Vishal Mega Mart, one of India’s leading value retail chains, is making headlines with its highly anticipated Initial Public Offering (IPO). Investors, market enthusiasts, and retail consumers are eagerly watching for the Grey Market Premium (GMP) trends, which offer early insights into the IPO’s potential performance. In this blog, we’ll delve into the Vishal Mega Mart IPO, its GMP, and everything surrounding this major retail market event.

Introduction to Vishal Mega Mart

Vishal Mega Mart is a popular name among Indian households, known for offering value-for-money products to the middle and lower-middle-income segments. The retail chain provides a wide assortment of products, including clothing, home essentials, groceries, and more. With over 550 stores across India, the company has a deep penetration into Tier-II and Tier-III cities.

Founded in 2001 and headquartered in Gurgaon, Haryana, the company employs over 10,000 people and is trusted for its affordability and wide product range.

Vishal Mega Mart IPO Overview

Vishal Mega Mart is planning a major IPO that includes both fresh issue and offer for sale. This allows the company to raise new funds for expansion and gives an exit opportunity to some of its current investors. While official numbers are awaited, early reports suggest an IPO size of around INR 4,000 Crore.

Key IPO Details (Tentative):

| Particulars | Details |

|---|---|

| IPO Size | INR 4,000 Crore (approx.) |

| Fresh Issue | INR 2,000 Crore |

| Offer for Sale (OFS) | INR 2,000 Crore |

| Face Value | INR 10 per share |

| Price Band | INR 295 – 325 (Expected) |

| Lot Size | 45 shares |

| Listing on | NSE & BSE |

| Tentative Listing Date | August 2025 |

The IPO is expected to list on NSE and BSE by August 2025. The price band is likely to be in the range of INR 295–325, and investors are watching the developments closely.

Understanding GMP and Its Significance

Grey Market Premium (GMP) is an unofficial, over-the-counter market where IPO shares are traded before official listing. It indicates investor sentiment about the IPO.

Why GMP Matters:

- It gives an early hint of possible listing gains.

- Shows investor confidence and demand.

- Helps in IPO application decisions, especially for retail investors.

However, it’s important to remember that GMP is speculative and not regulated by SEBI.

Vishal Mega Mart IPO GMP Trends

As of the latest update, Vishal Mega Mart’s IPO GMP is drawing strong interest among retail and institutional investors.

Latest GMP (Tentative): INR 120-140

Currently, the GMP for Vishal Mega Mart IPO is around INR 120–140, suggesting strong market enthusiasm. Based on this, the estimated listing price could be INR 445–465, which means a potential gain of 37% to 43%.

GMP Trend Table:

| Date | GMP (INR) | Trend |

| April 20 | 100 | Increasing |

| April 21 | 110 | Positive |

| April 22 | 130 | Strong Buy |

| April 23 | 140 | Bullish |

Note: GMP can fluctuate daily based on market conditions.

Key Insights:

- GMP is increasing steadily.

- Retail participation is high.

- Demand is likely to surge as the official announcement nears.

Financial Snapshot of Vishal Mega Mart

Over the last three financial years, Vishal Mega Mart has shown consistent revenue growth and improving profit margins. The pandemic slowdown was followed by a strong recovery.

Highlights:

| inancial Year | Revenue (INR Cr) | EBITDA (INR Cr) | Net Profit (INR Cr) |

| FY2022 | 6,100 | 540 | 110 |

| FY2023 | 7,850 | 730 | 200 |

| FY2024 (Est.) | 9,200 | 880 | 275 |

- FY2022 Revenue: ₹6,100 Cr | Net Profit: ₹110 Cr

- FY2023 Revenue: ₹7,850 Cr | Net Profit: ₹200 Cr

- FY2024 (Est.): ₹9,200 Cr | Net Profit: ₹275 Cr

Key Ratios:

- EBITDA Margin: ~9.5%

- Return on Equity (ROE): ~18%

- Debt-to-Equity: ~0.6x

These figures reflect strong operational efficiency and strategic growth.

Key Strengths and Potential Risks

Strengths:

- Strong foothold in semi-urban and rural markets.

- Established brand trusted by millions.

- Efficient supply chain and procurement model.

- Experienced management team.

Risks:

- Intense competition from players like DMart and Reliance Retail.

- Low profit margins typical of the value retail segment.

- Dependence on logistics and pricing-sensitive consumers.

Market Expert Opinions

Experts and brokerage firms are largely positive about the IPO. The fundamentals are strong, and the company is expected to benefit from India’s growing retail consumption.

Market Analyst View:

“The GMP and strong fundamentals suggest that Vishal Mega Mart IPO is a good opportunity for long-term investors. However, pricing will be key, and overvaluation should be avoided.”

