Introduction

Prasenjit Paul is a name that resonates with thousands of stock market enthusiasts in India. From being a humble engineering student to a renowned author and investor, his journey is an inspiring one. His book, How to Avoid Loss and Earn Consistently in the Stock Market, has become a bestseller and a go-to guide for beginners. In this blog, we will dive deep into his life, his investing journey, his strategies, and the lessons traders and investors can learn from him.

Early Life and Background

Prasenjit Paul was born and raised in a middle-class Bengali family in Kolkata. Like many Indian households, there was always a strong emphasis on academic success. He pursued engineering, a popular career choice among Indian youth. But unlike most students, he wasn’t content with just a degree. His interest in the stock market sparked early during his college days.

Despite financial limitations and little exposure to financial education, Paul started investing with just Rs. 25,000. Instead of treating it like gambling, he took a methodical and educated approach to stock investing. This mindset became the foundation of his future success.

“Start early, stay consistent, and let the power of compounding do its magic.” – Prasenjit Paul

Initial Struggles and Learning Phase

Like any newbie investor, Paul faced several setbacks in the beginning. He made losses, bought into stock market hype, and learned the hard way. But what made him different was his ability to learn from mistakes. He started reading extensively – not just newspapers or financial magazines, but also books written by legendary investors like Warren Buffett, Peter Lynch, and Benjamin Graham.

Key Takeaway: Continuous learning and understanding the fundamentals are essential in the stock market.

The Turning Point

The real turning point came when he realized that blindly following stock tips or market noise was not the path to wealth. He began to analyze company fundamentals – understanding revenue, profit, management quality, business models, and most importantly, growth potential.

He started identifying multibagger stocks – companies that could multiply in value over the years. With patience and discipline, he held onto quality stocks that grew consistently. His portfolio started showing substantial returns.

“It’s not about timing the market; it’s about time in the market.” – Prasenjit Paul

Authorship and Recognition

In 2015, he published his book How to Avoid Loss and Earn Consistently in the Stock Market. The book became a huge success due to its simplicity and real-world application. It’s written in layman’s language, avoiding unnecessary jargon, and focuses on building a long-term mindset.

Today, the book is considered one of the best Indian guides for stock market beginners.

Key Lessons from the Book:

- Avoid penny stocks

- Invest in companies with good fundamentals

- Don’t chase quick profits

- Stick to long-term investing

- Ignore market noise

Investment Strategy

Prasenjit Paul follows a long-term, fundamental analysis-based investment strategy. His focus is on:

- Small-cap and Mid-cap Companies

- He looks for small companies with strong growth potential.

- These companies often become multibaggers when their true value is recognized by the market.

- Business Model and Management

- He studies the quality of management, promoter holding, and ethics.

- Transparent and visionary management is a green flag for him.

- Consistent Growth in Revenue & Profit

- Paul avoids companies with inconsistent financials.

- He believes revenue and profit should grow year after year.

- Reasonable Valuation

- He avoids overvalued stocks even if they are trending.

- Prefers buying at a fair price rather than at a hype-driven premium.

