator and Bollinger Bands.

- Exit trades quickly, often within minutes, and avoid holding positions overnight.

Caution:

Scalping requires excellent focus and fast decision-making. It’s not ideal for everyone, especially those new to trading.

4. Swing Trading Strategy

Swing trading is a medium-term strategy where traders aim to capture price swings over several days. It requires less screen time than scalping and is more suitable for those with a full-time job.

How to Implement:

- Analyze daily and 4-hour charts to identify market reversals.

- Use Fibonacci retracement, RSI, and candlestick patterns to find entry points.

- Enter at support levels in uptrends and resistance levels in downtrends.

- Hold trades for a few days to maximize gains.

Unique Insight:

Swing trading combines both technical and fundamental analysis, allowing traders to take advantage of market sentiment changes triggered by news or economic reports.

Essential Risk Management Techniques

No trading strategy is complete without a strong focus on risk management. Here are some essential techniques every beginner must master:

1. Use Stop-Loss Orders

Always define how much you are willing to lose on a trade. A stop-loss ensures you exit the market automatically if the trade moves against you.

2. Maintain a Risk-Reward Ratio

A good rule of thumb is to aim for a minimum 1:2 risk-reward ratio. This means you’re aiming to gain $200 for every $100 you risk.

3. Calculate Position Size

Don’t randomly choose how much to trade. Use a position size calculator to determine how many lots you should trade based on your account size and risk tolerance.

4. Avoid Overleveraging

While leverage can enhance profits, it can also wipe out your account quickly. Stick to conservative leverage ratios (e.g., 10:1 or less).

5. Keep an Emotion Journal

Track your emotional state during trades. Understanding how fear or greed affects your decisions can help you avoid impulsive mistakes.

Must-Have Tools and Resources for Forex Beginners

Starting out with the right tools can make a significant difference in your learning curve and performance.

1. Demo Trading Account

Use a demo account to practice without risking real money. This allows you to test strategies and get familiar with trading platforms.

2. Economic Calendars

Track economic events like central bank announcements, employment data, and inflation reports that can move the forex markets.

3. Charting Software

Platforms like MetaTrader 4/5, TradingView, or cTrader provide robust tools for technical analysis.

4. Forex Education Platforms

Websites like BabyPips, Investopedia, and ForexFactory offer free tutorials, articles, and community forums to help beginners learn.

5. Reliable News Sources

Stay updated with financial news via outlets like Bloomberg, Reuters, and CNBC. Market-moving headlines can create trading opportunities.

Common Mistakes to Avoid

Many beginners repeat the same errors, often costing them valuable time and capital. Here’s what to avoid:

- Overtrading: Quality over quantity. Don’t enter trades just to stay active.

- Ignoring News: Economic news can disrupt technical setups. Always be aware of upcoming events.

- Revenge Trading: Accept losses as part of the game. Don’t let emotions drive you to make irrational decisions.

- Chasing the Market: Wait for setups to come to you rather than reacting impulsively to price movements.

Final Thoughts

Forex trading offers tremendous opportunities but also carries substantial risks. As a beginner, your focus should be on education, discipline, and consistent practice. Start with a demo account, master a single strategy, apply strict risk management, and gradually build your confidence.

Remember, trading is not about being right all the time — it’s about managing risk and maximizing winning trades while minimizing losses.

“In trading, your greatest asset isn’t your strategy — it’s your ability to stay disciplined when emotions run high.”