Introduction

The stock market crash 2025 has sent shockwaves through the global economy, leaving investors, businesses, and policymakers scrambling to respond. This sudden downturn has drawn comparisons to previous financial crises, raising concerns about economic stability and long-term recovery. In this article, we will explore the causes behind the crash, its impact on various sectors, investor reactions, and what the future holds.

Understanding the Stock Market Crash of 2025

A stock market crash occurs when stock prices plummet rapidly, wiping out billions in market value. The 2025 crash was triggered by a combination of economic factors, geopolitical tensions, and market speculation, creating a perfect storm for financial turmoil.

Market crashes typically result in panic selling, leading to further declines in stock prices. The 2025 crash was no exception, as investors rushed to liquidate their holdings, causing a downward spiral in global markets. The volatility index (VIX), often referred to as the “fear index,” skyrocketed, reflecting heightened market anxiety.

Key Causes of the Crash

- Interest Rate Hikes: The Federal Reserve and other central banks aggressively raised interest rates to combat inflation, leading to higher borrowing costs and reduced corporate profits. The impact was particularly severe on debt-heavy companies and mortgage markets.

- Economic Slowdown: A global slowdown in economic growth, exacerbated by lingering supply chain disruptions, led to decreased consumer spending and lower corporate earnings. Many emerging markets also faced declining foreign investment.

- Tech Bubble Burst: Overvaluation of tech stocks caused a massive sell-off, reminiscent of the dot-com bubble burst. Many startups with little to no profits saw their valuations plummet as investors moved away from speculative assets.

- Geopolitical Uncertainty: Ongoing conflicts, trade wars, and political instability created fear and uncertainty in the markets. Tensions between major economies such as the U.S. and China led to unpredictable shifts in trade policies and stock market reactions.

- Debt Crisis: High levels of corporate and government debt increased the risk of defaults, shaking investor confidence. Several high-profile bankruptcies among major corporations added fuel to the panic.

- Algorithmic Trading: Automated trading systems exacerbated the crash, accelerating sell-offs and market volatility. These high-frequency trading algorithms reacted instantly to market trends, often amplifying losses.

Historical Context: Comparing with Past Market Crashes

To put the 2025 crash in perspective, let’s compare it to previous stock market crashes:

| Year | Crash | Key Cause |

|---|---|---|

| 1929 | The Great Depression | Stock market speculation and lack of regulation |

| 1987 | Black Monday | Computerized trading and panic selling |

| 2000 | Dot-com Bubble | Overvalued tech stocks and market euphoria |

| 2008 | Financial Crisis | Housing bubble and risky mortgage-backed securities |

| 2020 | COVID-19 Crash | Pandemic-driven economic uncertainty |

The 2025 crash shares similarities with the dot-com bubble and the 2008 financial crisis, particularly in terms of speculative investments and high debt levels.

