When it comes to investing in Indian stocks, especially in the public sector and infrastructure space, one name that stands out is NSE IRFC, or Indian Railway Finance Corporation. Listed on the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE), IRFC plays a vital role in India’s railway infrastructure growth. In this SEO-friendly blog, we’ll break down everything you need to know about NSE: IRFC — what it does, its financial fundamentals, market performance, and whether it could be a good fit for your investment portfolio.

What is IRFC? – NSE: IRFC Overview

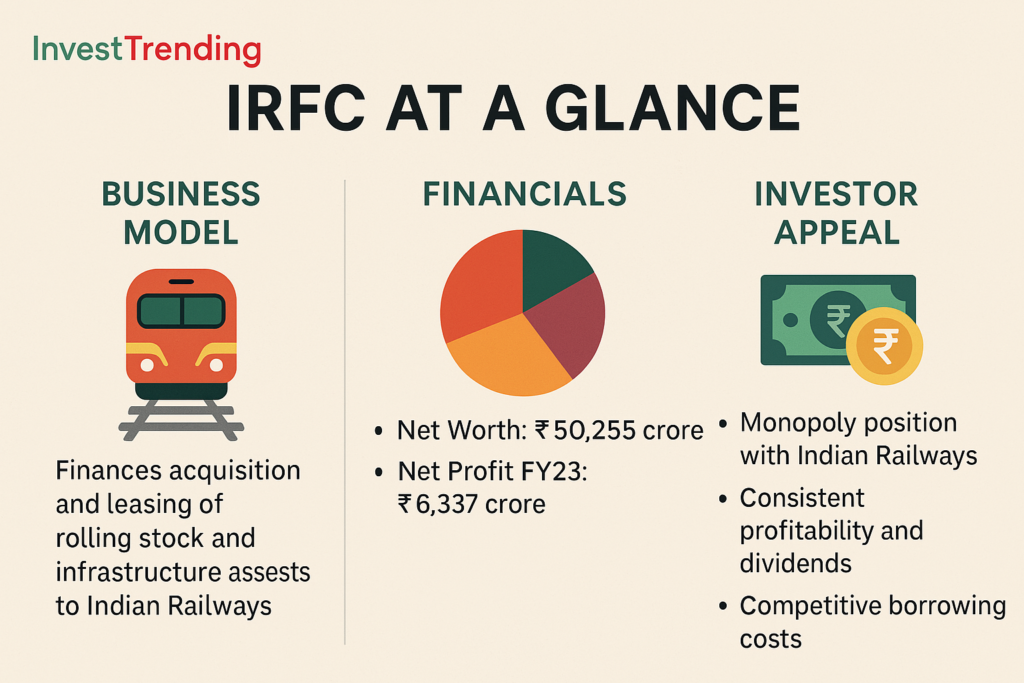

Indian Railway Finance Corporation (NSE IRFC) is a public sector enterprise under the Ministry of Railways. Established in 1986, its primary function is to raise funds for Indian Railways. This financing supports the acquisition of rolling stock assets such as wagons, coaches, and locomotives. IRFC also finances railway infrastructure projects.

In essence, NSE: IRFC acts like the financial arm of the Indian Railways, providing the capital necessary to keep operations moving and infrastructure expanding.

Why NSE: IRFC is Important

Indian Railways, one of the world’s largest rail networks, is critical to the Indian economy. With increasing focus from the government on modernization and expansion, NSE: IRFC becomes an indispensable entity by ensuring financial support for these developments.

Think of NSE: IRFC as the silent enabler behind Indian Railways’ growth journey.

