Introduction

Taiwan is one of Asia’s most dynamic economies, recognized globally for its leadership in technology, manufacturing, and innovation. As investors worldwide keep a keen eye on the Asian markets, the Taiwan Index has emerged as a significant benchmark for tracking Taiwan’s economic and stock market performance. In this blog, we’ll dive deep into what the Taiwan Index is, why it matters, how it functions, and how investors can use it for informed decision-making.

What is the Taiwan Index?

The Taiwan Index, most commonly referred to as the TAIEX (Taiwan Capitalization Weighted Stock Index), is the primary index that tracks the performance of companies listed on the Taiwan Stock Exchange (TWSE). Introduced in 1967, the TAIEX serves as a barometer of the health and direction of Taiwan’s equity market.

Key Features of the TAIEX

| Feature | Description |

|---|---|

| Full Form | Taiwan Capitalization Weighted Stock Index |

| Launched | 1967 |

| Managed By | Taiwan Stock Exchange (TWSE) |

| Constituents | All listed common stocks, excluding preferred stocks, full delivery stocks, and stocks under special treatment |

| Weighting Method | Market Capitalization Weighted |

| Currency | New Taiwan Dollar (TWD) |

How the TAIEX Works

The TAIEX is a market-capitalization weighted index, meaning companies with larger market caps have a greater impact on the index’s performance. The formula takes into account the total market value of all eligible companies listed on the TWSE.

Calculation Formula:

TAIEX = (Current Market Value of All Constituent Stocks / Base Market Value) x Base Index ValueThe base date is set to January 1967, and the base index value is 100.

Sectors Dominating the Taiwan Index

Taiwan’s economy is heavily driven by technology and electronics. Here’s a breakdown of the major sectors:

| Sector | Contribution to TAIEX |

| Technology (Semiconductors, Hardware) | ~60% |

| Financials | ~15% |

| Industrials | ~10% |

| Consumer Goods | ~5% |

| Others | ~10% |

Key Companies:

- Taiwan Semiconductor Manufacturing Company (TSMC)

- Hon Hai Precision (Foxconn)

- MediaTek

- Delta Electronics

These companies significantly influence the TAIEX’s movement due to their large market capitalization.

Company Overviews and Performance

1. Taiwan Semiconductor Manufacturing Company (TSMC):

- Founded in 1987, TSMC is the world’s largest dedicated independent semiconductor foundry.

- Supplies chips to companies like Apple, AMD, Nvidia, and Qualcomm.

- Accounts for over 50% of global foundry market share.

- Dominates TAIEX due to its large market cap and international demand.

2. Hon Hai Precision Industry Co., Ltd. (Foxconn):

- Established in 1974, Foxconn is the world’s largest electronics manufacturer.

- Key supplier for Apple (iPhones, iPads), Sony, and Dell.

- Plays a crucial role in Taiwan’s export sector.

3. MediaTek Inc.:

- A leading fabless semiconductor company, known for its mobile chipsets.

- Supplies to companies in telecom, automotive, and smart device industries.

- Competes globally with Qualcomm.

4. Delta Electronics:

- Major player in power and thermal management solutions.

- Serves industries such as renewable energy, automation, and data centers.

Historical Performance and Milestones

| Year | Major Events |

| 2000 | Tech bubble saw highs followed by a sharp drop. |

| 2008 | Global financial crisis impacted all sectors. |

| 2010-2015 | Gradual recovery driven by tech exports. |

| 2020 | COVID-19 caused initial dip, followed by a rally in tech stocks. |

| 2021 | Record highs due to semiconductor boom. |

| 2022 | Market correction due to global inflation and supply chain issues. |

| 2023 | Stabilization with diversified sector recovery. |

| 2024 | Renewed interest in AI and semiconductor demand driving growth. |

Why the Taiwan Index Matters

- Market Sentiment Indicator: It reflects investor sentiment towards Taiwan’s economy.

- Benchmark for Investments: Used by mutual funds, ETFs, and investors to benchmark performance.

- Foreign Investment Guide: Helps international investors track market trends and economic health.

- Risk Assessment: Useful for analyzing sector-specific risks and geopolitical factors.