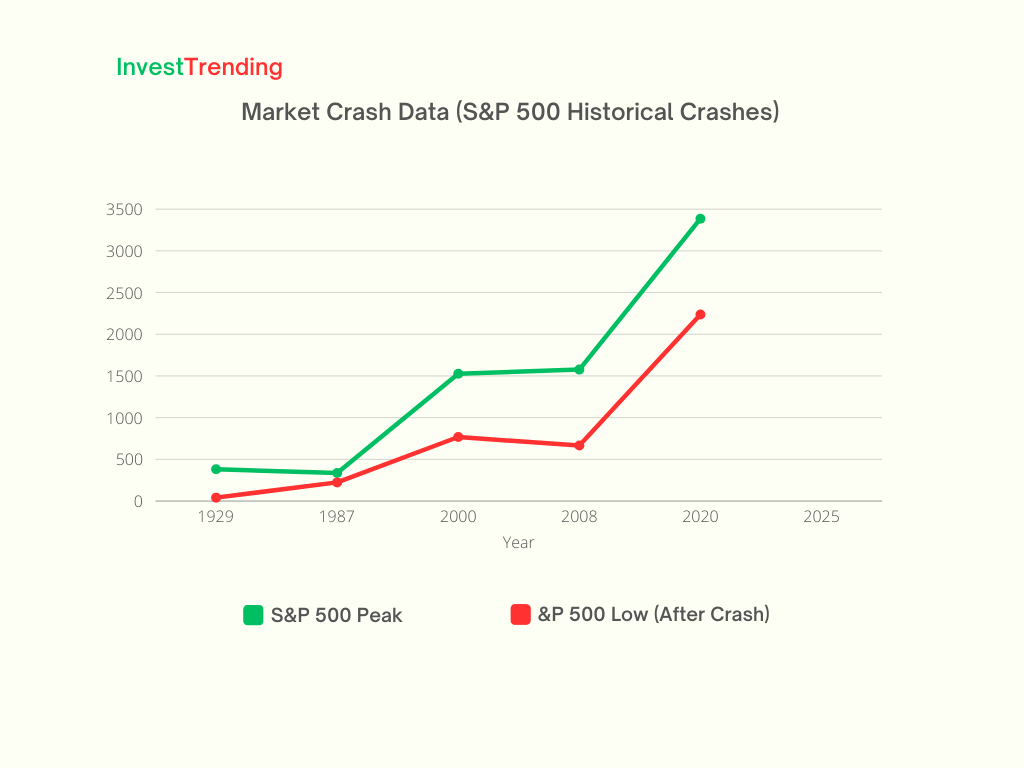

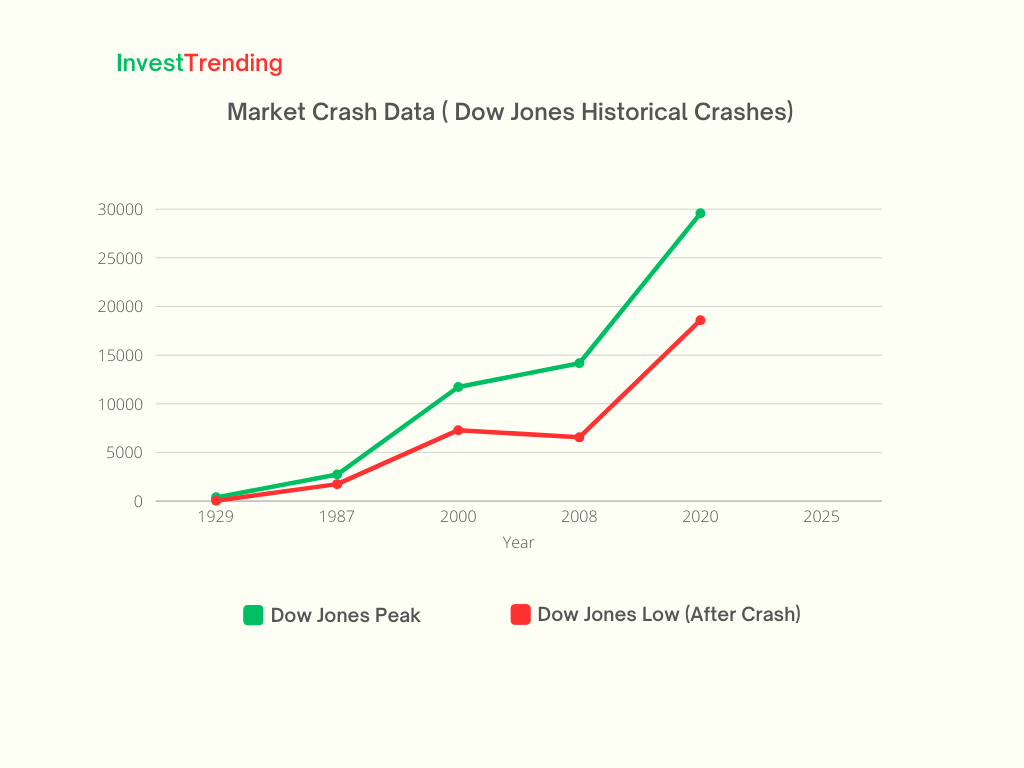

Market Crash Data (S&P 500 & Dow Jones Historical Crashes)

Market Crash Data (S&P 500 Historical Crashes)

