The stock market is an ever-evolving financial landscape that reflects global economic trends, investor sentiment, and technological advancements. As we step into 2025, investors are keen to understand where the market is heading. This comprehensive guide on Stock Market Predictions 2025 will provide insights into anticipated market trends, sector-wise growth, AI-driven forecasts, and strategic investment approaches to maximize returns in the coming year.

Market Trends & Economic Factors Influencing 2025

1. Global Economic Recovery Post-Pandemic

The world economy has been recovering from the pandemic, but several challenges persist, including inflation, interest rate fluctuations, and geopolitical tensions. Key factors influencing the stock market in 2025 include the pace of central bank policies, supply chain stabilization, and global trade dynamics. Additionally, emerging markets are playing a greater role in driving global growth, while investors are closely watching shifts in consumer behavior and energy transitions to assess long-term opportunities.

- Federal Reserve policies and interest rates

- Inflation control measures

- Global GDP growth forecasts

- Supply chain stability

2. Technological Innovations & AI in Stock Market Predictions

AI and machine learning models are revolutionizing stock market predictions. In 2025, traders and investors will increasingly rely on AI-driven analytics for real-time data processing, sentiment analysis, and predictive modeling. These technologies enhance decision-making accuracy and reduce human error. Furthermore, algorithmic trading powered by AI is expected to dominate high-frequency trading, while personalized robo-advisors will provide tailored investment strategies for retail investors.

- Trend detection and sentiment analysis

- Algorithmic trading for better investment decisions

- Predictive analytics for stock price forecasting

Indian Stock Market Predictions 2025

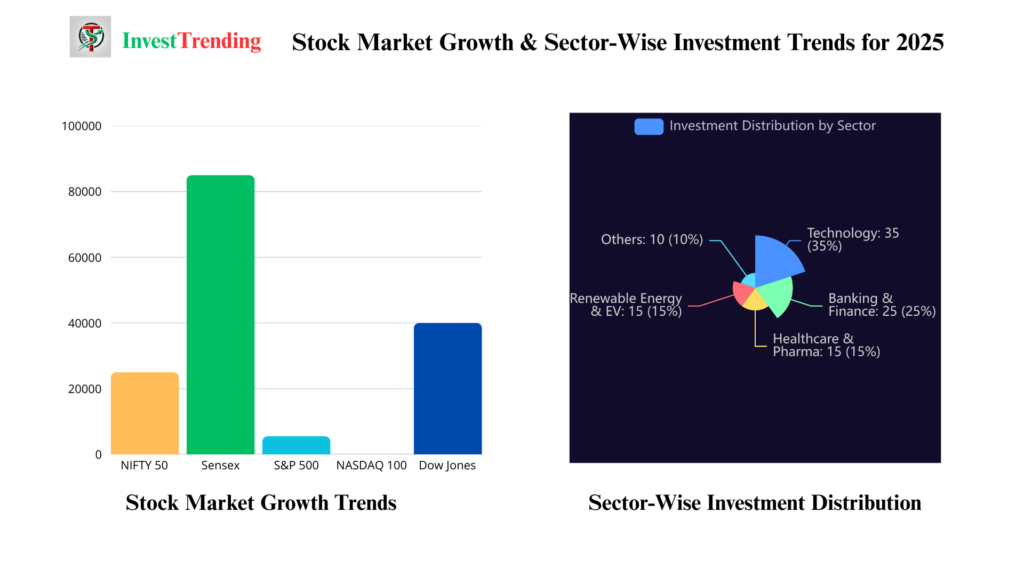

NIFTY 50 & BSE Sensex Outlook

India’s stock market is poised for strong growth, backed by rapid digital transformation, strong GDP growth, and increasing foreign investments. Key sectors such as IT, renewable energy, and infrastructure are expected to lead the rally. Additionally, government initiatives like ‘Make in India’ and Production Linked Incentive (PLI) schemes are likely to boost corporate earnings and investor confidence in the NIFTY 50 and BSE Sensex.

- NIFTY 50 projection: Expected to reach 25,000 by the end of 2025

- Sensex projection: May touch 85,000 if economic growth remains stable

- Key growth sectors: IT, Pharma, Renewable Energy, Banking

Best Sectors for Investment in India

| Sector | Top Indian Stocks |

|---|---|

| IT & Software | Infosys (INFY), TCS (TCS), Wipro (WIPRO), HCL Tech (HCLTECH) |

| Banking & Finance | HDFC Bank (HDFCBANK), ICICI Bank (ICICIBANK), Axis Bank (AXISBANK) |

| Pharma & Healthcare | Sun Pharma (SUNPHARMA), Cipla (CIPLA), Dr. Reddy’s Labs (DRREDDY) |

| EV & Renewable Energy | Tata Motors (TATAMOTORS), Adani Green (ADANIGREEN), NTPC (NTPC) |