Brokerage Firm Review:

- Angel One: Subscribe for long-term

- Motilal Oswal: Subscribe with caution

- Zerodha: Attractive valuation if priced below INR 320

What Analysts Say:

- “Promising for long-term investors but monitor pricing.”

- “Subscribe if priced below INR 320; GMP suggests listing gains.”

- “Retail growth and brand recall are strong positives.”

Final Takeaway for Investors

Vishal Mega Mart’s IPO is poised to become one of the most notable offerings in the retail sector. With solid GMP trends, consistent financial performance, and growing consumer trust, it stands out as a potential long-term investment.

Investment Tips:

- Use GMP as an indicator, not a decision-maker.

- Review the company’s financials and future strategy.

- Compare IPO valuation with similar companies.

- Keep track of official announcements from SEBI and the company.

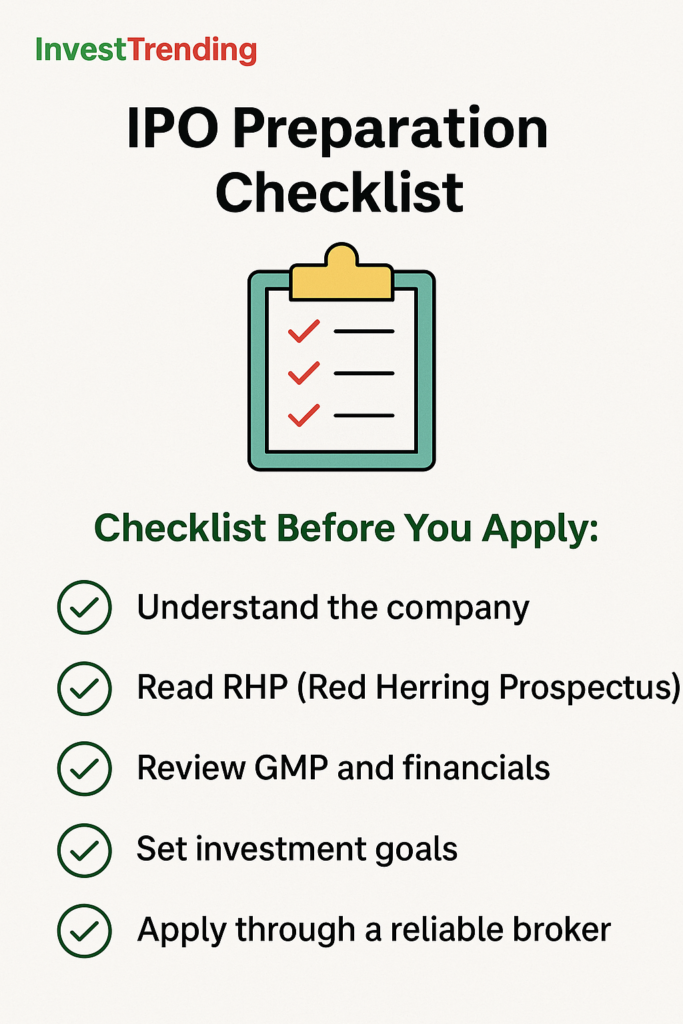

IPO Preparation Checklist

Frequently Asked Questions (FAQs)

Q1: What is the expected listing date of the Vishal Mega Mart IPO? A: The IPO is expected to be listed by August 2025 on NSE and BSE.

Q2: What does GMP indicate? A: GMP (Grey Market Premium) is an unofficial market indicator that shows the premium investors are willing to pay for IPO shares before they are listed.

Q3: Can GMP guarantee listing gains? A: No, GMP is speculative and unofficial. It should be used as one of many factors while making investment decisions.

Q4: How can I apply for the Vishal Mega Mart IPO? A: Investors can apply via ASBA (Applications Supported by Blocked Amount) through net banking or trading platforms like Zerodha, Upstox, Angel One, etc.

Q5: What is the lot size of this IPO? A: The lot size will be announced in the Red Herring Prospectus (RHP), which is awaited.

Conclusion

The Vishal Mega Mart IPO has garnered significant attention due to its brand value, performance, and market footprint. With strong GMP trends and an expanding retail footprint, it represents a promising opportunity. However, as with any investment, due diligence, risk assessment, and a clear understanding of financials are essential.

Invest wisely and stay informed!

Disclaimer

The information provided in this article is for informational purposes only and does not constitute investment advice or a recommendation. Grey Market Premium (GMP) figures are unofficial and speculative. Always consult a financial advisor or conduct your own research before making any investment decisions. The author or platform is not responsible for any losses incurred.