“Rule No. 1: Never lose money. Rule No. 2: Never forget Rule No. 1.”

– Warren Buffett

Early Life and Background

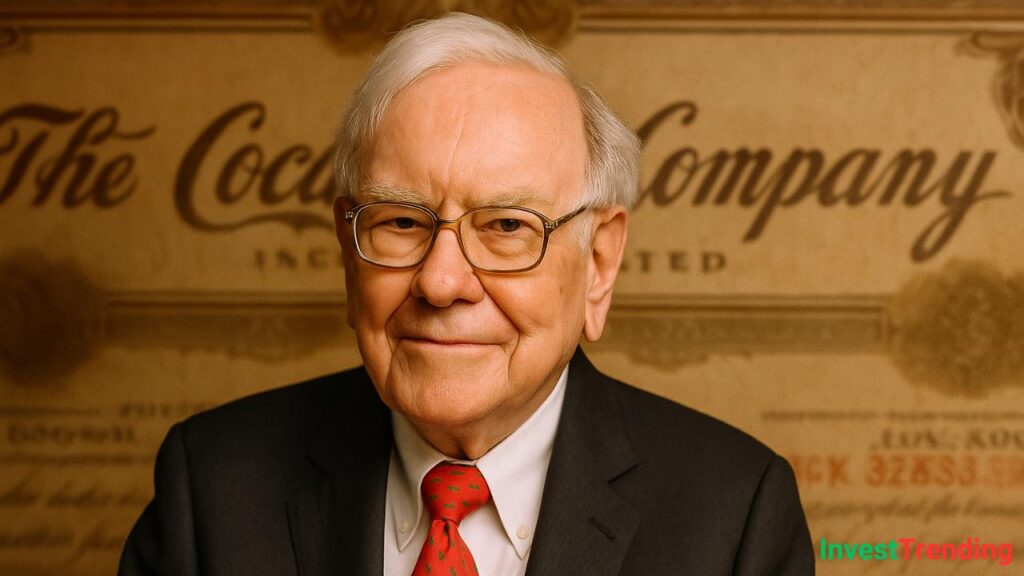

Warren Edward Buffett was born on August 30, 1930, in Omaha, Nebraska. He was the second of three children born to Howard Buffett, a stockbroker and future U.S. congressman, and Leila Buffett. From an early age, Warren exhibited an affinity for numbers and business.

At just six years old, Buffett made his first business venture by buying packs of Coca-Cola from his grandfather’s store and selling individual bottles at a profit. By the age of 11, he had already made his first stock market investment, purchasing three shares of Cities Service Preferred for himself and three for his sister. This early exposure to investing sparked a lifelong passion for finance.

“Be fearful when others are greedy, and greedy when others are fearful.”

– Warren Buffett

Education and Early Career

Buffett attended the Wharton School of the University of Pennsylvania at the age of 17 but later transferred to the University of Nebraska, where he earned his Bachelor of Science degree in business administration. Despite his exceptional intelligence and a keen interest in investing, Buffett was initially rejected from Harvard Business School. However, he was later accepted at Columbia Business School, where he studied under the legendary value investor Benjamin Graham, author of The Intelligent Investor.

Buffett’s time at Columbia was transformative, as he adopted Graham’s value investing principles—focusing on buying undervalued stocks with strong financials and long-term growth potential. After graduation, Buffett worked at Graham’s investment firm, the Graham-Newman Corporation, where he honed his skills as an investor.

“The stock market is designed to transfer money from the Active to the Patient.”

– Warren Buffett

The Beginning of Buffett’s Investment Journey

In 1956, after Graham’s firm closed, Buffett returned to Omaha and started Buffett Partnership Ltd. With an initial capital of $105,000 raised from family and friends, he applied his value investing principles and achieved extraordinary returns.

Between 1956 and 1969, Buffett’s partnerships grew rapidly, with annual returns averaging 29.5%. His investment in undervalued companies such as American Express and Disney proved to be highly profitable.