NSE: IRFC Stock – Key Facts

| Feature | Details |

|---|---|

| Ticker | IRFC |

| Exchange | NSE & BSE |

| Sector | Finance – Term Lending |

| Market Cap | Over INR 1 Lakh Crore |

| PE Ratio | Around 7 to 9 |

| Dividend Yield | ~2-3% |

| Government Holding | Around 86% |

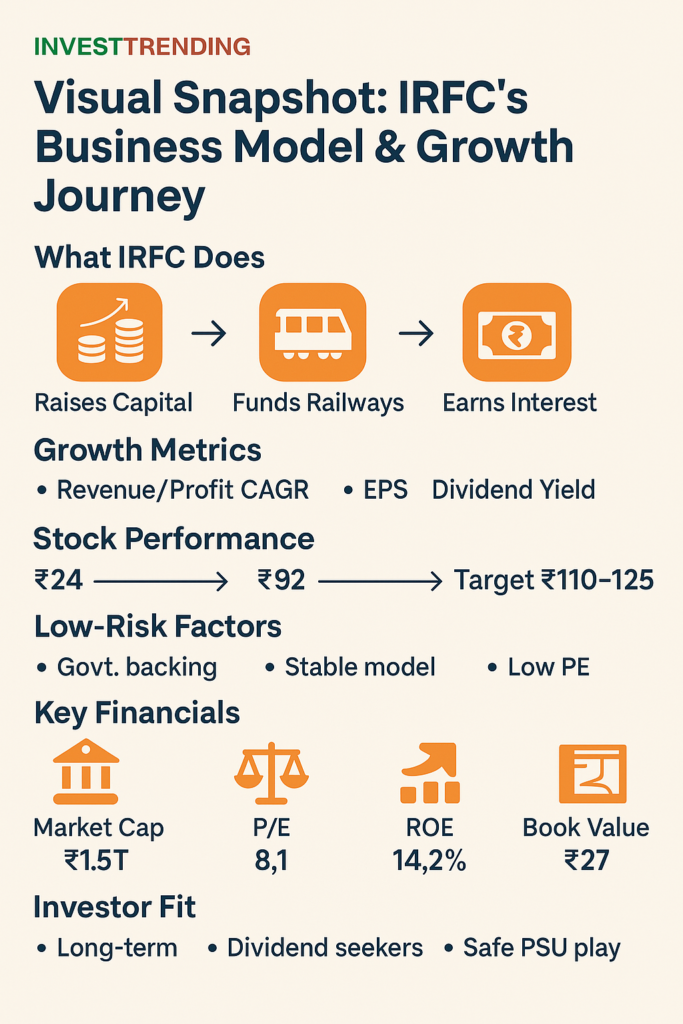

NSE: IRFC Revenue Model

NSE IRFC borrows funds from the market at competitive rates, benefiting from its government backing, and lends these to Indian Railways at a margin. Since the repayment is guaranteed by the Government of India, the risk of default is minimal.

This stable revenue model ensures predictable income, even during economic uncertainties.

Visual Snapshot: IRFC’s Business Model & Growth Journey

Company Fundamentals – NSE IRFC NSE Overview

| Metric | Value (2025 Estimate) |

|---|---|

| Revenue Growth (5 Yrs) | CAGR ~12% |

| Net Profit Growth (5 Yrs) | CAGR ~13.5% |

| Debt-to-Equity Ratio | ~7.5 (manageable) |

| EPS | ₹2.80 (TTM) |

| P/E Ratio | ~8.1x |

| Return on Equity | ~14.2% |

| Book Value/Share | ₹26.9 |

| Operating Cash Flow | Strong and consistent |

NSE IRFC Stock Performance on NSE

| Aspect | Details |

|---|---|

| Past Stock Trend | ₹24 (2021) to ₹92 (2024) |

| Volatility | Low to Medium |

| Historical High | ₹92 (2024) |

| Historical Low | ₹20.3 (2021) |

| Dividend Yield | 2.5% to 3.2% |

IRFC has shown strong price appreciation in the last 3 years, positioning it as a semi-defensive PSU stock.

| Metric | FY 2023 | FY 2024 (Est.) |

|---|---|---|

| Revenue | INR 20,298 Crore | INR 23,412 Crore |

| Net Profit | INR 6,337 Crore | INR 7,104 Crore |

| Dividend | ₹1.05/share | ₹1.20/share |

Who Should Invest in NSE IRFC?

NSE: IRFC is ideal for:

- Long-term Investors: Stable returns and consistent dividends.

- New Investors: Government-backed low-risk stock.

- Traders: News-driven stock movements.

- Dividend Seekers: Regular dividend payments.

