Keeping track of upcoming IPOs is essential for any retail or institutional investor seeking to benefit from early-stage investments in promising companies. In this guide, we will walk you through the professional, human-written process of tracking IPOs in India, understanding relevant terms like IPO GMP Today, and using this information wisely.

Why Tracking IPOs and Monitoring IPO GMP Today Matters

Investing in IPOs can offer:

- Early access to potentially high-growth companies

- Short-term listing gains predicted through IPO GMP today

- Long-term wealth creation if invested in fundamentally strong companies

Being informed helps you:

- Plan funds in advance

- Study company fundamentals early

- Avoid last-minute decisions based on hype

- Analyze current IPO GMP today for better listing strategies

Recent Example: In 2024, the IPO of Tata Technologies was oversubscribed 69 times, and its IPO GMP today showed a premium of ₹350 before listing. On listing day, it opened at ₹1,200, giving significant returns to investors. This shows how tracking IPO GMP today can help estimate potential returns.

Key Sources to Track Upcoming IPOs and Get IPO GMP Today Updates

A. Official Stock Exchange Websites

- BSE India (https://www.bseindia.com/) – Search IPO section for announcements

- NSE India (https://www.nseindia.com/) – Lists DRHPs and IPO schedules

B. SEBI (Securities and Exchange Board of India)

- Visit https://www.sebi.gov.in/ for approved Draft Red Herring Prospectuses (DRHPs) and final IPO documents.

C. Financial News Portals

- Moneycontrol IPO GMP Today Section – Timely GMP and allotment updates

- LiveMint Markets – Latest financial news

- Economic Times Markets – IPO news and investor sentiment

- Business Standard IPO Updates – Detailed analysis and expert views

D. Brokerage Apps and Platforms

- Zerodha Console – Portfolio, IPOs, alerts

- Groww IPO Tracker – Live GMP, application tracker

- Upstox – Fast GMP updates and in-app IPO tracking

- Angel One IPO Center – Subscription status and IPO analysis

Key Information to Track for Each IPO

To make smart decisions, track the following data for each IPO:

| Field | Description |

|---|---|

| Company Name | Name of the company issuing shares |

| Industry Sector | Understand the domain – IT, Pharma, Energy, etc. |

| Issue Type | Book-Built Issue or Fixed Price Issue |

| Price Band | Minimum and maximum price per share offered |

| Lot Size | Minimum shares to be applied for in one lot |

| Issue Open & Close Dates | Timeline to apply for the IPO |

| Face Value | Nominal value of a share |

| Total Issue Size | Total capital to be raised |

| Fresh Issue vs OFS | New shares vs Offer for Sale (existing shareholders selling their shares) |

| GMP (Grey Market Premium) | Unofficial market price prior to listing – updated under IPO GMP Today |

| Listing Date | When shares will be listed on BSE/NSE |

IPO GMP Today: Real-Time Insights for Retail Investors

The keyword “IPO GMP Today” is crucial for investors looking for insights into the grey market pricing of ongoing or upcoming IPOs.

What is IPO GMP Today?

“IPO GMP Today” refers to the current grey market premium for IPOs. It helps estimate the expected listing price based on unofficial market demand.

Grey Market Premium is:

- Calculated based on sentiment

- Influenced by subscription figures (especially QIB, HNI categories)

- A volatile, unofficial indicator (not regulated by SEBI)

