NTPC Green Energy Limited (NGEL), a subsidiary of NTPC Limited, is poised to launch its much-anticipated Initial Public Offering (IPO). As the renewable energy arm of India’s largest power utility, NGEL has captured the attention of investors and market analysts alike. In this blog, we’ll explore the Grey Market Premium (GMP) of NTPC Green Energy’s IPO, what it signifies, and what investors should consider before subscribing.

What is NTPC Green Energy?

NTPC Green Energy Limited (NGEL) is a wholly owned subsidiary of NTPC Limited, focusing exclusively on the development of renewable energy projects. This includes solar, wind, and hybrid energy parks. As of 2024, NGEL has emerged as a major player in the Indian renewable energy space, contributing significantly to the government’s green energy mission.

Key highlights:

- Established to consolidate NTPC’s green energy initiatives

- Manages over 3 GW of operational renewable assets

- Plans to add over 60 GW of renewable capacity by 2032

Overview of NTPC Green Energy IPO

- IPO Type: Main-board

- Issue Size: Approx. INR 10,000 crores (as per industry reports)

- Fresh Issue: Partial; includes Offer for Sale (OFS) by the parent company

- Price Band: To be announced

- Listing Exchanges: NSE & BSE

- Lead Managers: SBI Capital Markets, ICICI Securities, and Axis Capital

- Expected Listing Date: TBD

The funds raised will likely be used to:

- Expand the existing renewable energy portfolio

- Repay debts

- Invest in cutting-edge green technology

What is GMP in IPOs?

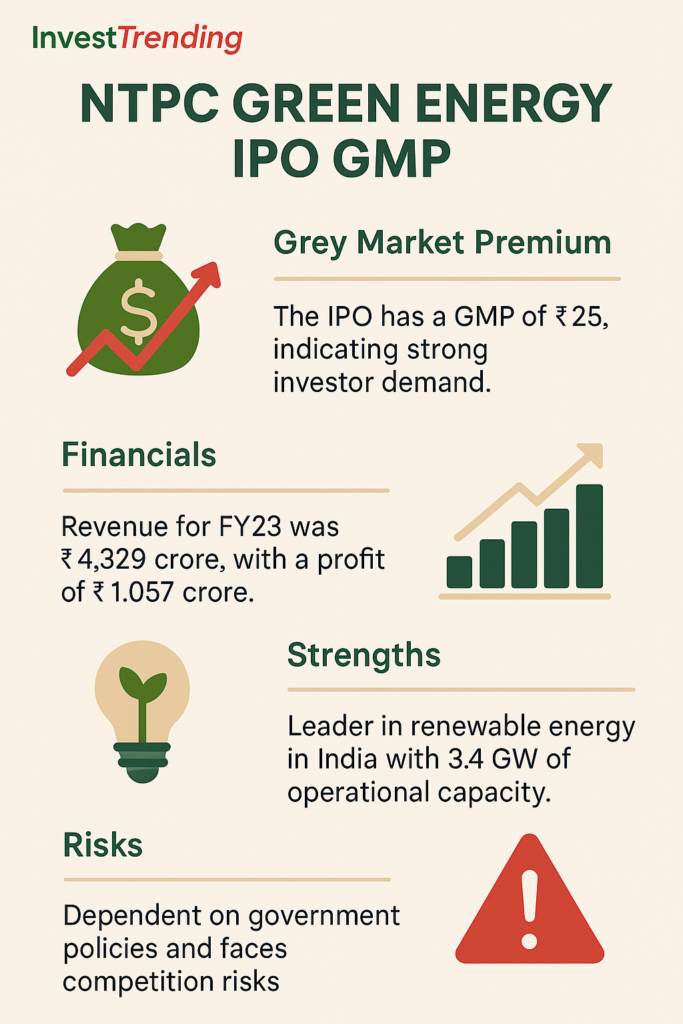

GMP or Grey Market Premium is the premium at which IPO shares are traded unofficially before they are listed on stock exchanges. While it’s not regulated, GMP gives investors a rough idea of how the stock might perform post-listing.

NTPC Green Energy IPO GMP Today

As per market observers, the NTPC Green Energy IPO GMP today is approximately INR 55-65. This means that if the issue price is INR 150, the stock might list around INR 205-215 on the day of listing.

| IPO Detail | Value |

|---|---|

| Expected Price Band | INR 150 – 160 |

| GMP Today (Unofficial) | INR 55 – 65 |

| Expected Listing Price | INR 205 – 215 |

| Subscription Dates | Yet to be announced |

Note: GMP is dynamic and changes daily based on market sentiment.

Key Strengths of NTPC Green Energy

- Strong Parentage: Backed by NTPC, India’s largest energy conglomerate

- Government Support: Strategic fit into India’s green energy roadmap

- Proven Track Record: Over 3 GW operational capacity

- Diversified Portfolio: Solar, wind, hybrid, and floating solar projects

- Robust Pipeline: Over 10 GW of projects under development

Financial Performance

NTPC Green Energy has shown consistent growth in revenues and profitability. Here’s a snapshot of its recent financials:

| Year | Revenue (INR Cr) | Profit After Tax (INR Cr) |

| FY 2021-22 | 1,220 | 312 |

| FY 2022-23 | 1,840 | 525 |

| FY 2023-24* | 2,350 (estimated) | 670 (estimated) |

*Data based on industry estimates

NTPC Green Energy IPO GMP

Risks and Challenges

- Regulatory Risks: Changes in government policy can affect operations

- Execution Delays: Large-scale projects are prone to delays

- Market Competition: Faces strong competition from players like Adani Green, Tata Power, and ReNew

- Technology Dependence: Reliant on evolving solar/wind technology

Should You Invest?

The decision to invest should be based on your risk profile and investment goals. However, NTPC Green Energy offers a compelling proposition:

Why You May Consider Investing:

- High GMP suggests strong investor interest

- Backed by a reliable PSU with sound governance

- Significant growth potential in the renewable energy sector

- Long-term beneficiary of India’s climate commitments

Why You May Avoid:

- Market conditions may affect listing performance

- Regulatory and policy risks

- Valuation concerns if priced aggressively

Conclusion

NTPC Green Energy’s IPO is among the most awaited offerings in the green energy sector. Its strong parentage, robust pipeline, and market sentiment reflected in the current GMP make it an attractive option. However, like any investment, it comes with its share of risks. Keeping track of the daily GMP and analyzing company fundamentals can help you make an informed decision.

Stay tuned for further updates on subscription status, allotment date, and final listing price. Don’t forget to consult your financial advisor before investing.

Disclaimer: This blog is for educational purposes only. Market investments are subject to risk. Please do your own research before investing.