Introduction

Manish Dhawan’s transformation from a corporate professional to a full-time options trader and founder of Mystic Wealth is a compelling story of ambition, strategy, and discipline. Today, he’s considered one of India’s most respected voices in options trading and momentum investing. This blog captures his complete journey—from his early career to becoming a trading mentor and thought leader—along with trading strategies, challenges, and insights every aspiring trader will love to know.

Early Life and Corporate Career

Before stepping into the financial markets, Manish spent over 12 years in the corporate world. He held roles in business development and quality assurance at companies like Hyper Quality and American Express. These positions helped him develop a structured and analytical mindset, honing skills such as data analysis, risk assessment, and decision-making—skills that later became crucial in his trading career.

The Entry into Financial Markets

In 2011, Manish made a bold move and founded Mystic Wealth, a boutique money management firm. At the time, options trading was still gaining ground in India. With no formal finance background, he began self-educating, testing strategies, and embracing data-driven decision-making. Mystic Wealth became his platform to offer well-researched trading models based on proven market inefficiencies.

Adoption of Momentum Investing

Among the first few in India to explore Momentum Factor Investing, Manish built a portfolio model based on buying high-performing stocks and selling the underperformers. This approach was rooted in academic research and suited his probabilistic thinking style. He developed clear rules and backtested systems for equity momentum trading.

Founding and Growing Mystic Wealth

Mystic Wealth is now a SEBI-registered investment advisory firm, where Manish leads the Momentum and Options desk. The firm offers structured models based on:

- Long-term momentum investing

- Income-generating options strategies

- Tactical asset allocation

Mystic Wealth runs subscription-based model portfolios, educational content, and a popular podcast series “Stoic Talks.”

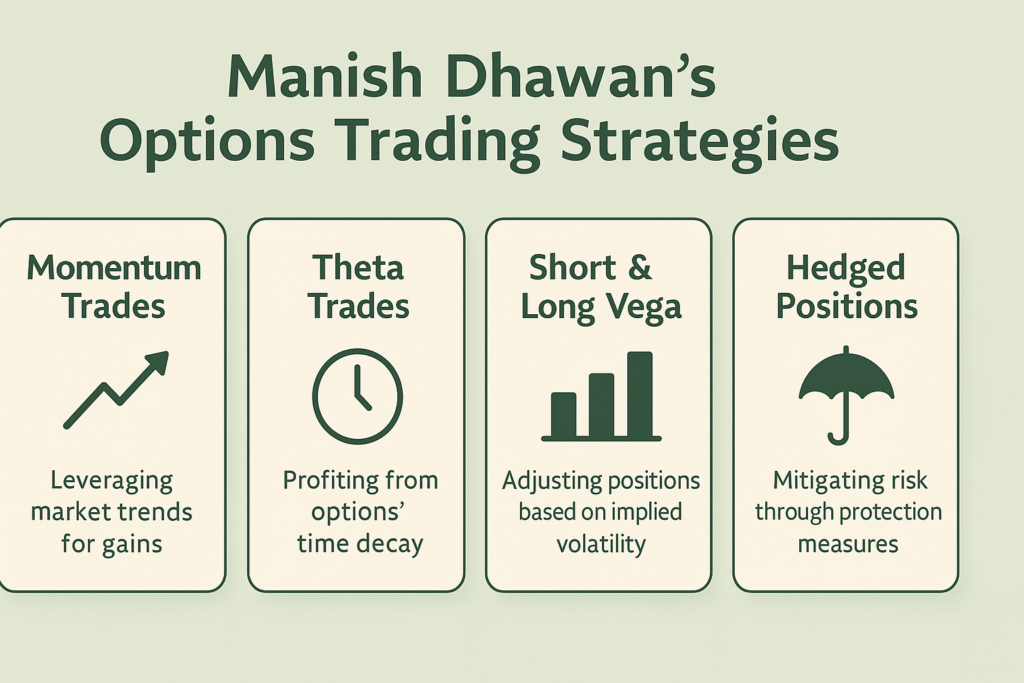

Core Trading Strategies Used by Manish Dhawan

Manish follows a systematic approach to trading that adapts to different market conditions:

- Theta Decay Strategy

- Sells options close to expiry to capitalize on time decay.

- Implied Volatility (IV) Based Strategy Selection

- Uses IV levels to decide between selling or buying options.

- Delta-Neutral Hedging

- Maintains market-neutral positions to reduce directional risk.

- Multi-leg Options Strategies

- Employs strategies like Iron Condors, Calendars, and Butterflies.

- Momentum Investing

- Runs a long-only portfolio of high-momentum stocks updated monthly.