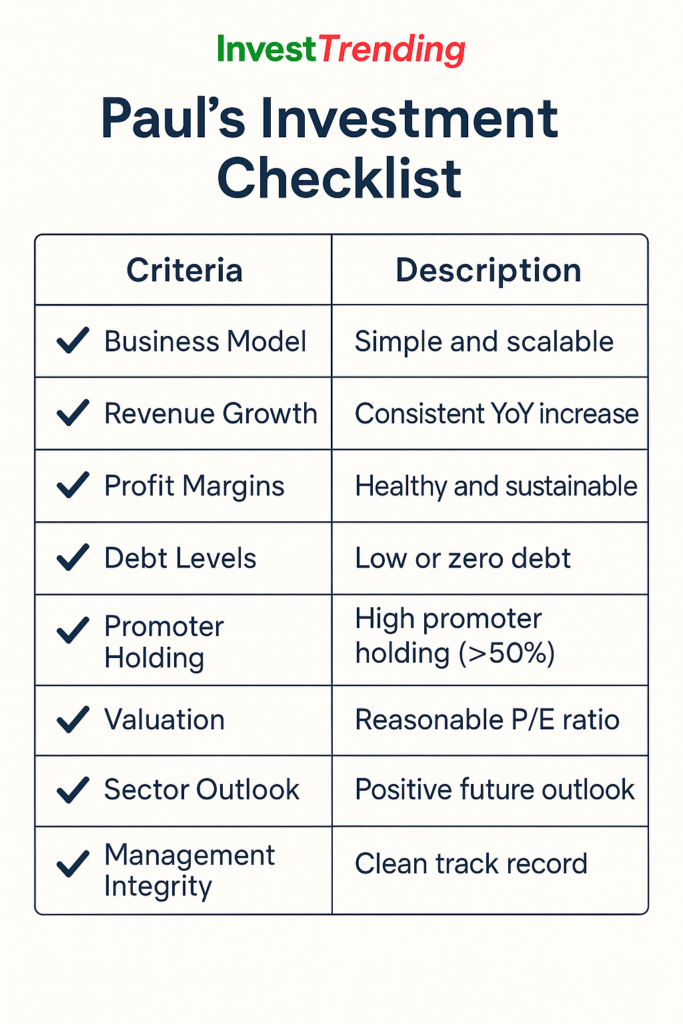

Paul’s Investment Checklist

| Criteria | Description |

|---|---|

| Business Model | Simple, scalable, and easy to understand |

| Revenue Growth | Strong and consistent YoY growth |

| Profit Margins | Stable and improving |

| Debt Levels | Preferably debt-free or low debt |

| Promoter Holding | High and increasing (>50%) |

| Valuation | Reasonable with respect to peers |

| Sector Outlook | Positive long-term macro trends |

| Management Integrity | Proven track record and ethical governance |

Sector Preferences

Paul believes in theme-based investing. He identifies macroeconomic and industry trends and picks stocks accordingly. Some sectors he favors:

- IT Services and Software: Due to global demand and scalability.

- Consumer Goods (FMCG): Offers steady growth and brand value.

- Pharmaceuticals: Innovation and exports give long-term value.

- Infrastructure: When supported by government policy.

- Financial Services: Especially niche NBFCs with innovative models.

- Green Energy and EV: Future-oriented and policy-backed sectors.

The Power of Patience and Discipline

One of Paul’s greatest strengths is emotional control. He never lets greed or fear dictate his investments. While many panic during market crashes, he sees them as buying opportunities. He also avoids unnecessary portfolio churn.

“Panic selling never made anyone rich. Stay calm, stay invested.” – Prasenjit Paul

Golden Rule: Buy great businesses and stay invested for the long haul.

Digital Presence and Education

Paul didn’t just stop at writing a book. He started his own investment advisory platform – Paul Asset – to share stock recommendations and research.

He also shares free educational content, market insights, and webinars to empower retail investors.

What Makes Him Unique?

- Focuses on education before profit

- Transparent about his own mistakes

- Believes in ethical investing

- Promotes financial literacy among youth and beginners

Practical Advice for Aspiring Investors

| Tip | Explanation |

| Start Early | The earlier you invest, the more you benefit from compounding. |

| Do Your Own Research (DYOR) | Never blindly follow stock tips. Understand the company. |

| Stay Away from Penny Stocks | High risk, low transparency, and potential for scams. |

| Invest in What You Understand | Know the business model before investing. |

| Review Periodically | Track performance but avoid overtrading. |

| Build a Diversified Portfolio | Don’t put all eggs in one basket. Diversify across sectors and themes. |

Life Lessons for Investors

- Start Small, Think Big: You don’t need lakhs to begin investing. Even Rs. 1000 can grow with the right mindset.

- Avoid Greed: Multibaggers are discovered through research, not tips.

- Long-Term Vision: Wealth is built over years, not overnight.

- Continuous Learning: The market keeps evolving. So should you.

- Have a Process: Always follow a checklist or strategy.

Conclusion

Prasenjit Paul’s journey is a real-life example of how knowledge, discipline, and patience can create financial freedom. From an engineering student with limited resources to a respected investor and author, his life teaches us that success in the stock market is not about luck—it’s about strategy, self-education, and conviction.

If you’re just starting out, take a leaf out of Paul’s book—literally and figuratively. Learn the basics, avoid shortcuts, and focus on becoming a better investor every day.

“The stock market is not a casino if you treat it like a business.” – Prasenjit Paul