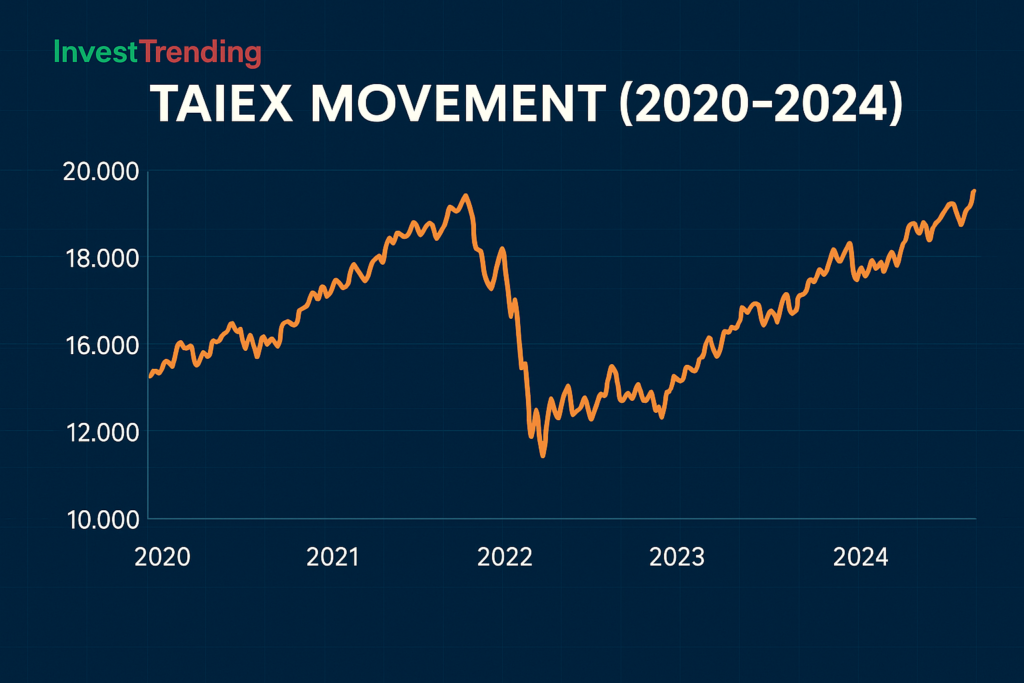

Recent Trends in the Taiwan Index

- 2020-2022 Boom: Tech boom due to global chip shortage drove TAIEX to all-time highs.

- 2023 Correction: Market corrections due to inflation, interest rate hikes, and global tensions.

- 2024 Recovery: Renewed investor interest and stable chip demand fostered a recovery.

TAIEX Movement (2020-2024)

How to Invest in the Taiwan Index

Investors have multiple ways to gain exposure to the Taiwan Index:

- ETFs (Exchange-Traded Funds):

- iShares MSCI Taiwan ETF (EWT)

- Franklin FTSE Taiwan ETF (FLTW)

- Index Funds:

- Taiwan-focused mutual funds tracking TAIEX

- Direct Stock Purchase:

- Via international brokerage platforms offering access to TWSE

- Derivatives and Futures:

- For advanced traders seeking leveraged exposure

Risks and Considerations

Investing in the Taiwan Index, while promising, comes with risks:

- Geopolitical Risks: Tensions with China can impact market volatility.

- Currency Risk: Fluctuations in the TWD can affect returns for foreign investors.

- Sector Concentration: Heavy reliance on tech sector makes it vulnerable to tech downturns.

Tips for Investors

- Diversify: Combine TAIEX exposure with other global indices.

- Stay Updated: Follow Taiwan’s central bank policies, export data, and political developments.

- Use Technical Analysis: Apply moving averages, RSI, and MACD to identify trends.

SEO Keywords to Consider

- Taiwan Index performance

- TAIEX explained

- Taiwan Stock Exchange

- Invest in Taiwan Index

- Taiwan stock market outlook

- TAIEX 2024 forecast

- Taiwan ETF investment

Conclusion

The Taiwan Index (TAIEX) is more than just a stock market indicator; it is a window into one of Asia’s most advanced economies. Whether you’re a seasoned investor or a beginner exploring Asian markets, understanding TAIEX can offer valuable insights and help guide your investment strategy. By keeping an eye on sector performance, key players, and macroeconomic indicators, investors can harness the potential of Taiwan’s growth story.

Start exploring TAIEX-linked investment opportunities today and be part of Taiwan’s dynamic market journey.

Frequently Asked Questions (FAQs)

Q1. Can foreign investors invest in the Taiwan Index? Yes, through international ETFs and mutual funds that track the TAIEX.

Q2. What influences the TAIEX the most? The performance of major tech companies like TSMC and global semiconductor demand.

Q3. Is TAIEX a good long-term investment? It can be, especially for investors bullish on technology and the Asian markets.

Q4. How can I track real-time TAIEX data? You can check financial news websites, Taiwan Stock Exchange’s official site, or use investment apps like Bloomberg and TradingView.

Q5. Are there alternatives to TAIEX for investing in Taiwan? Yes, such as MSCI Taiwan Index and other thematic or sector-specific indices.

Disclaimer

This blog post is for informational purposes only and does not constitute investment advice. All investments involve risk, including the potential loss of principal. Investors should conduct their own research or consult with a qualified financial advisor before making investment decisions related to the Taiwan Index or any other financial instrument.