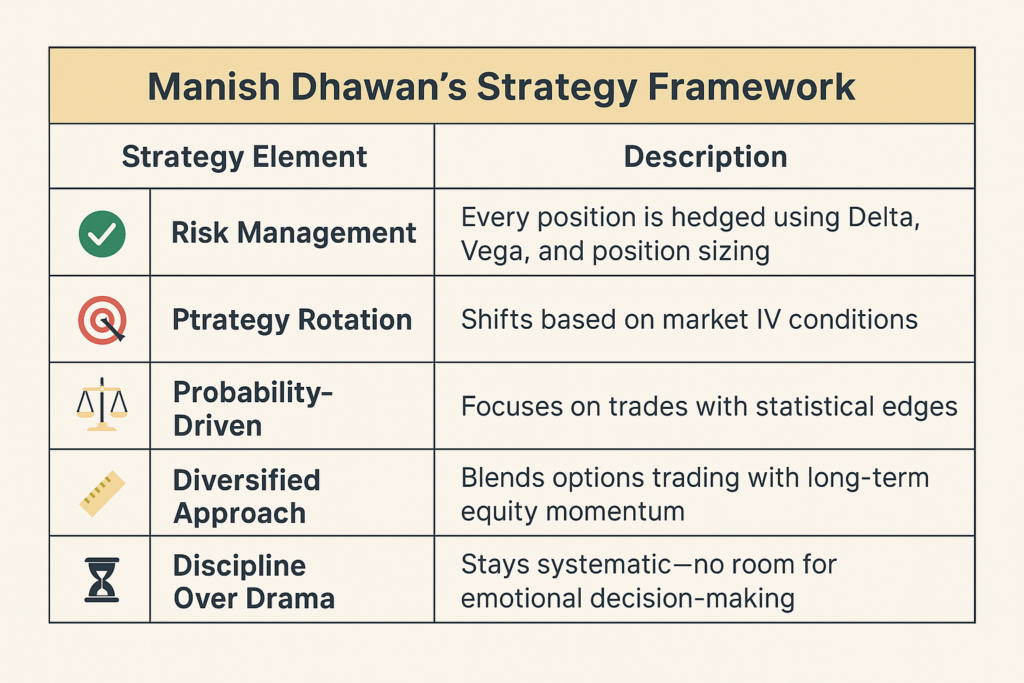

Infographic: Manish Dhawan’s Trading Strategy Framework

| Strategy Element | Description |

|---|---|

| Risk Management | All positions are hedged; Greeks are monitored (Delta, Vega, Gamma) |

| Strategy Rotation | Adjusts between short Vega (low IV) and long Vega (high IV) trades |

| Probability Focus | Focuses on trades with 60–80% win probability |

| Diversification | Balances momentum equity, options income, and asset allocation |

| Discipline & Consistency | Follows rule-based systems with no discretionary trade |

Challenges Faced and Lessons Learned

- Initial Learning Curve: With no finance degree, Manish had to learn the markets from scratch.

- Emotional Discipline: Trading full-time brought emotional ups and downs, but he learned to control impulses.

- Backtesting vs Reality: He discovered that live markets often behave differently from backtested scenarios.

- Capital Allocation: Managing risk capital across different strategies was one of his biggest lessons.

What Aspiring Traders Love to Learn From Him

- ✅ How to go full-time in trading without a finance background

- ✅ The importance of systematic risk management

- ✅ Tools and software he uses for backtesting and execution

- ✅ Difference between theory and practical trading

- ✅ How to combine momentum investing and options trading

- ✅ Book recommendations and mentors he followed

- ✅ Why position sizing and psychology matter more than accuracy

Manish Dhawan’s Tools & Platforms

| Tool | Purpose |

| AmiBroker | Strategy Backtesting |

| NSE Option Chain | Analyzing IV and option premiums |

| Excel / Google Sheets | Manual portfolio tracking |

| Brokers (e.g., Zerodha) | Trade Execution |

| Telegram + Mystic Blog | Community Building and Strategy Updates |

Books Recommended by Manish Dhawan

- “Fooled by Randomness” by Nassim Nicholas Taleb

- “The Psychology of Money” by Morgan Housel

- “Thinking in Bets” by Annie Duke

- “Reminiscences of a Stock Operator” by Edwin Lefèvre

- “Quantitative Momentum” by Wesley Gray

Knowledge Sharing & Community Building

Manish regularly shares his knowledge via:

- Mystic Wealth Blog

- Podcast: “Stoic Talks”

- Live webinars, workshops, and sessions at trading events

He has spoken at multiple CFA Society India events and webinars hosted by trader communities.

Conclusion: The Legacy of a Self-Made Trader

Manish Dhawan’s journey is a testament to the power of self-education, data-driven decision making, and resilience. By building rule-based strategies, respecting risk, and adapting to the ever-changing markets, he has earned his place as a leader in India’s trading community.

His work continues to inspire thousands of traders who seek a systematic, sustainable path to financial independence.

Want to Follow His Work?

Check out: Mystic Wealth – Manish Dhawan

👍