Market Crash Data ( Dow Jones Historical Crashes)

| Year | S&P 500 Peak | S&P 500 Low (After Crash) | Drop (%) | Dow Jones Peak | Dow Jones Low (After Crash) | Drop (%) |

|---|

| 1929 | 381 (Sep 3) | 41 (Jul 1932) | -89% | 381 (Sep 3) | 41 (Jul 1932) | -89% |

| 1987 | 336 (Aug 25) | 224 (Oct 19) | -33% | 2722 (Aug 25) | 1739 (Oct 19) | -36% |

| 2000 | 1527 (Mar 24) | 768 (Oct 2002) | -49% | 11722 (Jan 14) | 7286 (Oct 2002) | -38% |

| 2008 | 1576 (Oct 9) | 666 (Mar 9, 2009) | -57% | 14164 (Oct 9) | 6547 (Mar 9, 2009) | -54% |

| 2020 | 3386 (Feb 19) | 2237 (Mar 23) | -34% | 29568 (Feb 12) | 18591 (Mar 23) | -37% |

| 2025 | ??? (Projected) | ??? | ??? | ??? | ??? | ??? |

Impact on Different Sectors

1. Technology Sector

The biggest losers in the 2025 crash were tech companies. High valuations, speculative investments, and disappointing earnings led to massive sell-offs. Even well-established companies such as Apple, Microsoft, and Tesla saw their stock prices decline significantly.

2. Banking & Financial Institutions

Banks faced liquidity issues due to rising interest rates and increased loan defaults, leading to reduced lending and tighter credit conditions. Some smaller financial institutions collapsed, triggering concerns over a banking crisis.

3. Real Estate Market

High interest rates made mortgages unaffordable, causing a slowdown in real estate sales and declining property values. Homebuilders also faced plummeting demand, leading to layoffs in the construction industry.

4. Cryptocurrency Market

Bitcoin and other cryptocurrencies faced extreme volatility, with many investors pulling out amid uncertainty. The collapse of a few major crypto exchanges worsened the situation, leading to regulatory crackdowns.

5. Retail & Consumer Goods

Declining consumer confidence led to reduced spending, impacting retail businesses and consumer goods companies. Luxury brands and non-essential goods suffered the most, as people prioritized saving over spending.

6. Employment & Labor Market

Layoffs and hiring freezes became common as companies struggled to cut costs. The unemployment rate spiked, leading to increased government intervention through stimulus measures and relief programs.

Investor Reactions: Panic vs. Opportunity

While some investors panicked and sold off their stocks, others saw the crash as a buying opportunity. Warren Buffett’s famous saying, “Be fearful when others are greedy and greedy when others are fearful,” became particularly relevant during this time.

Investment Strategies During a Market Crash

- Diversification: Investors who diversified their portfolios across various asset classes suffered fewer losses.

- Long-Term Holding: Those who held onto strong stocks avoided panic-induced losses.

- Value Investing: Smart investors looked for undervalued stocks with strong fundamentals.

- Hedging Strategies: Some investors turned to options trading and short-selling to profit from market declines.

Recovery & Future Predictions

Market crashes are temporary, and history has shown that stock markets eventually recover. Experts predict the following trends in the post-crash recovery:

- Government Stimulus: Policymakers will likely introduce stimulus packages to revive the economy.

- Interest Rate Adjustments: Central banks may lower interest rates to encourage borrowing and spending.

- Shift to Safer Investments: Investors will move towards bonds, gold, and dividend stocks.

- Emerging Markets Growth: Developing economies may provide new growth opportunities.

- Regulatory Reforms: Governments may implement stricter financial regulations to prevent future crises.

Lessons for Future Investors

1. Avoid Speculation

Investing in overhyped stocks can lead to severe losses.

2. Have an Emergency Fund

A financial cushion helps navigate economic downturns.

3. Stick to Fundamentals

Invest in companies with strong balance sheets and sustainable growth models.

4. Use Risk Management Strategies

Stop-loss orders and hedging can help minimize losses.

Conclusion

The stock market crash of 2025 was a wake-up call for investors, businesses, and policymakers. While the immediate impact was severe, history suggests that markets will recover, and new investment opportunities will arise. Staying informed, managing risks, and making well-researched decisions will be key to navigating future market downturns.

🔗 Backlink: Visit Our Financial Blog for More Insights