“Price is what you pay. Value is what you get.”

– Warren Buffett

Acquisition of Berkshire Hathaway

One of the most pivotal moments in Buffett’s career came in 1965 when he took control of Berkshire Hathaway, a struggling textile company. Although the textile business eventually failed, Buffett transformed Berkshire into a massive holding company by acquiring strong, well-managed businesses like GEICO, See’s Candies, and The Washington Post.

“It’s better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

– Warren Buffett

Transition to Insurance and Financial Holdings

Buffett understood the power of insurance companies and used them as cash-generating machines. His acquisition of National Indemnity and later GEICO provided Berkshire Hathaway with a steady stream of “float” (insurance premiums collected but not yet paid out in claims). This float allowed Buffett to invest large sums of money into stocks and businesses, compounding Berkshire’s value significantly.

“Risk comes from not knowing what you’re doing.”

– Warren Buffett

Investment Strategies: The Buffett Way

Buffett’s investment philosophy is rooted in value investing but refined with his own insights. Some key principles include:

1. Buying Businesses, Not Stocks

Buffett views stocks as partial ownership of a business rather than speculative assets. He invests in companies with strong fundamentals, competitive advantages, and excellent management.

2. Long-Term Focus

Unlike many traders, Buffett adopts a long-term approach. He famously said, “Our favorite holding period is forever.” He believes in buying great companies and letting them grow over decades.

3. Economic Moats

Buffett looks for businesses with strong “moats”—competitive advantages that protect them from competitors. Examples include Coca-Cola’s brand strength, Apple’s ecosystem, and GEICO’s cost advantages.

4. Strong Management Teams

He invests in companies led by honest, competent managers who reinvest profits wisely.

5. Margin of Safety

Borrowing from Graham, Buffett insists on buying stocks at prices significantly below their intrinsic value to reduce risk.

6. Avoiding Unnecessary Risks

Buffett stays away from speculative investments, including cryptocurrencies and companies he doesn’t fully understand. He avoids heavy debt and prioritizes financial stability.

“Our favorite holding period is forever.”

– Warren Buffett

Major Investments and Success Stories

Over the decades, Buffett made several legendary investments:

- Coca-Cola (1988): Invested $1 billion, now worth over $20 billion.

- Apple (2016): A major bet that turned into Berkshire’s most valuable holding.

- American Express (1963): Bought shares during a crisis, making massive profits.

- Bank of America (2011): Invested during the financial crisis and reaped significant returns.

“Someone’s sitting in the shade today because someone planted a tree a long time ago.”

– Warren Buffett

Challenges and Criticism

Despite his success, Buffett has faced challenges:

- Tech Investments: Initially avoided tech stocks, missing out on early opportunities like Amazon and Google.

- 2008 Financial Crisis: Though Berkshire weathered the storm, some criticized Buffett’s bets on companies like Goldman Sachs.

- Slow Adaptation to New Markets: Critics argue that Buffett was slow to invest in newer industries like AI and cloud computing.

Buffett Today and His Legacy

As of today, Buffett remains one of the richest individuals in the world, with a net worth exceeding $100 billion. He still serves as Chairman and CEO of Berkshire Hathaway but has begun transitioning leadership to his successors, including Greg Abel.

Buffett is known for his philanthropy, having pledged to give away more than 99% of his fortune through the Giving Pledge, which he co-founded with Bill Gates.

Conclusion

Warren Buffett’s journey from a young boy selling Coca-Cola to one of the greatest investors in history is a testament to patience, discipline, and value investing. His strategies and principles continue to shape the financial world, making him a true “Oracle of Omaha.”

Whether you’re an aspiring investor or a business enthusiast, Buffett’s insights offer invaluable lessons on wealth-building and success. His legacy will undoubtedly endure for generations to come.

“The difference between successful people and really successful people is that really successful people say no to almost everything.”

– Warren Buffett

Pingback: Radhakishan Damani: From Stock Market to DMart Billionaire