Pros of NSE: IRFC Investment

- Government Backing = Low Default Risk

- Predictable Business Model

- Steady Dividend Income

- Undervalued P/E Ratio

- Low Volatility

Risks in NSE IRFC Investment

- Slower Price Growth (PSU nature)

- High Policy Dependence

- Limited Liquidity due to High Promoter Holding

Competitor Analysis of IRFC

While IRFC enjoys a monopoly in financing Indian Railways, it operates in the broader public sector lending and infrastructure finance space. Some comparable PSU companies include:

| Company | P/E Ratio | Dividend Yield | Risk Profile | Core Focus |

|---|---|---|---|---|

| Power Finance Corp (PFC) | ~5.8x | ~4.5% | Medium | Power sector financing |

| REC Ltd | ~6.2x | ~4.0% | Medium | Rural electrification |

| IRFC | ~8.1x | ~2.8% | Low | Railway infrastructure |

| HUDCO | ~9.3x | ~1.5% | Medium-High | Housing & urban finance |

Key Differences:

- IRFC has lower default risk due to sovereign guarantees.

- IRFC’s business model is more specialized and less exposed to macroeconomic shocks.

- IRFC has a higher valuation than peers, but it is still undervalued considering growth potential.

Why IRFC is Unique Among Indian PSU Stocks

- Monopoly Advantage: IRFC is the only company allowed to raise funds specifically for Indian Railways.

- Sovereign Guarantee: Loans given by IRFC are backed by the Indian government, ensuring repayment.

- Zero NPA Record: Unlike many financial PSUs, IRFC has virtually no bad loans.

- Consistent Financials: Double-digit profit growth and stable dividend payouts.

- Policy Support: Always a budget highlight due to India’s railway and infra thrust.

- Low Operational Complexity: It doesn’t carry operational risks like PSU banks or power companies.

In summary, IRFC combines the predictability of a bond with the upside of an equity, making it a rare hybrid in the PSU universe.

Expert Market Sentiment on NSE IRFC

- Analysts: Most have a ‘Buy’ rating.

- Budget Emphasis: Positive outlook due to infra push.

- Price Target: ₹110–₹125 (as per broker estimates).

How to Invest in NSE IRFC

- Open a Demat/trading account.

- Search for “IRFC” on NSE.

- Study charts and financials.

- Place buy order.

Business Model & Industry Placement

- Core Business: Railway project financing.

- Market Share: ~75% lender to Indian Railways.

- Competitive Edge: Monopoly, low-cost funds.

- Sector Growth: ₹35 Lakh Crore investment by 2030.

Management & Governance

| Metric | Details |

|---|---|

| CEO Leadership | Stable & experienced |

| Promoter Holding | 86.36% (Govt of India) |

| Insider Trading | No unusual activity |

| Governance | Transparent and regular |

Macro Factors Influencing NSE IRFC

- RBI Interest Rates: Slight impact on borrowing costs.

- Inflation: Limited effect due to guaranteed revenue.

- Government Policies: Strong impact (currently positive).

Valuation Metrics – NSE IRFC

| Metric | Value |

|---|---|

| P/E Ratio | ~8.1x |

| PEG Ratio | ~0.6 (Undervalued) |

| Sector Average | 12x–14x |

Demand for IRFC Services

IRFC’s services are tightly linked to Indian Railways’ demand — a massive and continuous need in India’s infrastructure story.

Key Events to Track

- Q4 FY25 Earnings: May 2025

- AGM: July 2025

- Dividend Announcement: August 2025

- Union Budget: February 2026

Conclusion: Why NSE IRFC Deserves a Spot in Your Portfolio

NSE IRFC offers government-backed safety, predictable growth, and dividend stability. As Indian Railways accelerates its infrastructure plans, IRFC’s strategic role strengthens. For long-term, low-risk investors, NSE IRFC combines value investing with steady returns.

NSE: IRFC AT A GLANCE

FAQs About NSE IRFC

Q: Is NSE IRFC a good long-term investment?

A: Yes, due to consistent earnings, dividends, and low-risk profile.

Q: Is IRFC overvalued?

A: No, it is still undervalued based on valuation ratios.

Q: What influences NSE IRFC’s stock price?

A: Budgets, interest rate changes, dividend announcements, and infrastructure policies.

Q: Is IRFC a safe stock?

A: Yes, backed by the Government of India with a strong business model.

Q: Does IRFC pay dividends?

A: Yes, consistently.

Q: Can IRFC double in 2–3 years?

A: While no stock can guarantee returns, strong fundamentals and increasing infra investment make it possible.

Stay informed, invest smartly, and always do your own research before investing.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please consult a registered financial advisor before investing.