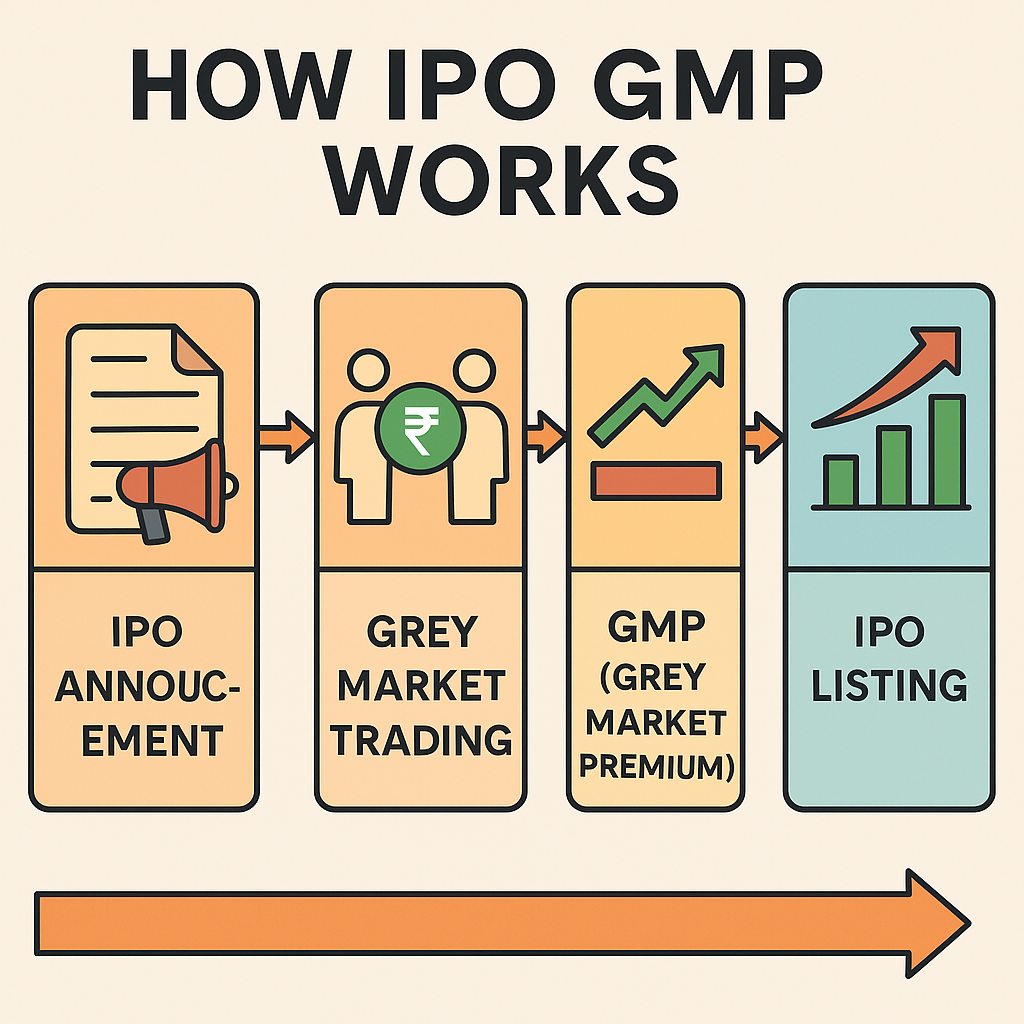

How IPO GMP Works

Sample Table: IPO GMP Today (As of April 30, 2025)

| IPO Name | Issue Price (₹) | GMP (₹) | Expected Listing Price (₹) | Subscription Status |

| Ather Energy | 311 | 1 | 312 | 30% on Day 2 |

| Arunaya Organics | 65 | 5 | 70 | 34% on Day 1 |

| Iware Supplychain | 95 | 10 | 105 | Data Not Available |

| Kenrik Industries | 50 | 2 | 52 | 21% on Day 1 |

| Wagons Learning | 100 | 15 | 115 | Data Not Available |

Note: IPO GMP today fluctuates daily. Always verify from multiple trusted sources.

How to Set Alerts and Stay Updated on IPO GMP Today

A. Google Alerts

Create alerts for:

- “IPO GMP today”

- “Upcoming IPO in India”

- “IPO subscription status update”

B. Telegram & WhatsApp Groups

Subscribe to channels managed by market experts for GMP insights.

C. IPO Tracker Apps and Widgets

Some apps provide widgets that include real-time IPO GMP today data and alerts.

Steps to Analyze an Upcoming IPO

- Download DRHP/RHP and read about the company’s vision, risks, and objectives

- Evaluate Financial Statements – Revenue, Profit, Debt, and ROE trends

- Check GMP Trends to understand grey market response (search “IPO GMP today”)

- Compare with Peers – Is the IPO pricing fair compared to listed competitors?

