Introduction

Shankar Sharma is a name every serious investor in India knows. A man who didn’t just ride the market waves—he anticipated them. Known for his sharp insights and fearless contrarian calls, Sharma has built a reputation as one of India’s most successful and respected investors.

This blog dives into his full story: from humble beginnings in Dhanbad to predicting some of the biggest financial events in history.

Early Life: Roots in Dhanbad

Sharma’s story starts in Dhanbad, a coal-mining town. Unlike many market giants born into financial families, his beginnings were modest. But his early exposure to market dynamics through a tenant’s IPO earnings planted a seed.

That early spark turned into a lifelong passion when he used ₹2,500—borrowed from his mother—to invest in the stock market. It grew into something far bigger than just money: it became a mission.

Education and the First Corporate Job

After finishing school, Sharma pursued a management degree from the Asian Institute of Management in Manila, one of Asia’s top B-schools. Afterward, he landed a position at Citibank, a dream for many. But his heart wasn’t in the corporate world. He realized early that he was meant for something more independent, dynamic, and high-risk: the stock market.

This bold mindset led to his next big chapter.

Founding First Global

In 1989, Shankar Sharma and his wife Devina Mehra co-founded First Global, an investment research firm. Starting with only ₹5,000, they envisioned a company that offered independent, unbiased, data-backed equity research—something rare in India back then.

At a time when most brokers were driven by commissions and insider tips, First Global brought a fresh approach: analytical, global, and fearless.

Investment Style: What Makes Shankar Sharma Unique

Unlike traditional investors, Sharma isn’t interested in following the herd. His approach is contrarian—he buys when others are selling, and sells when the market is euphoric.

His Key Investment Principles:

- Data over emotion – Let numbers, not feelings, guide decisions.

- Independent thinking – Don’t rely on consensus.

- Global outlook – Watch trends beyond India.

- Risk-balanced strategies – Make small bets with big upside potential.

He believes that long-term wealth is created by doing what others aren’t willing to do.

The Famous 4 AM Strategy

One of Sharma’s well-known approaches is the “4 AM Strategy.” These are high-risk, high-reward investments that can give you sleepless nights but also extraordinary returns.

Here’s how it works:

- Keep only a small portion (1–2%) of your capital in such bets.

- Diversify across multiple ideas.

- Research heavily before entering.

- Accept that some will fail—but one good pick can cover all others.

Data-Driven Thinking: Technical Meets Fundamental

Sharma isn’t married to any one method. He blends:

- Technical Analysis: Reading charts, price action, and volume.

- Fundamental Research: Analyzing balance sheets, ratios, earnings.

- Quantitative Models: Looking for statistical trends.

- Behavioral Finance: Understanding investor psychology.

This hybrid approach is rare and powerful—it allows him to see patterns others miss.

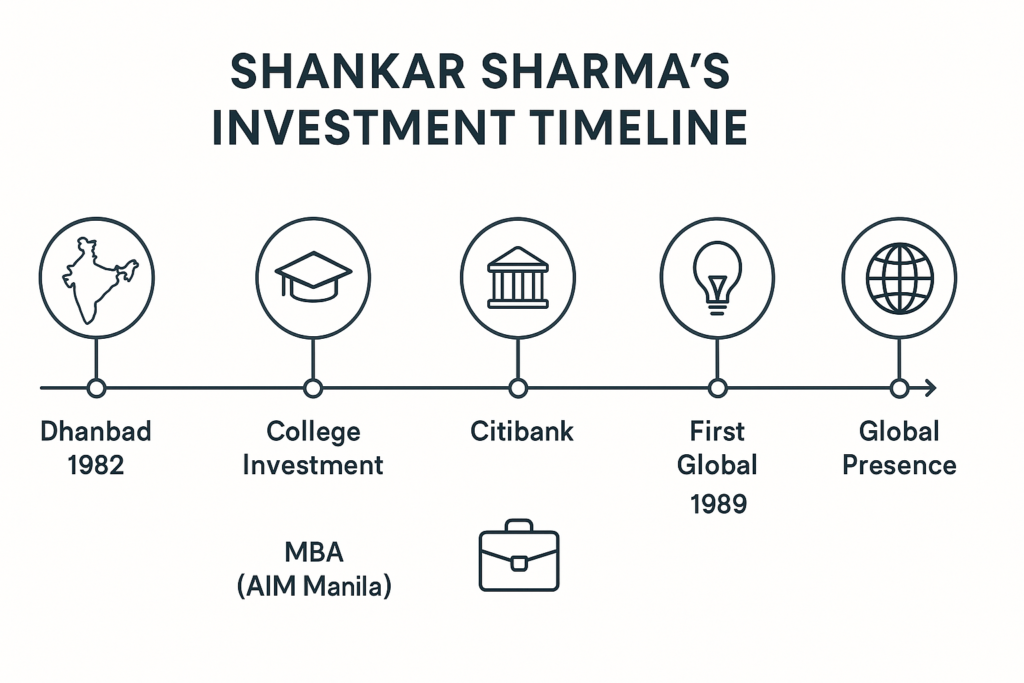

Shankar Sharma’s Investment Timeline

Here’s a simplified visual timeline of his journey:

| Year | Milestone |

|---|---|

| 1982 | Began investing with ₹2,500 in IPOs |

| 1989 | Founded First Global with Devina Mehra |

| 1992 | Predicted Harshad Mehta bubble |

| 2000 | Warned about dot-com bubble |

| 2008 | Anticipated global financial meltdown |

| 2020 | Called the post-COVID bull run |

Famous Market Predictions

Over the years, Sharma has accurately predicted several critical market events:

- 1992: Warned about the overheated Indian market before the Harshad Mehta crash.

- 2000: Cautioned investors about the dot-com bubble.

- 2008: Saw the signs of the global financial collapse before most did.

- 2020: Urged investors to buy during COVID-19 fear — markets surged later.

His success isn’t about being lucky—it’s about data-backed courage.

Controversies and Challenges

No great investor avoids scrutiny, and Sharma is no exception.

- His firm First Global was under SEBI investigation at one point.

- Investments in companies like Brightcom Group drew criticism.

- He’s often faced backlash for speaking against popular opinion.

But in every storm, he held his ground, relying on research and conviction, not speculation.

Where is He Now?

Today, Shankar Sharma is a global investor and continues to lead First Global. He focuses on:

- Helping clients grow wealth globally.

- Sharing insights via media and conferences.

- Mentoring a new generation of investors.

His footprint now spans not just India but London and Wall Street as well.

Lessons for Young Investors

- Think for yourself – Don’t blindly follow trends or tips.

- Learn continuously – Study history, economics, behavior.

- Invest cautiously – Don’t bet big without deep research.

- Embrace failures – Even the best investors lose sometimes.

- Stay patient – Wealth compounds over years, not weeks.

Top Quotes by Shankar Sharma

“If you are doing what everyone else is doing, you are already late.”

“The markets don’t reward your intelligence. They reward your ability to act against your fear.”

“Data is the new oil, and in markets, it’s the only truth.”

Final Thoughts

Shankar Sharma’s story proves that success in investing doesn’t come from shortcuts. It comes from:

- Thinking differently

- Researching deeply

- Taking bold, smart risks

He didn’t just build wealth — he built a mindset. And that’s what every investor should aim for.

Pingback: Manish Dhawan: India’s Options Trading Expert InvestTrending