Global Stock Market Predictions for 2025

Stock Market Index Forecasts for 2025

| Index | Bullish Prediction | Bearish Prediction |

| S&P 500 | 5,500+ | 4,200 |

| NASDAQ 100 | 12%-15% Growth | 8%-10% Growth |

| Dow Jones | 40,000+ | 35,000 |

| NIFTY 50 (India) | 25,000 | 22,000 |

| BSE Sensex (India) | 85,000 | 78,000 |

Sector-Wise Stock Market Predictions for 2025

| Sector | Global Stocks | Indian Stocks |

| Technology | Apple (AAPL), Nvidia (NVDA) | TCS, Infosys, HCL Tech |

| Banking | JPMorgan Chase (JPM) | HDFC Bank, ICICI Bank |

| Renewable Energy | Tesla (TSLA), NextEra (NEE) | Adani Green, Tata Power |

| Healthcare | Moderna (MRNA), Pfizer (PFE) | Sun Pharma, Dr. Reddy’s |

Sector-Wise Stock Market Predictions for 2025

1. Technology Sector

Tech stocks are set to outperform other sectors, thanks to advancements in artificial intelligence, blockchain, and quantum computing. The growing demand for cloud computing, cybersecurity, and semiconductor innovations will further fuel this momentum. Moreover, tech giants are expected to expand into emerging markets, driving global adoption and creating new revenue streams across digital platforms.

- Top tech stocks to watch: Apple (AAPL), Nvidia (NVDA), Microsoft (MSFT), Amazon (AMZN), and Tesla (TSLA)

2. Healthcare & Biotech

The healthcare sector will witness exponential growth, driven by innovation in biotech, genomics, and personalized medicine. Advancements in AI-powered diagnostics, telemedicine, and mRNA technology are reshaping patient care and accelerating drug development. Additionally, increased global investment in healthcare infrastructure and an aging population are expected to sustain long-term growth in this sector.

3. Renewable Energy & EV Market

The green energy sector will gain momentum due to global initiatives toward sustainability. Increased government incentives, policy support, and technological advancements in solar, wind, and hydrogen energy are accelerating the transition to clean power. Simultaneously, the electric vehicle (EV) market is expected to surge, driven by improved battery technologies and expanding charging infrastructure worldwide.

- Top picks: Tesla (TSLA), NextEra Energy (NEE), Plug Power (PLUG)

4. Cryptocurrency & Blockchain Stocks

Despite volatility, blockchain technology and cryptocurrencies continue to gain acceptance in mainstream finance. Institutional adoption is rising, and regulatory frameworks are gradually becoming clearer, boosting investor confidence. Moreover, blockchain applications beyond digital currencies—such as in supply chain, healthcare, and smart contracts—are opening new avenues for stock market growth in this sector.

- Stocks to watch: Coinbase (COIN), Marathon Digital (MARA), Riot Blockchain (RIOT)

Investment Strategies for 2025

1. Diversification is Key

Investing in a mix of stocks, ETFs, and bonds will help mitigate risks. A well-diversified portfolio can cushion against market volatility and sector-specific downturns. Additionally, including global assets and emerging market funds can enhance returns and provide broader exposure to high-growth opportunities.

2. Growth vs. Value Investing

Growth investing: Focus on tech and innovation-driven companies that show potential for above-average revenue and earnings growth. These include sectors like AI, biotech, and renewable energy, which are expected to thrive in 2025.

Value investing: Target undervalued stocks with strong fundamentals, stable cash flows, and solid dividend histories. This strategy is ideal for risk-averse investors looking to capitalize on market inefficiencies and long-term stability.

- Growth investing: Focus on tech and innovation-driven companies

- Value investing: Target undervalued stocks with strong fundamentals

3. Passive Investing & ETFs

For investors who prefer stability, ETFs tracking major indices are an ideal option.

- Best ETFs for 2025: SPY (S&P 500 ETF), QQQ (NASDAQ ETF), VOO (Vanguard S&P 500 ETF)

Risks & Challenges to Watch Out For

- Inflation & Interest Rate Hikes: Impacting stock valuations

- Geopolitical Tensions: Market uncertainty due to global conflicts

- Supply Chain Disruptions: Affecting industrial and manufacturing sectors

Conclusion

The stock market in 2025 presents numerous opportunities for investors who stay informed and adopt strategic approaches. With technological advancements, economic recovery, and evolving investment trends, now is the time to make data-driven investment decisions.

For more insights, visit our Stock Market Insights Page.

Pingback: Jio Finance Share Price & Stock Analysis 2025 InvestTrending