- Look at Subscription Data – QIB, HNI, Retail investor interests

- Read Analyst Reports from brokerage houses or finance websites

Pro Tip: Maintain a checklist with the above parameters for every IPO you review.

Bookmark These for Live IPO GMP Today Info

| Website Name | URL | Why Bookmark It? |

| IPO Watch | www.ipowatch.in | Updated IPO GMP today table |

| Chittorgarh | www.chittorgarh.com | GMP, allotment status, investor sentiment |

| Moneycontrol IPO | www.moneycontrol.com/ipo | Performance trends and company-specific GMP |

| NSE & BSE Portals | www.nseindia.com, bseindia.com | Verified IPO announcements |

Final Thoughts: Use IPO GMP Today as an Indicator, Not a Rule

- IPO GMP today gives a market pulse – not a guaranteed outcome

- Always validate with business fundamentals

- Stay updated during the IPO period using the right digital tools

- Use GMP to supplement your decision, not to replace research

Frequently Asked Questions (FAQs) About IPO GMP Today

Q1. What is the full form of IPO GMP?

Answer: IPO GMP stands for Initial Public Offering Grey Market Premium. It indicates the extra amount investors are willing to pay for shares before they are officially listed on the stock exchange.

Q2. Is IPO GMP today reliable for investment decisions?

Answer: IPO GMP today provides a hint of market sentiment but should not be the sole factor in investment decisions. Always analyze the fundamentals.

Q3. How often does IPO GMP today change?

Answer: IPO GMP can fluctuate daily, even hourly, depending on demand and market news. Track it using trusted financial platforms.

Q4. Where can I check IPO GMP today accurately?

Answer: Trusted sources include IPOWatch, Chittorgarh, Moneycontrol, and broker apps like Upstox or Groww.

Q5. Can IPO GMP be negative?

Answer: Yes, if market sentiment is weak or if the issue is overpriced, the GMP can be negative, indicating possible listing at a discount.

Q6. What factors influence IPO GMP today?

Answer: IPO GMP is influenced by factors like investor demand, company fundamentals, peer performance, overall market sentiment, and subscription levels in QIB, HNI, and retail categories.

Q7. Can retail investors apply based on IPO GMP today only?

Answer: While IPO GMP today reflects current sentiment, it’s risky to apply solely based on it. Always combine it with fundamental analysis of the company.

Q8. Does a high GMP always guarantee good listing gains?

Answer: Not necessarily. Sometimes, IPOs with high GMP fail to meet expectations due to market volatility or weak fundamentals, leading to listing-day disappointments.

Q9. Where can I get daily IPO GMP updates with alerts?

Answer: Use platforms like IPOWatch.in, Chittorgarh.com, and Groww. Many apps also allow you to set custom alerts for GMP changes.

Q10. How is the expected listing price calculated using GMP?

Answer: It’s calculated by adding the grey market premium (GMP) to the IPO issue price. For example, if the IPO price is ₹100 and GMP is ₹20, the expected listing price is ₹120.

Q11. Is IPO GMP today regulated by SEBI?

Answer: No. The grey market is unofficial and unregulated. SEBI does not oversee GMP data or transactions.

Q12. How can I verify if GMP trends are real or fake?

Answer: Cross-check data across multiple trusted sources and observe consistency. Avoid relying on social media or unverified channels.

Q13. What is Kostak Rate and how is it related to IPO GMP?

Answer: Kostak Rate is the premium for selling an IPO application in the grey market. It indicates demand and, like GMP, is used to estimate interest in an IPO.

Q14. Can IPO GMP help predict long-term performance?

Answer: No. IPO GMP reflects short-term sentiment and cannot be used to predict long-term company performance or stock value.

Q15. Should I invest in an IPO with zero or negative GMP?

Answer: A zero or negative GMP suggests low demand. It’s crucial to study the company’s fundamentals, prospects, and risks before investing.